In the FT, Martin Wolf discusses Mervyn King’s proposal to make the central bank a “pawnbroker for all seasons” as laid out in King’s recent book “The End of Alchemy.” Lord King offers a novel alternative. Central banks would still act as lenders of last resort. But they would no longer be forced to lend against virtually any asset, since that very possibility must create moral hazard. Instead, they would agree the terms on which they would lend against assets in a crisis, including...

Read More »Capital Requirements for Large Swiss Banks

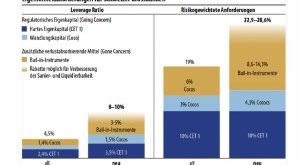

They have been increased. The illustration is taken from Finanz und Wirtschaft. Report by Hansueli Schöchli in the NZZ.

Read More »Banks Without Debt

In his blog, John Cochrane points to SoFi, a FinTech company, as proof that banking services can be delivered by institutions without the traditional characteristics of a bank. SoFi finances loans by selling equity. The loans are securitized and the cash is reinvested in loans. As John points out: A “bank” (in the economic, not legal sense) can finance loans, raising money essentially all from equity and no conventional debt. And it can offer competitive borrowing rates — the supposedly...

Read More »Regulation Catches Up with Fintech

The Economist reports that regulation catches up with peer-to-peer lending: Meanwhile, a case working its way through the courts may subject P2P loans to state usury laws, from which banks with a national charter are exempt. That would prevent the P2P firms from lending to the riskiest borrowers in much of America. In addition, the Consumer Financial Protection Bureau, a federal agency, announced this month that it would begin accepting complaints about P2P consumer lending. Rates of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org