The Chinese government reported estimates for Industrial Production, Retail Sales, and Fixed Asset Investment (FAI) for both January and February 2018. The National Bureau of Statistics prepares and calculates China’s major economic statistics in this manner at the beginning of each year due to the difficulties created by calendar effects (New Year Golden Week). Despite this attempt to offset them, there remains significant noise even in the combined two-month statistics. Industrial Production rose 7.1% in January and February 2018 together over January and February 2017. That’s a slight increase from the ~6% range IP had been stuck within for most of last year. Given the absolute surge in export growth particularly

Topics:

Jeffrey P. Snider considers the following as important: $CNY, China, China Fixed Asset Investment, China Industrial Production, China Retail Sales, currencies, Dollar, economy, EuroDollar, exports, fai, Featured, Federal Reserve/Monetary Policy, fixed asset investment, hkd, Hong Kong, industrial production, Markets, newslettersent, Retail sales

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

The Chinese government reported estimates for Industrial Production, Retail Sales, and Fixed Asset Investment (FAI) for both January and February 2018. The National Bureau of Statistics prepares and calculates China’s major economic statistics in this manner at the beginning of each year due to the difficulties created by calendar effects (New Year Golden Week). Despite this attempt to offset them, there remains significant noise even in the combined two-month statistics.

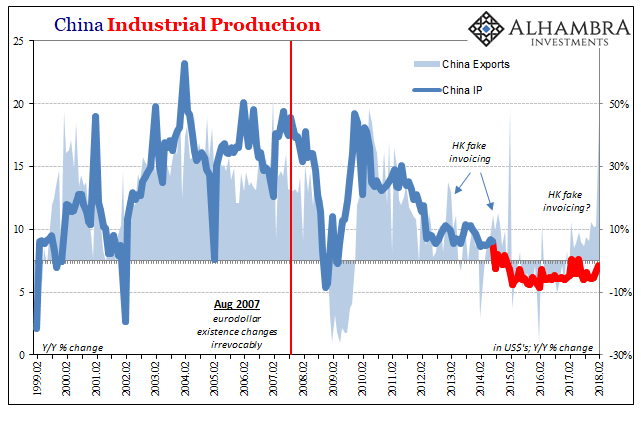

| Industrial Production rose 7.1% in January and February 2018 together over January and February 2017. That’s a slight increase from the ~6% range IP had been stuck within for most of last year. Given the absolute surge in export growth particularly in February, 7.1% is far less than I would have expected. Assuming no other abnormalities, if Chinese export firms were stacking orders to get them into the US beating expected tariffs (not just on steel and aluminum, there have been growing fears over broader restrictions dating back to late last year), that should have meant a more determined burst of production to go along with it. |

China Industrial Production, Feb 1999 - 2018(see more posts on China Industrial Production, ) |

| There is no perfect one-to-one relationship between exports and IP (the latter containing more than manufacturing), but in the recent past substantial differences have been explained in some part by fake invoicing in Hong Kong (in order to import dollars; fake product goes out, “paid for” by dollars that come in). Further, we know via the behavior in HKD, particularly in February, that some considerable monetary movement was taking place at least between HKD and USD (borrowing USD from HK would look like selling HKD/buying USD; and then there was considerable selling USD/buying CNY).

There is as yet no confirmation or even corroboration that is taking place, merely these correlations, but the small acceleration in IP given the clearly disproportionate surge in exports does little to alleviate our suspicions. |

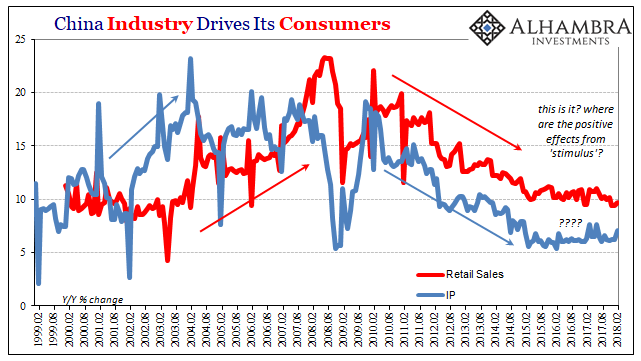

China Industry, Feb 1999 - 2018 |

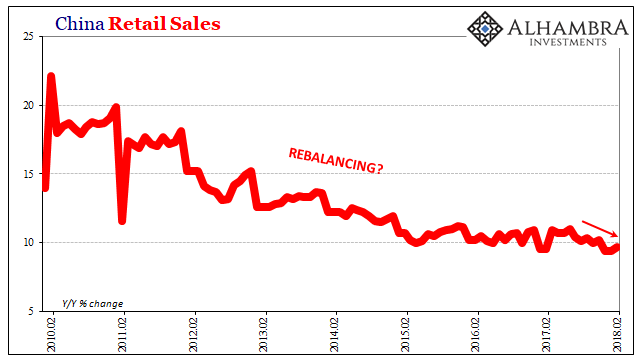

| Elsewhere in China’s economy, retail sales were less than 10% for the second straight time (meaning third straight month). Rising just 9.7% year-over-year January/February, that follows a 9.4% increase in December which was the weakest in more than a decade. Retail sales figures hadn’t recorded two (or three) months in a row at less than 10% since 2003 and the tail end of the weak global recovery from the global dot-com recession.

Going back to last summer, Chinese retail sales have slowed somewhat rather than improving in obvious fashion according to “globally synchronized growth.” China’s contributions to that idea are supposed to be significant; in truth, it doesn’t happen without it. Continued spending at last year’s pace does nothing to further the idea of “rebalancing”, while again raising the same kinds of issues about what’s really going on in China (with CNY rising as it did). |

China Retail Sales, Feb 2010 - 2018(see more posts on China Retail Sales, ) |

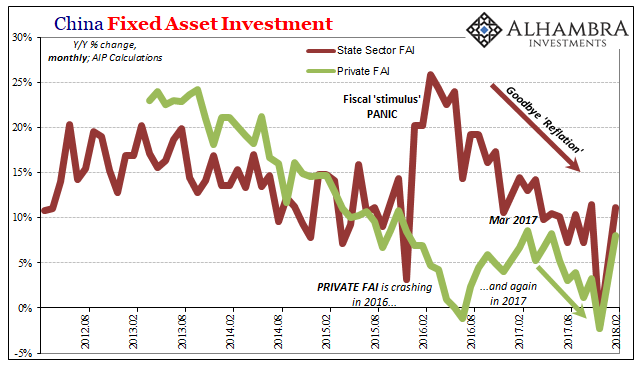

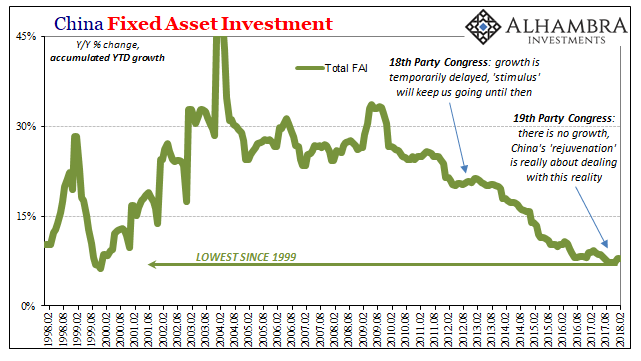

| Fixed Asset Investment (FAI) improved the last two months from outright contraction in December. That, however, is as likely the noisiness of the series in some combination with Golden Year effects, perhaps year-end too, as well as the clear tendency of Chinese firms (particularly state-owned) to front-load their planned activities for any year. |

China Fixed Asset Investment, Aug 2012 - Feb 2018(see more posts on China Fixed Asset Investment, ) |

| Private FAI rose 8.1% in those two months above the first two months of 2017. If we include December’s estimates as if calendar distortions were responsible for that month’s contraction (capex projects pushed off for unknown reasons until the start of 2018?), for the three months together private FAI was just 2.1% above the same three months starting December 2016. Since we can’t account for December’s weakness, it’s as reasonable to assume some December-January shifting.

State-owned FAI grew by 11.2% in January/February, and 9.4% December-February. Total FAI increased just 7.9% in the first two months of 2018, down slightly from the total increase (8.9%) in January/February 2017. That was only marginally higher than the accumulated growth of 7.2% in all of last year, suggesting a far more uncertain beginning. For those months plus December, Total FAI gained just 1.9%, a very low level for a three-month period. |

China Fixed Asset Investment, Feb 1998 - 2018(see more posts on China Fixed Asset Investment, ) |

Again, since a lot of what happens in China’s economy is set by how it starts, a lower overall FAI (which doesn’t account for whatever happened in December) sets it off potentially on a weaker foot. We won’t know for sure until March and April figures are released in the coming months when all potential distortions will recede and the real trends emerge.

Tags: $CNY,China,China Fixed Asset Investment,China Industrial Production,China Retail Sales,currencies,dollar,economy,EuroDollar,exports,fai,Featured,Federal Reserve/Monetary Policy,fixed asset investment,hkd,Hong Kong,industrial production,iprsfai,Markets,newslettersent,Retail sales