The market volatility this year has been blamed on a lot of factors. The initial selloff was blamed on a hotter than expected wage number in the January employment report that supposedly sparked concerns about inflation – although a similar number this month wasn’t mentioned as a cause of last Friday’s selling. The unwinding of the short volatility trade exacerbated the situation and voila, 12% came off the market in a...

Read More »Bi-Weekly Economic Review

[embedded content] Bob Williams and Joseph Y. Calhoun talks about Bi-Weekly Economic Review for April 01, 2018. Related posts: Bi-Weekly Economic Review: Embrace The Uncertainty Bi-Weekly Economic Review Bi-Weekly Economic Review: One Down, Three To Go Bi-Weekly Economic Review: A Whirlwind of Data Bi-Weekly Economic Review: Don’t Underestimate...

Read More »Bi-Weekly Economic Review: Embrace The Uncertainty

There’s something happening here What it is ain’t exactly clear There’s a man with a gun over there Telling me I got to beware I think it’s time we stop, children, what’s that sound Everybody look what’s going down There’s battle lines being drawn Nobody’s right if everybody’s wrong Young people speaking their minds Getting so much resistance from behind It’s time we stop, hey, what’s that sound Everybody look what’s...

Read More »Bi-Weekly Economic Review

[embedded content] Bob Williams and Joseph Y. Calhoun talks about Bi-Weekly Economic Review for March 15, 2018. Related posts: Bi-Weekly Economic Review: The New Normal Continues Bi-Weekly Economic Review: Gridlock & The Status Quo Bi-Weekly Economic Review: Maximum Optimism? Bi-Weekly Economic Review: As Good As It Gets Bi-Weekly Economic...

Read More »Bi-Weekly Economic Review: The New Normal Continues

There has been a lot of talk about the economic impact of the recent tax reform. All of it, including the analyses that include lots of fancy math, amounts to nothing more than speculation, usually informed by little more than the political bias of the analyst. I am guilty of that too to some degree but I don’t let my personal political views dictate how I view the economy for purposes of investing. I am, to put it...

Read More »Bi-Weekly Economic Review: One Down, Three To Go

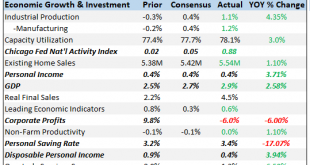

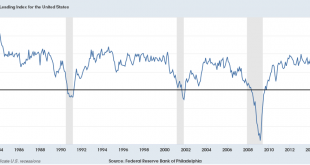

Economic Reports Economic Growth & Investment We pay particular attention to broad based indicators of growth. The Chicago Fed National Activity Index and the Conference Board’s Leading Economic Indicators are examples. We watch them because we are mostly interested in identifying inflection points in the broad economy and aren’t as interested in the details. Why? Because, while bear markets do happen outside of...

Read More »Bi-Weekly Economic Review

Economic Reports Economic Growth & Income Personal income for December was better than expected at up 0.4% on the month and 4.11% year over year. Wages and salaries were up 0.5%. Unfortunately, that rate of rise is not even up to the lower end of the range we’ve seen in past expansions when 5% income growth was a precursor to recession. Still, it is, sadly, about average for this expansion. Two items in this...

Read More »Bi-Weekly Economic Review: Markets At Extremes

Economic Reports Production Production ended the year on a strong note but early readings from January are not as positive. The December industrial production report headline was strong at a 0.9% gain but a lot of that strength was in the mining (oil drilling) and utility sectors. Mining has actually led the way the last year as rig count has risen with drilling activity. I’d love to see our economy less dependent on...

Read More »Bi-Weekly Economic Review: A Weak Dollar Stirs A Toxic Stew

Economic Reports Employment We received several employment related reports in the first two weeks of the year. The rate of growth in employment has been slowing for some time – slowly – and these reports continue that trend. The JOLTS report showed a drop in job openings, hires and quits. The Fed has been talking about a tight labor market but this report peaked last July so that may not be as much a concern as they...

Read More »Bi-Weekly Economic Review: Housing Market Accelerates

The economy ended 2017 with current growth just slightly above trend. In general the reports of the last two weeks of the year were pretty good with housing a standout performer going into the new year. We are still trying to get past the impact – positive and negative – from the hurricanes a few months ago though so it is probably prudent to wait for more evidence before making any definitive pronouncements about the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org