Gold’s Little Brother Today I want to put a popular precious metal under the magnifying glass for you: silver. Silver, often referred to as the “little brother” of gold, has a particularly interesting seasonal pattern I would like to share with you. Shiny large good delivery door stops made of silver – about to enter interesting seasonal phase. PT Silver’s seasonality under the magnifying glass Take a look at the seasonal chart of silver. In contrast to a standard price chart, the seasonal chart shows the average pattern of silver in the course of a calendar year. For this purpose, an average was calculated from the price patterns of the past 52 years. The horizontal axis shows the time of the year, the vertical axis depicts price information. As the chart

Topics:

Dimitri Speck considers the following as important: 6b.) Acting Man, 6b) Austrian Economics, 7) Markets, Featured, newsletter, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Gold’s Little BrotherToday I want to put a popular precious metal under the magnifying glass for you: silver. Silver, often referred to as the “little brother” of gold, has a particularly interesting seasonal pattern I would like to share with you. |

|

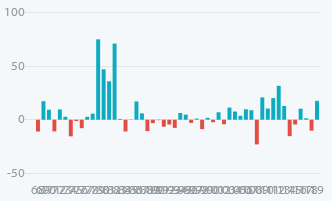

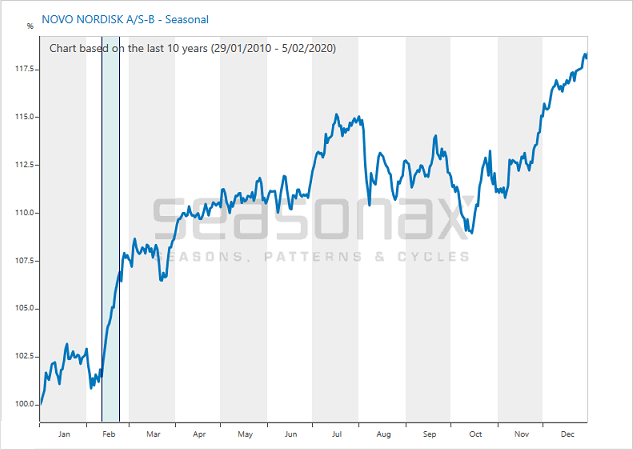

Silver’s seasonality under the magnifying glassTake a look at the seasonal chart of silver. In contrast to a standard price chart, the seasonal chart shows the average pattern of silver in the course of a calendar year. For this purpose, an average was calculated from the price patterns of the past 52 years. The horizontal axis shows the time of the year, the vertical axis depicts price information. As the chart illustrates, there are two favorable seasonal phases in silver. The first one begins in mid December (i.e., on the right hand side of the chart) and lasts until February (due to the turn of the year on the left hand side of the chart; arrow to the left). The second one starts at the end of June and lasts until the end of September (arrow to the right). In addition I have highlighted the beginning of this second phase with a circle. |

Silver price in USDSilver price in USD per troy ounce, seasonal pattern over the past 52 years – Silver starts to rise at the end of June |

The silver price rose in 31 of 52 cases!The imminent strong seasonal period in silver begins on 28 June and ends on 21 September. A positive performance was recorded in 31 of the 52 cases under review. During this phase silver generated an average gain of 4.87 percent, which corresponds to an annualized return of 22.71 percent. The bar chart below shows the return generated by the silver price during this seasonally strong period in every year since 1968. Blue bars indicate years in which gains were achieved, red bars show years in which losses were posted. On two occasions the price increase reached even more than 70 percent. A particularly strong advance of 75.15 percent was recorded in 1979. The largest loss was posted in 2008. At 23.08 percent it was noticeably smaller. In short, the imminent strong seasonal phase not only includes an above-average number of especially strong gains, but also fewer and less pronounced declines. |

Silver Price |

What is the situation with gold, platinum and palladium?

Something you may not be aware of: although the price of silver has a strong positive correlation with the gold price, in part its seasonal pattern differs significantly. The same applies to platinum and palladium. If you want to examine the precise seasonal patterns of gold and the other precious metals, take a look at www.seasonax.com!

PS: Silver is glittering again – don’t focus exclusively on equities!

Dimitri Speck specializes in pattern recognition and trading systems development. He is the founder of Seasonax, the company which created the Seasonax app for the Bloomberg and Thomson-Reuters systems. He also publishes the website www.SeasonalCharts.com, which features selected seasonal charts for interested investors free of charge. In his book The Gold Cartel (published by Palgrave Macmillan), Dimitri provides a unique perspective on the history of gold price manipulation, government intervention in markets and the vast credit excesses of recent decades. His ground-breaking work on intraday patterns in gold prices was inter alia used by financial supervisors to gather evidence on the manipulation of the now defunct gold and silver fix in London. His Stay-C commodities trading strategy won several awards in Europe; it was the best-performing quantitative commodities fund ever listed on a German exchange. You can find an introduction to the Seasonax app and in-depth information on what it can do here. Furthermore, here is a complementary page on the web-based Seasonax app, which costs less and offers slightly different functionality (note: subscriptions through Acting Man qualify for special discounts – for both the Bloomberg/Reuters and the web-based versions of the app. Details are available on request – simply send a note to [email protected] with the header Seasonax!). PS: in the run-up to Christmas, very large special holiday discounts are available!

Charts by Seasonax

Chart & image captions (where indicated) by PT

Tags: Featured,newsletter,Precious Metals