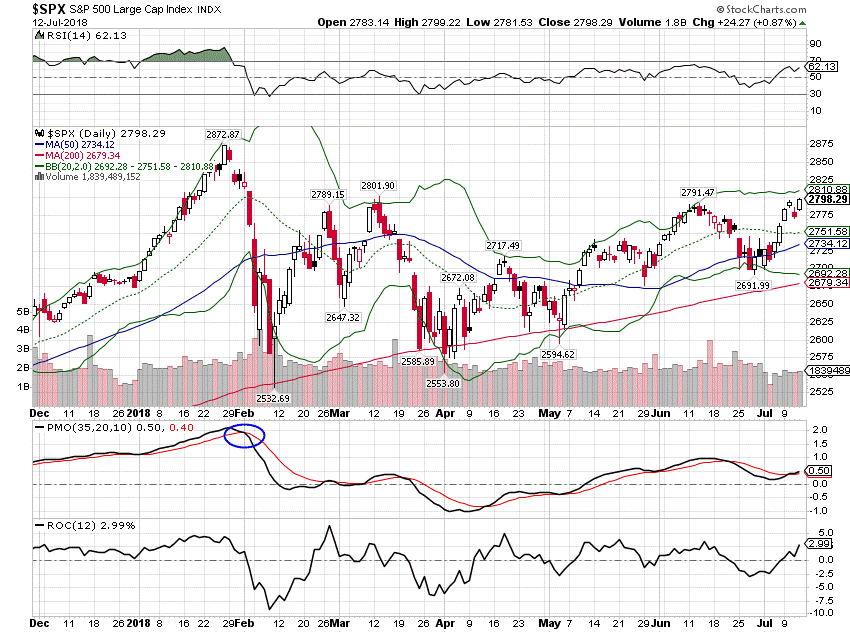

Volatility returned to markets with a vengeance in the first half of this year. 2018 started off as an extension of last year when volatility was almost wholly absent. Stocks roared out of the starting gate, up almost every day until January 26th. And then – whoosh. What took nearly a month to gain took just 6 trading days to give back and then some. Since that correction, the S&P 500 has traded in a range with a slight upward bias. The correction that hit stocks in February was driven by a number of factors but was mostly a reaction to a market that had run too far, too fast. The narrative at the time was that inflation fears were driving interest rates higher and causing a revaluation of stocks. That never made

Topics:

Joseph Y. Calhoun considers the following as important: 5) Global Macro, Alhambra Research, Bi-Weekly Economic Review, China, Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Volatility returned to markets with a vengeance in the first half of this year. 2018 started off as an extension of last year when volatility was almost wholly absent. Stocks roared out of the starting gate, up almost every day until January 26th. And then – whoosh. What took nearly a month to gain took just 6 trading days to give back and then some. Since that correction, the S&P 500 has traded in a range with a slight upward bias.

The correction that hit stocks in February was driven by a number of factors but was mostly a reaction to a market that had run too far, too fast. The narrative at the time was that inflation fears were driving interest rates higher and causing a revaluation of stocks. That never made much sense but it was a convenient rationalization to take profits. Exacerbating the sell-off was a structural issue of today’s market where anything that can be bet on, will be. The volatility index – VIX – was once a mere indicator of the premiums in the index option market. As an indicator, it acted mostly as a weathervane, a sentiment indicator. A high VIX meant speculators were paying up for market downside protection, a real-time measure of fear. So, a high VIX acted as a contrarian buy signal.

Since its introduction, though, the VIX has transformed into a tradeable entity itself. VIX futures and options were first since the indicator was developed in the pits. As exchange-traded index products (ETFs and ETNs) proliferated it was only a matter of time before a VIX product came along; anything with volatility – and yes volatility is itself quite volatile – is bound to be a popular trading vehicle. The VIX was an obvious one but the range of available products borders on the ridiculous and probably says a lot about the speculative nature of markets these days. You can be long the VIX, short the VIX, long leveraged, short leveraged and if that isn’t exciting enough for you there are long or short leveraged 2X and 3X and probably 4X.

The increased trading of the VIX changed its nature from an indicator of market sentiment to an exaggerator of market sentiment. Markets are not generally all that volatile on a day to day basis; a VIX over 25 or 30 is actually pretty rare. So, naturally, the popular trade was to short the VIX, to bet that volatility would stay low and get lower. And as more people piled into this short volatility trade, it became a self-fulfilling prophecy. Low volatility begat lower volatility. Until February when the whole thing went in reverse for reasons that are still a bit murky. It turns out the feedback loop works the other way too as higher volatility begets even higher volatility. And the ETFs that gave speculators an easy way to bet on the VIX turned out to be an easy way to lose a lot of money very, very quickly.

Despite the warnings of February, the VIX exchange-traded products remain very popular. For a while after the correction and the wiping out of a number of short vol players, the favored trade just shifted to being long volatility. But, as I said, markets aren’t really all that volatile day to day so this didn’t produce the expected profits. The speculators are now back to doing the short vol trade as if February never happened. The conclusion to be drawn is that the markets will have this feedback loop in the future and you should expect volatility to be more volatile when it arrives.

Other markets also exhibited heightened volatility. Bonds sold off steadily with the 10 year Treasury rate starting the year around 2.4% and peaking in mid-May at 3.12%. For bonds that is a very large percentage move but just as everyone decided that rates had nowhere to go but up, bonds turned around and rallied. Today we sit at about 2.85%, still a full 45 basis points higher than where we started the year. That move in the 10-year translated to other maturities as well and bonds as an asset class are down on the year. Intermediate Treasuries (3-7 year index) fell almost 1% in the first half of the year. Longer-dated bonds performed worse as the 20+ year index was down over 3%. A broader index of bonds, the aggregate bond index, fell 1.62% in the first six months of the year.

The rise in rates was a reflection of rising US nominal growth expectations and with real rates also rising it wasn’t just about inflation fears; real growth expectations rose too in the wake of tax reform. At the same time, growth expectations outside the US waned a bit. This divergence in growth expectations – seen in interest rate differentials – pushed the US dollar higher which had implications in a variety of other asset classes.

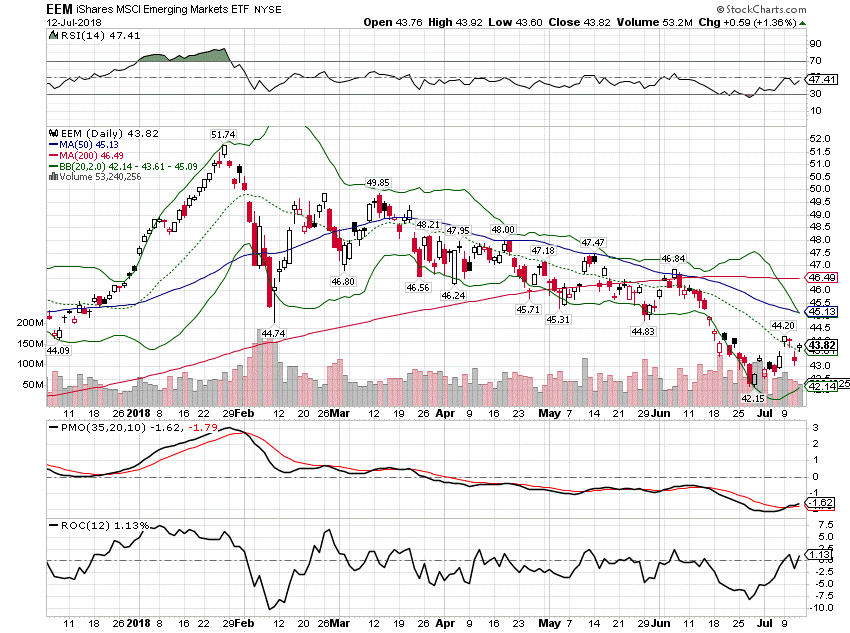

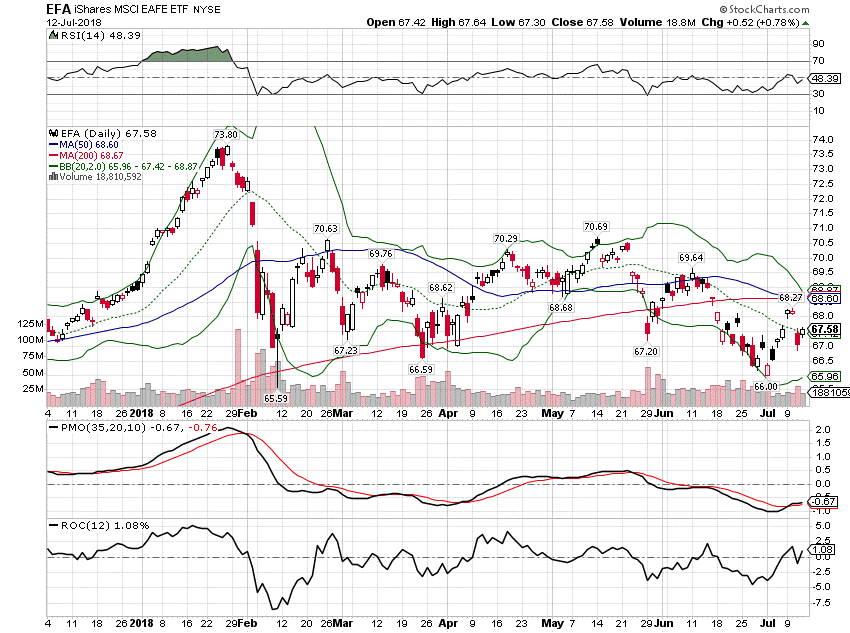

Non-US stocks (EAFE) were down almost 3% in the first half with EM stocks down more (-6.66%). That was driven by falling growth expectations and lower commodity prices (linked to some degree). Commodities initially held up pretty well in the face of a stronger dollar but ultimately finished the first half down. As is often the case with commodities, there was a wide dispersion of returns among individual commodities. Copper and gold were both down, 10% and 5.4% respectively, while crude oil managed a nearly 23% gain despite a surge in US output. That divergence in results skewed the commodity indexes. The GSCI, dominated by energy, was up 10%+ in the first half while the more widely diversified Bloomberg index was down almost 1%.

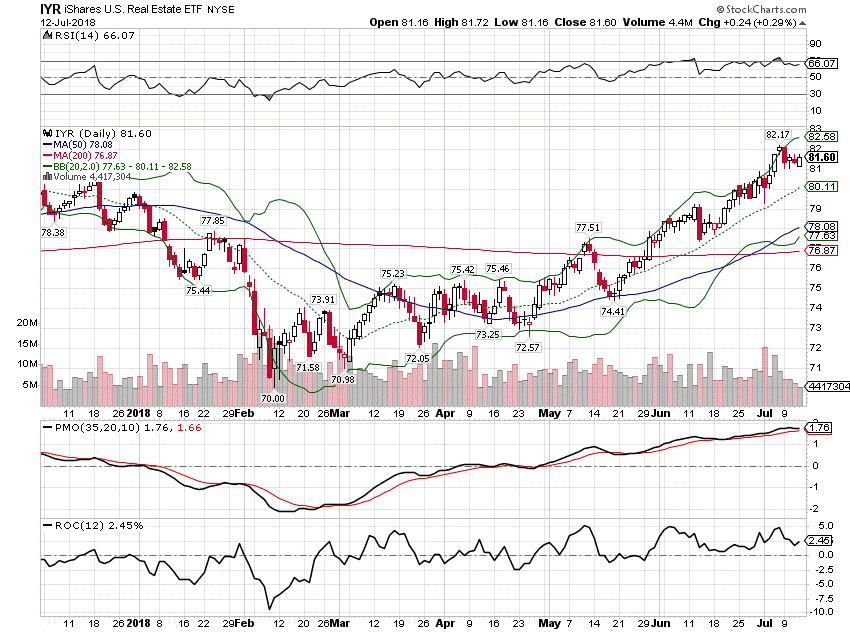

Real estate equities were also buffeted by the spike in rates but recovered completely and then some when rates pulled back. The Dow Jones US Real Estate index gained 1.4% in the first half.

Putting all these asset classes together in a moderate risk portfolio yielded a slightly negative return for the first half. An investor with a 50/50 portfolio of S&P 500 and Aggregate bond did a little better, a gain of about 0.5%. Since no one works for free, subtract some fees from that and you cleared 0.4% or less. If you diversified across other assets, you probably did worse unless you had a large allocation to crude oil. In short, there weren’t a lot of places to hide in the first half but the overall effect on most portfolios was fairly mild.

Stocks

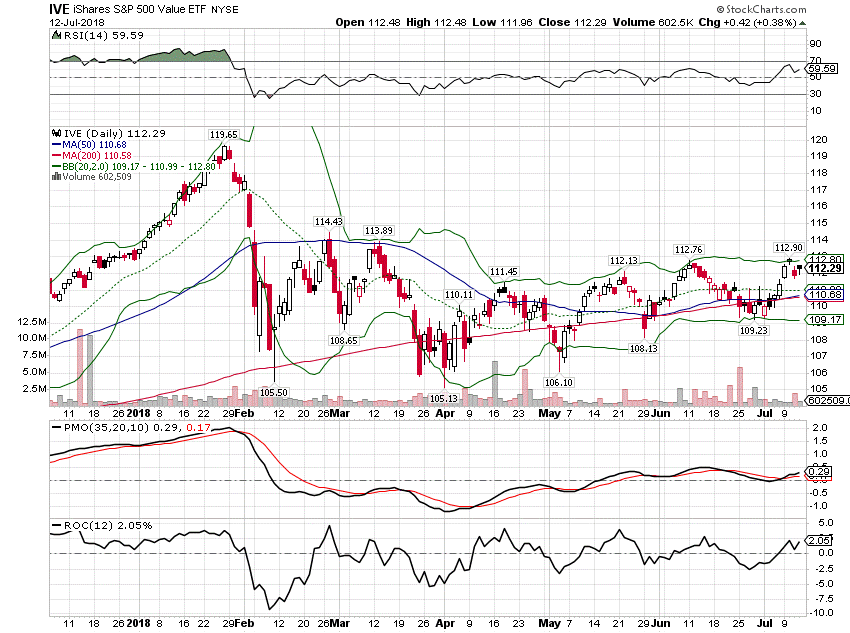

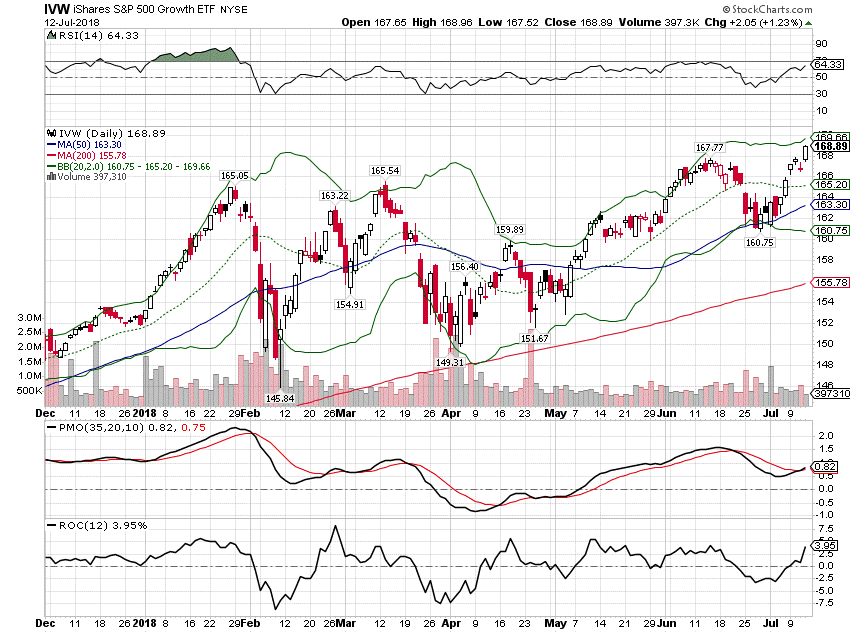

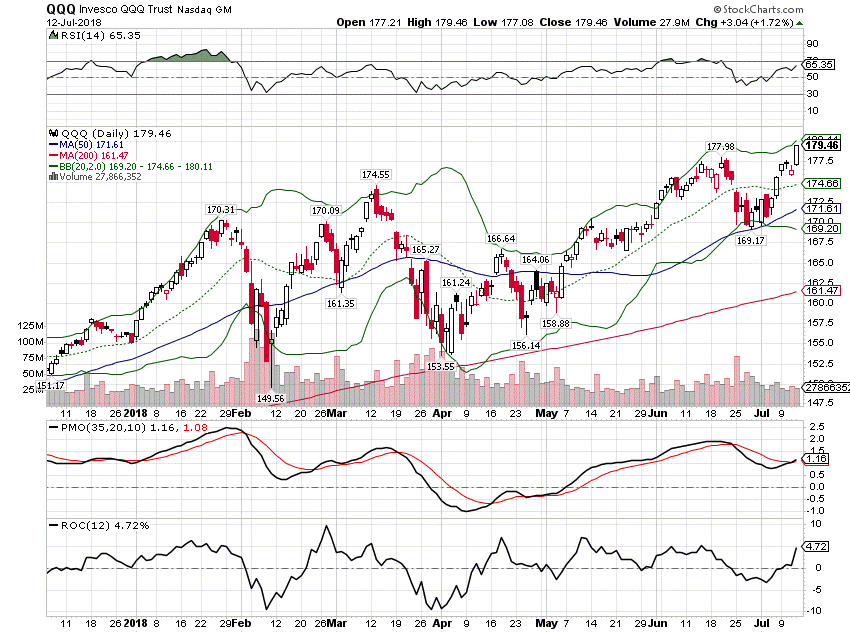

Stock markets in the first half were a bi-polar mess with growth stocks vastly outperforming value stocks and momentum trouncing both. The S&P 500 growth index rose 7.28% in the first six months of the year, driven by a few high momentum technology stocks. This can be seen more clearly in the NASDAQ, up 9.37% over the same time frame. However, the valuation on some of these names should give any bull pause. Netflix is a fast-growing company – earnings are expected to rise by nearly 70% next year – but at 85 times that estimate there is little room for error. Investors better hope all those billions they are spending on programming keep paying off. Facebook seems tame by comparison at 22 times next year’s estimate of 20% earnings growth. One does wonder if they can pull that off considering the recent bad publicity but it doesn’t seem that wild of a bet.

Amazon, another of the so-called FAANG stocks, trades at similar nosebleed levels. Earnings are expected to rise by 60% but today’s stock price is roughly 90 times that estimate. That doesn’t even take into account that forecasting Amazon’s earnings is next to impossible. Nor does it acknowledge any potential execution errors such as the website outage the company is experiencing as I write this on Prime Day. As I said, no room for error.

(Note: Netflix reported earnings as I was writing this and the report was, apparently, disappointing. The stock is down 14% from the closing price. That’s one of the reasons I’ve never been a fan of momentum investing in single names. It works great right up to the moment it doesn’t and then it really doesn’t work.)

S&P 500 |

S&P 500(see more posts on S&P 500, ) |

S&P 500 Value |

S&P 500 Value |

S&P 500 Growth |

S&P 500 Growth |

NASDAQ |

NASDAQ |

Emerging Markets |

Emerging Markets |

EAFE (Broad-based International) |

EAFE (Broad-based International) |

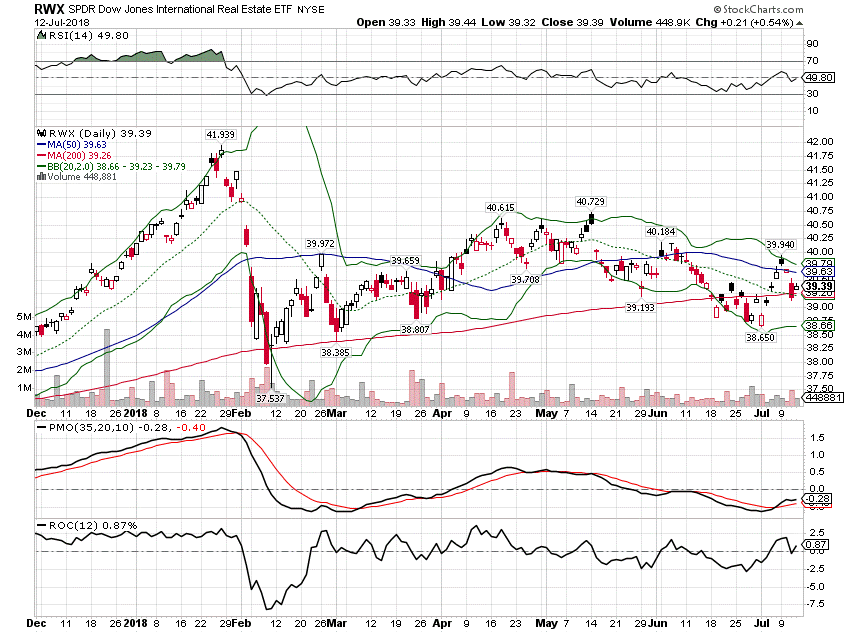

Real EstateUS REITs are very interest rate sensitive so they performed poorly early in the year as rates spiked. But as the 10-year yield pulled back under the 3% level US REITs recovered and finished the first half in the black. International REITs, like other non-US dollar assets, suffered from a stronger dollar and finished Q2 down almost 2% on the year. DJ US Real Estate |

DJ US Real Estate |

International Real Estate |

International Real Estate |

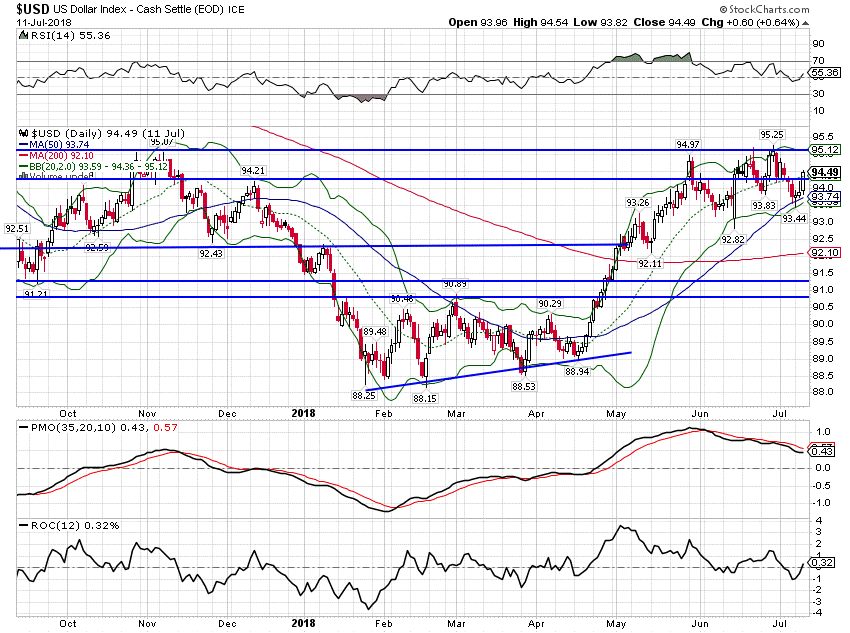

Dollar & CommoditiesThe dollar bottomed in early February and had a fairly rapid rally back up to the 95 level. The stronger dollar, as mentioned, proved negative for commodities generally although crude oil bucked the trend. The dollar rally so far appears to be a countertrend move and I expect the dollar to resume its previous downtrend in the second half. That is, of course, mostly a guess based on President Trump’s history of rhetoric on the dollar. He clearly prefers a weak dollar and someone in the administration must know that a stronger dollar largely offsets any rise in tariffs. Or at least I hope so. |

Dollar & Commodities |

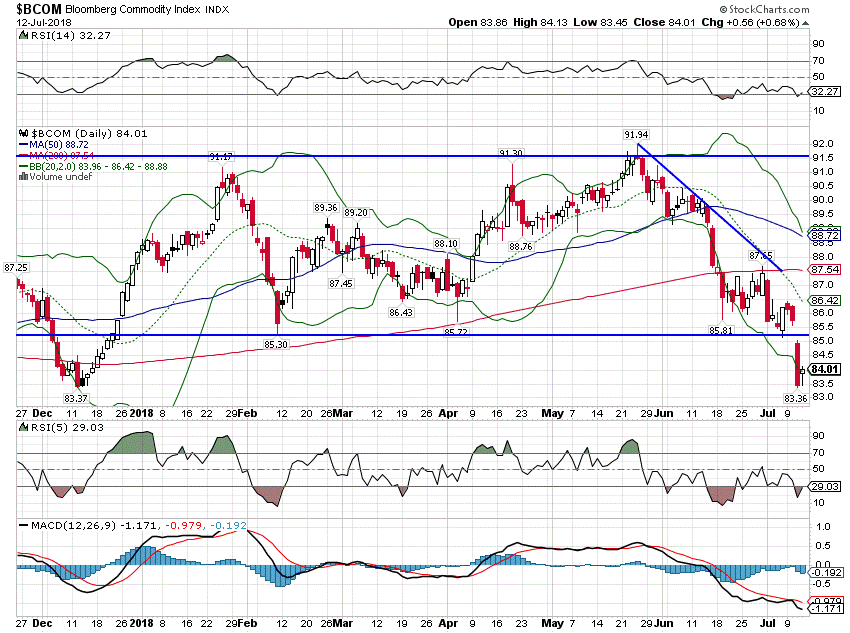

Bloomberg Commodity IndexThe Bloomberg index did fine until late May when agricultural commodities started to react to the Chinese tariff retaliation. The general drop in global growth expectations also played a role as copper and other industrial metals prices fell. |

Bloomberg Commodity Index |

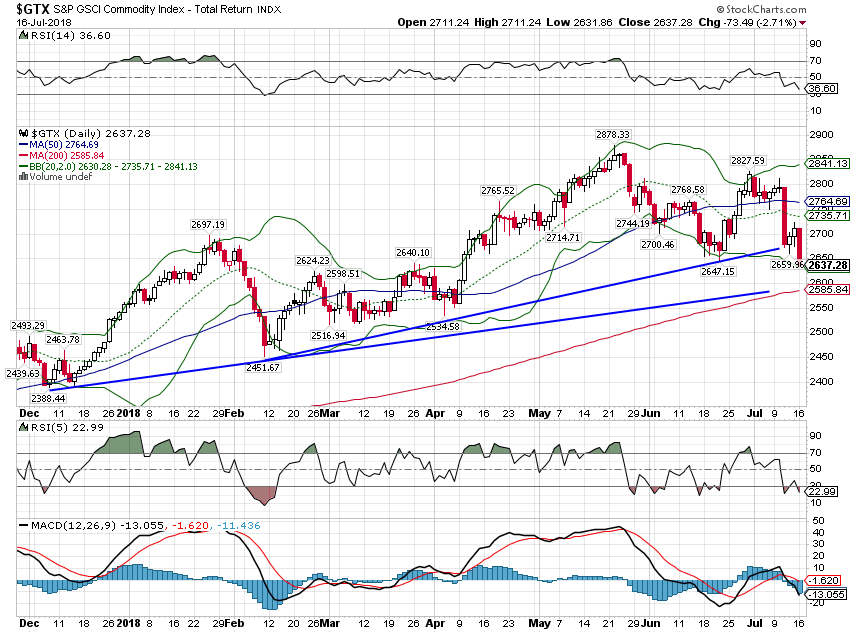

Goldman Sachs Commodity IndexThe GSCI performed better than the Bloomberg index because of a high allocation to crude oil. |

Goldman Sachs Commodity Index |

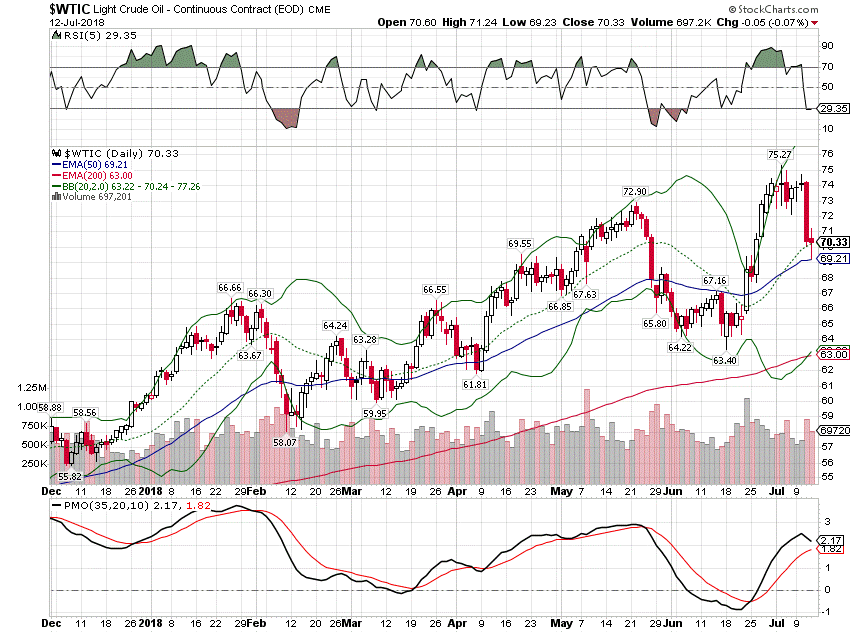

West Texas Intermediate – Crude OilCrude has performed very well this year despite a continued ramp up in US production. Venezuela was part of the reason for that as the Bolivarian revolution has produced what all other Marxian revolutions have before it – not much. And certainly not much oil production at PDVSA where I hear the insiders have stolen everything that wasn’t nailed down. The collapse of the Iran deal also played a role. |

West Texas Intermediate – Crude Oil |

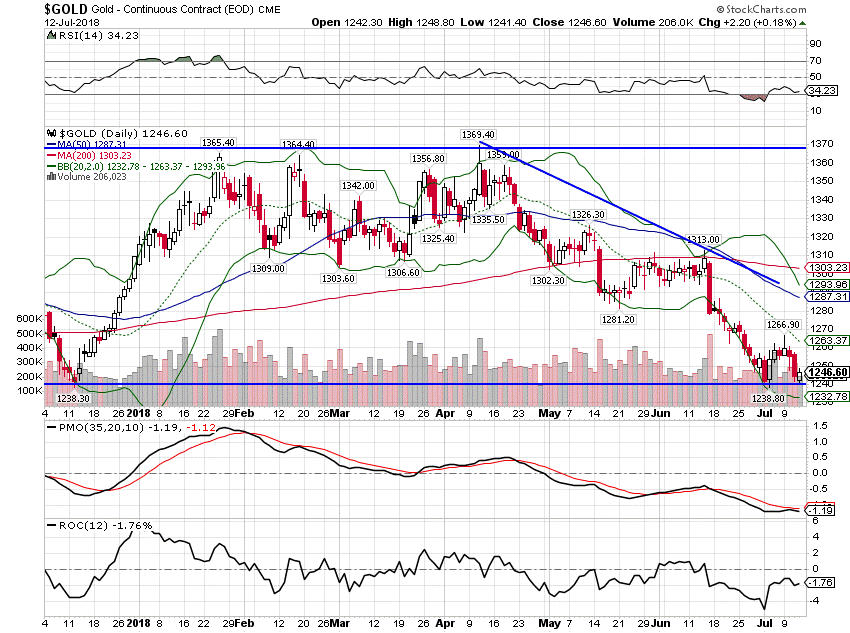

GoldGold did fall after its peak in mid-April but it didn’t fall as far as copper and the other industrial metals. Normally I’d see a drop in gold prices as a positive indication for economic growth but in this case, something else seems to be driving the metal price. |

Gold |

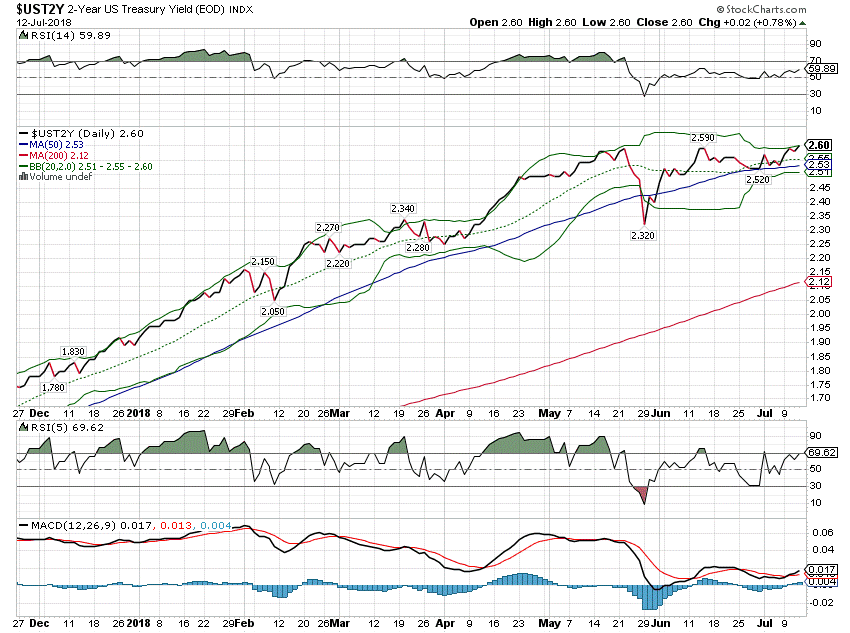

BondsInterest rates rose in the first half of the year but recently short-term rates have stopped rising and long-term rates have fallen from their highs. What does that mean? Not much – yet. The economy definitely picked up in Q2 from Q1 but we started to see a bit of a slowdown at the end of the quarter. There may be some mitigating factors with both the acceleration and then the slowdown. How much of the improvement in Q2 was due to accelerated purchases in anticipation of the tariffs that have now been imposed? There is no doubt that steel and aluminum were stockpiled ahead of the tariffs. There was also a surge in food exports as China anticipated their own retaliation against US agricultural products. Could car orders have also been accelerated as Trump started making noises about imposing tariffs on European cars (for national security concerns of all things)? And what about the recent slowdown? There was definitely a moderation in Industrial Production, Factory Orders, and Durable Goods orders recently but part of the reason for that was the shutdown of a major auto parts manufacturer due to a fire. The tariffs and the fire at Meridian have definitely confused the economic outlook. Is the Q2 surge sustainable? Will the late Q2 slowdown persist? I don’t have good answers for either but the market seems to be saying no to the first and maybe to the second. |

2-Year US Treasury Yield |

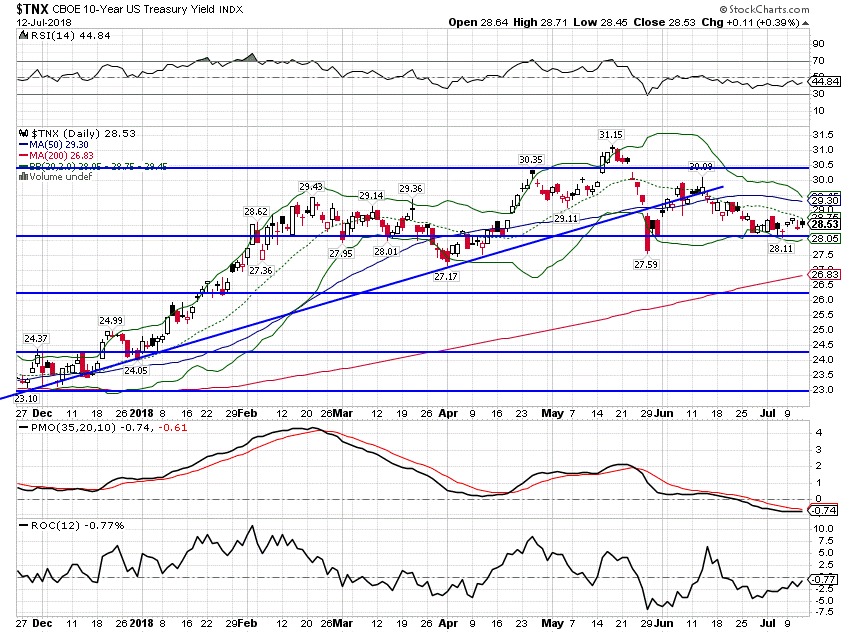

| Since the early year surge, the 10-year rate has settled into a range. To me, that means status quo until it moves out of the range one way or the other. |

10-Year US Treasury Yield(see more posts on US Treasury yield, ) |

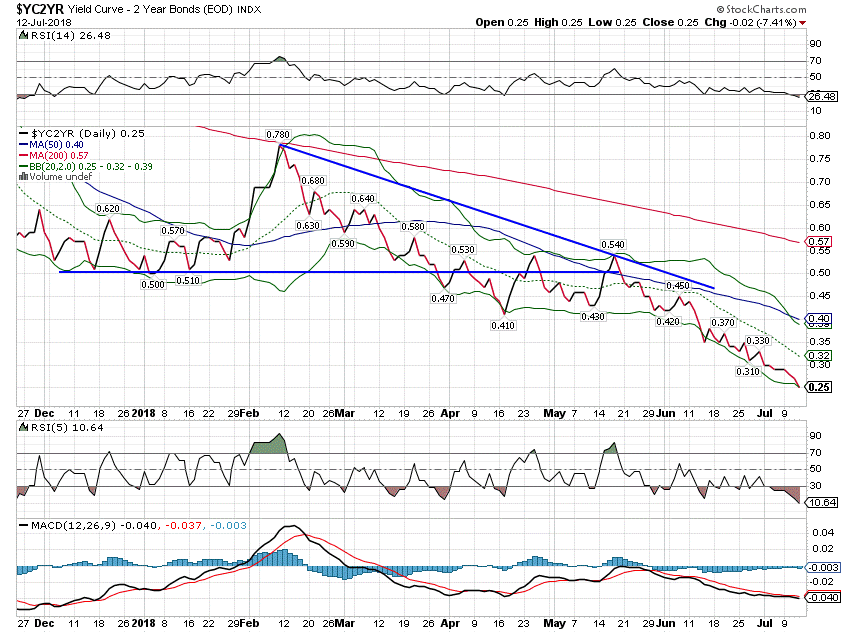

10/2 Yield curveThe yield curve, one of our main business cycle indicators, steepened during the stock market correction in early February. The steepening was not the variety we see just prior to recession when short rates fall faster than long rates. In this case, long rates rose faster than short rates as both inflation and real growth expectations rose. But the steepening didn’t last long and it has been flattening since mid-February. All that really means is that short-term growth expectations have been steady while long-term expectations have fallen somewhat. It does not mean we are near recession. The comparable time frame from the last cycle was August of 2005, more than two years prior to recession. No, I’m not saying we are two years from recession. We don’t know what the pace of flattening will be in this cycle. It could be shorter or longer than the previous one. I have also been wondering lately about the attention being paid to the inversion of the curve. I’ve been doing this for 27 years and when I started most people didn’t know what the yield curve was or why it mattered. Indeed, I’m not sure I did either. But this time around, everyone knows about the yield curve and that it inverts prior to recession. Of course, as I’ve pointed out many times before, that isn’t actually the recession signal. The recession signal is what is known in the bond market as a bull “steepener” when short-term rates fall faster than long rates. That is generally caused by an expectation that the Fed will have to cut rates soon, i.e. the economy is worsening enough to warrant Fed action. As I’ve also said many times, the Fed follows the market not the other way around. With everyone focused on the potential inversion, it may be that they miss the real message of the bond market. There is no rule that says the yield curve must invert prior to recession and I can think of ways we could be looking at a recession with the yield curve static. What if short-term rates and long-term rates fall at the same pace? The curve wouldn’t invert but that surely wouldn’t be a positive sign for growth. Like the VIX and some other indicators, I think the mere fact that more people are aware of them today means they won’t work as they have in the past. Call it the financial Heisenberg uncertainty principle. |

10/2 Yield curve |

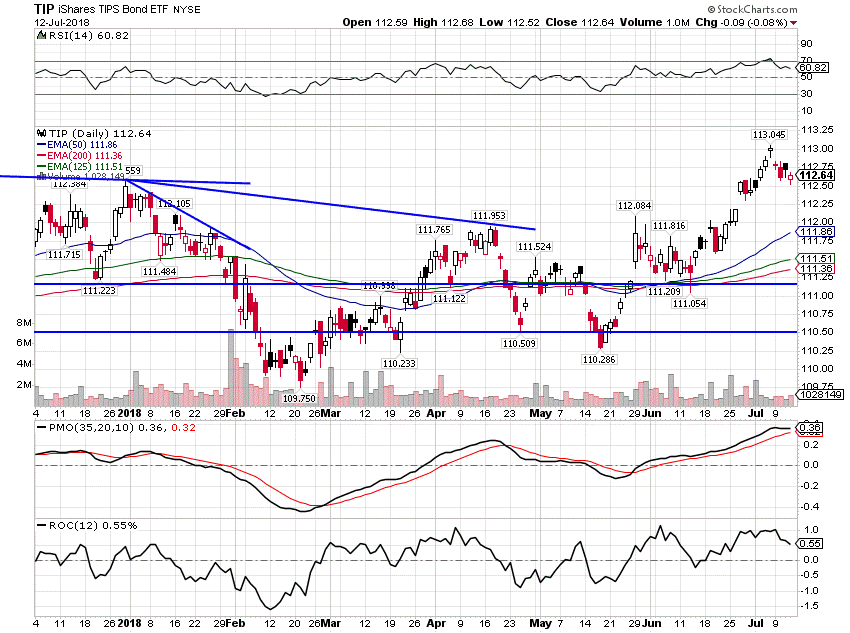

TIPS (Inflation protected bonds)Inflation-protected bonds have been the best performing part of the bond market this year. While real rates rose too they didn’t rise as much as nominal rates. |

TIPS (Inflation protected bonds) |

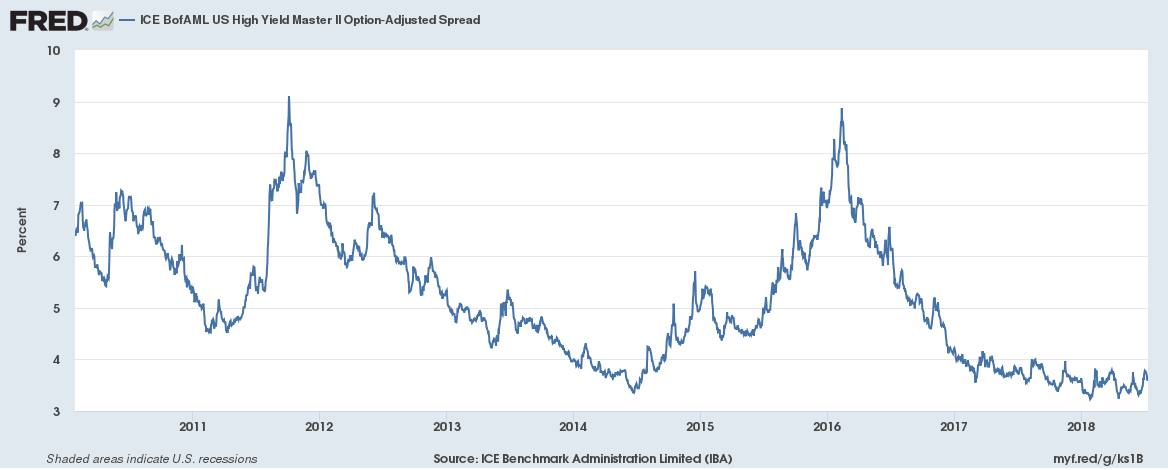

Credit SpreadsWhile stocks were in correction mode there was no confirmation from credit spreads. High yield bonds were stable relative to Treasuries even as stocks sold off; fear was confined to equities. Stock market corrections that are not associated with credit spread widening are generally short-lived as they aren’t driven by concerns about recession. Spreads this year have been pretty stable although we have seen a minor uptick recently. |

Credit Spreads 2011-2018 |

Outlook

If you’ve been reading me for a while you know I’m not going to spend a lot of time trying to predict the future, an endeavor nearly guaranteed to be embarrassing at some point in the future. But like everyone else in this business, I do like to think about the possibilities.

The biggest threat to growth is one I identified very early on in this administration. My largest fear, by far, was the new President’s views on trade. For the first year, it was looking like those fears might be misplaced. The President talked tough but didn’t seem anxious to actually do anything other than withdrawing from the TPP and initiate the procedure to revisit NAFTA. Those didn’t seem like a big deal. Opposition to TPP was one of the few bipartisan agreements in Congress. And updating NAFTA, if anything, seemed overdue.

But things have gotten a little more serious here in year two. The rhetoric is sharper, tariffs have actually been imposed and other countries have responded with retaliatory tariffs, a near textbook description of a trade war. Not only that but we don’t really seem to have too many friends in this war, with the possible exception of Australia which was exempted from the steel and aluminum tariffs. The administration has not drawn much distinction between China and any other country or region. Canada, Mexico, and the EU have all been hit with tariffs and threatened with more if they don’t come to heel.

I do think the rhetoric has softened ever so slightly recently (See here: Donald Trump, Free Trader?). And there does seem to be a more defined strategy now with a greater emphasis on the end result rather than the tactics used to accomplish it. But the proof will be in the pudding and to date I haven’t noticed any countries rushing to the negotiating table. I do think we need to see some progress soon though. So far, if anything, the tariffs have worked to the administration’s favor. If consumers and companies were front-running the tariffs then they pulled some sales forward and made growth look better than it would have otherwise. But the longer the tariffs stay in place the harder they will be to remove and the greater the economic distortion.

Think of the tariffs like a consumption tax. We know what happens when people know a tax is about to rise – they accelerate activity to avoid the higher rate. Just look at what happened to the Japanese economy when they hiked their consumption tax a few years back. There was a surge in growth – consumption – prior to the tax hike and a slowdown afterward. If we follow a similar course, then the slowdown is starting now and will get worse just in time for the mid-term elections. It may be Trump who is rushing to the negotiating table. We are already starting to hear companies talk about postponing investments until they have more clarity on the trade issue. We’ll likely hear more of that on conference calls as earnings season progresses.

One thing we don’t know is the magnitude of any sales brought forward and so we can’t know the degree of slowdown either. I do know that companies have been using the fear of tariffs in their marketing. I’ve been hearing a radio ad for a couple of months now run by a local AC contractor that urges people to buy now before the price goes up because of the steel and aluminum tariffs. How effective has it been? I don’t know but they wouldn’t run it that long if it wasn’t working to some degree.

I also think it would be a mistake to overstate the case against tariffs right now. The magnitude of the tariffs is still quite small – so far – if still negative over the longer run. This is not the second coming of Smoot and Hawley when tariffs were raised to the highest level since the Tariff of Abominations in 1828. You might have guessed that the Tariff of Abominations was not a positive and neither was Smoot-Hawley (see Depression, Great). But these tariffs don’t even come close in scope (number of products) or scale (the amount of the tariffs). And the US economy is just not that dependent on trade for growth. If a trade war can be won, the US is probably the best-positioned country to do it. I personally don’t think it is worth the risk but I don’t get a vote on such matters. Maybe we’ll all be surprised and when this is all over, trade is freer than it has ever been. I can dream.

But all of the trade stuff is mere speculation. About all I’m sure about when it comes to the Trump administration and trade is that I have no idea what they or other countries will do next. And while we might see some positive movement prior to the election, it is unrealistic to think all this will be resolved in a matter of months. If the administration really intends to negotiate with the entire world, one country at a time plus the EU, then it isn’t going to go quickly.

In any case, despite a few days of volatility, we haven’t really seen much impact on markets from the tariffs. Stocks are still within spitting distance of all-time highs. But if that starts to change I suspect you’ll get some movement out of the administration. President Trump and Treasury Secretary Mnuchin appear to both believe that the stock market is a good barometer of their policies. If stocks start to take on water, look for some kind of calming event. Maybe a trade summit of some kind or a concession by the administration on something.

In the meantime, all we can really do is rely on markets as our guide to the economy. Right now the markets seem to be saying that growth peaked in the second quarter and that Q3 will see a bit of a slowdown. Growth expectations have moderated over the last two months while inflation expectations have remained steady. But even with that slowing, the economy seems to be running a little over trend. The Chicago Fed National Activity Index did turn negative last month but the three-month average is still at 0.18, a reading consistent with activity slightly above trend. And the 10 year Treasury yield is still 45 basis points higher than it was at the beginning of the year.

If that level of growth continues and bond yields continue to behave, I think stocks will probably make a run at the old highs. Earnings growth has been good and is expected to continue although outlooks and conference calls this earning season probably take on added importance. Despite underperforming so far this year, earnings at foreign companies have also been good. The key to EAFE and EM performance is more likely geared to the dollar which appears to be making a top after the big countertrend move. If that is true and the dollar resumes its downtrend expect foreign stocks and commodities to outperform.

The first six months of 2018 have been frustrating for diversified investors. It has been another period of US stock outperformance and all other asset classes have lagged. That is mostly a function of the recently stronger US dollar but long-term momentum continues to favor a weaker dollar. This period of strength, driven by the Q2 growth spurt, seems likely to fade as the administration’s tariffs offset the gains from tax reform. Even positive developments on trade would seem likely to spur a weaker dollar as reduced US tariffs would be seen as positive for foreign economies.

There is one last factor to consider for the second half of the year. This is an election year and control of Congress is up for grabs. There is a fairly widespread expectation that Democrats will take control of either the House or the Senate. What is unexpected is a sweep by either side. If Democrats are able to wrest control of Congress from the Republicans, the last two years of the Trump administration are not going to be pleasant. Markets have in the past performed quite well when different parties control the executive and legislative branches, mostly because not much gets done. But gridlock and impeachment proceedings would probably not have the same effect. So, as you are watching the stock ticker you might want to keep an eye on the polls as well.

Tags: Alhambra Research,Bi-Weekly Economic Review,Featured,newsletter