This economic cycle is one of the longest on record for the US, eight years and counting since the end of the last recession. It has also been, as almost everyone knows, a fairly weak expansion, one that has managed to disappoint both bull and bear. Growth has oscillated around a 2% rate for most of the expansion, falling at times perilously close to recession while at others rising tantalizingly close to escape...

Read More »Bi-Weekly Economic Review: Attention Shoppers

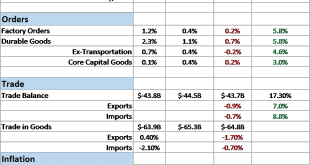

The majority of the economic reports over the last two weeks have been disappointing, less than the consensus expectations. The minor rebound in activity we’ve been tracking since last summer appears to have stalled. Retail sales continue to disappoint and inventory/sales ratios are once again rising – from already elevated levels. Even the positive reports were clouded by negative undertones. So far though our market...

Read More »Bi-Weekly Economic Review: The Return of Economic Ennui

The economic reports released since the last of these updates was generally not all that bad but the reports considered more important were disappointing. And it should be noted that economic reports lately have generally been worse than expected which, if you believe the market to be fairly efficient, is what really matters. The disappointing employment report and the generally less than expected tone of the reports...

Read More »Bi-Weekly Economic Review

The economic data releases since the last update were generally upbeat but markets are forward looking and the future apparently isn’t to their liking. Of course, it is hard to tell sometimes whether bonds, the dollar and stocks are responding to the real economy or the one people hope Donald Trump can deliver when he isn’t busy contradicting his communications staff. Politics has been front and center recently but...

Read More »Bi-Weekly Economic Review

The economic reports since the last economic update were generally less than expected and disappointing. The weak growth of the last few years had been supported by autos and housing while energy has been a wildcard. When oil prices fell, starting in mid-2014 and bottoming in early 2016, economic growth suffered as the shale industry retrenched. I said during that entire time that while the problems in the energy...

Read More »Bi-Weekly Economic Review

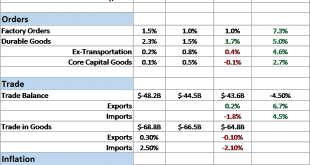

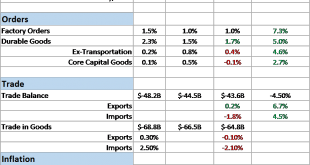

It wasn’t a very good two weeks for economic data with the majority of reports disappointing. Most notable I think is that the so called “soft data” is starting to reflect reality rather than some fantasy land where President Trump enacts his entire agenda in the first 100 days of being in office. Politics is about the art of the possible and that is proving a short list for now. Republicans can’t agree among...

Read More »Bi-Weekly Economic Review

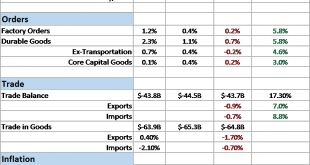

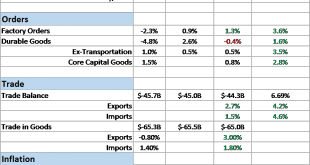

It is hard not to notice that the chart above has a lot less red in it than it has in some time. That is true of the month to month data as well as the year over year changes. There has been a widely reported gap between so called soft data – surveys and polls – and the hard data – actual economic activity reports. Bulls say the gap is there because the soft data always leads the hard data. Bears say the soft data...

Read More »Bi-Weekly Economic Review

The Fed did, as expected, hike rates at their last meeting. And interestingly, interest rates have done nothing but fall since that day. As I predicted in the last BWER, Greenspan’s conundrum is making a comeback. The Fed can do whatever it wants with Fed funds – heck, barely anyone is using it anyway – but they can’t control what the market does with long term rates. At least not without making a commitment like the...

Read More »Bi-Weekly Economic Review

Economic Reports Scorecard The Federal Reserve is widely expected to raise interest rates again at their meeting next week. They obviously view the recent cyclical upturn as being durable and the inflation data as pointing to the need for higher rates. Our market based indicators agree somewhat but nominal and real interest rates are still below their mid-December peaks so I don’t think a lot has changed. More...

Read More »Bi-Weekly Economic Review

Economic Reports Scorecard The economic data released since my last update has been fairly positive but future growth and inflation expectations, as measured by our market indicators, have waned considerably. There is now a distinct divergence between the current data, stocks and bonds. Bond yields, both real and nominal, have fallen recently even as stocks continue their relentless march higher. The incoming, current...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org