Swiss Franc For us the developments in the trade balance express if a currency is overvalued or not (more details here). The Swiss trade surplus is constant or rather rising, hence the Swiss Franc is correctly valued or rather undervalued.And – as we see below – the franc appreciated. Switzerland Trade Balance(see more posts on Switzerland Trade Balance, )Switzerland Trade Balance – click to enlarge. FX Rates...

Read More »FX Daily, September 19: Dollar Begins Important Week on Softer Note

[unable to retrieve full-text content]The US dollar, which finished last week on a firm note, is under pressure to start the new week that features Bank of Japan and Federal Reserve meetings. The slighter stronger August CPI reading helped lift the greenback ahead of the weekend, but investors continue to see a low probability of a Fed hike this week.

Read More »FX Weekly Preview: Punctuated Equilibrium and the Forces of Movement

[unable to retrieve full-text content]Shifting intermarket relationships pose challenge for investors. The market is convinced the Fed will not raise rates. Greater uncertainty surrounds the BOJ; there seems less willingness to shock and awe.

Read More »Janet Yellen’s Shame

[unable to retrieve full-text content]n honest capitalism, you do what you can to get other people to voluntarily give you money. This usually involves providing goods or services they think are worth the price. You may get a little wild and crazy from time to time, but you are always called to order by your customers.

Read More »FX Daily, September 12: Markets Off to a Wobbly Start

Swiss Franc The EUR/CHF retreated today together with falling stock prices. Later during the European day, U.S. stocks recovered. When investors sell their stocks and move into cash, then the Swiss Franc very often appreciates. This is the safe haven effect: cash in Swiss Franc is perceived as more secure. Click to enlarge. FX Rates Stocks and bonds have begun the new week much like last week ended. Sharp losses...

Read More »Negative and the War On Cash, Part 2: “Closing The Escape Routes”

Submitted by Nicole Foss via The Automatic Earth blog, Part 1 Here. History teaches us that central authorities dislike escape routes, at least for the majority, and are therefore prone to closing them, so that control of a limited money supply can remain in the hands of the very few. In the 1930s, gold was the escape route, so gold was confiscated. As Alan Greenspan wrote in 1966: In the absence of the gold...

Read More »Negative Rates and The War On Cash, Part 1: “There Is Nowhere To Go But Down”

[unable to retrieve full-text content]As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »FX Weekly Preview: Yellen at Jackson Hole

Lastly, a brief word about next week. I will not post my usual piece on macro considerations on Sunday. Here, though, is a brief thumbnail sketch of the top five things I will be watching: 1. Yellen at Jackson Hole at the end of next week: To the extent that she shares her assessment of the economy, I would expect to largely echo the broad sentiment expressed by NY Fed President Dudley. Click to enlarge. 2....

Read More »The Need for Higher Wages: Lots of Thunder, No Rain

Summary: Major central banks and many economists are calling for higher wages. However, they are reluctant to offer proposals to strengthen those institutions who’s goal is to boost labor’s share of national income. The advocates are more interested in boosting prices than in lifting aggregate demand or addressing the disparity of income and wealth. Charlie Chaplin All that is solid is melting. After...

Read More »Stupid is What Stupid Does – Secular Stagnation Redux

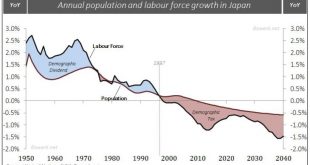

Annual population and labour force growth in Japan Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org