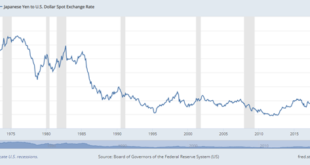

On February 8, the Japanese yen fell to a 24-year low against the dollar, dropping to 143 yen per dollar. Not much has changed since then with the yen hovering between 142 and 144 per dollar. In September of 2021, one only needed 109 yen to buy a dollar. Overall, the yen has dropped 21 percent against the dollar over the past year, yet Japan’s central bank apparently has no plans to change course. Nor should we expect it to do so. Japan’s debt load has become so...

Read More »Why the Fed Usually Ignores its Mandate for “Stable Prices”

In recent years, Congress has attempted to add various new mandates to the Federal Reserve’s mission. In 2020, Democrats introduced the “Federal Reserve Racial and Economic Equity Act.” Then, in 2021, pundits and politicians were telling us that it’s the Fed’s job to “combat climate change.” These are just the latest efforts to use the enormously powerful central bank to achieve political ends to the liking of elected officials. This is a helpful reminder, of...

Read More »Review: Free Market: The History of an Idea

Free Market: The History of an Idea by Jacob Soll Basic Books, 2022; viii + 326 pp. Jacob Soll is a distinguished historian, and Free Market contains much of value, but the book cannot be considered a success, and indeed as it reaches the twentieth century, it becomes a disaster. Even in the parts of the book worth reading, Soll is in the iron grip of a central thesis, one that his historical approach by its nature makes impossible to prove. In some books, discerning...

Read More »Socialism Is Not Groupthink, but Statethink: A Brief Comment on Jordan Peterson

According to Jordan Peterson, left-wing totalitarians are characterized by an ideology in which group identity is paramount. I will demonstrate that this is a misconception. Historically, socialists have fought against feudalism and capitalism in the name of emancipating the individual from any kind of group or class identity. The totalitarian tendencies of socialist thinking stem from its insistence on using the state as an instrument to destroy all group identities...

Read More »Wages, Unemployment, and Inflation

Our economic system—the market economy or capitalism—is a system of consumers’ supremacy. The customer is sovereign; he is, says a popular slogan, “always right.” Businessmen are under the necessity of turning out what the consumers ask for and they must sell their wares at prices which the consumers can afford and are prepared to pay. A business operation is a manifest failure if the proceeds from the sales do not reimburse the businessman for all he has...

Read More »The Truth about American Inequality

Economist and Mises Institute Associated Scholar Robert Ekelund recently teamed up with former US Senator Phil Gramm and John Early to write The Myth of American Inequality: How Gernment Biases Policy Debate. The book was released this month by Rowman and Littlefield Publishers. In it, the authors explore some of the many ways that the debate over inequality in the United States is based on bad research, bad data, and a variety of other misconceptions. I recently...

Read More »Molinari Explains the Difference between Monarchy and Popular Government

With the impending burial of the United Kingdom’s Queen Elizabeth II, republicans from London to Sydney have ramped up their efforts to end the British monarchy. The resulting war of words between monarchists and their opponents has highlighted the sheer diversity of opinions over the desirability of monarchy. Indeed, it would be impossible to enumerate all the different criteria on which different groups and individuals judge monarchy as an institution. However, for...

Read More »Government Intervention into International Currency Exchange Rates: Japan as a Case Study

The recent hefty depreciation of the yen to a twenty-four-year low against the dollar has raised eyebrows due to the yen’s traditional safe haven role in times of turmoil, such as the war in Ukraine. The yen’s decline had already started when major central banks signaled a tightening of monetary policy to fight inflation while the Bank of Japan (BoJ) doubled down on its loose monetary policy and zero target for ten-year bond yields. The depreciation accelerated...

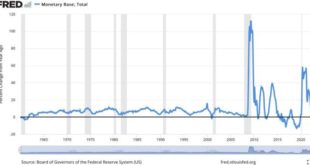

Read More »Powell’s Pivot to “Pain” but No Gain: Triggering the Coming Recession

Jay “The Inflation We Caused Is Transitory” Powell finally did it. On Friday, the Fed chair finally mustered the courage to say that he is going to do the job he has been hired to do: the Fed will not “pivot” to cut interest rates until inflation slows meaningfully and persistently—even if the stock, bond, and housing bear markets become much worse and the economy goes into recession. Powell’s Speech Translated Below we provide key quotes from Powell’s Jackson Hole...

Read More »The Fed Is Wrong to Make Policies Based upon the Phillips Curve

Speaking at Jackson Hole, Wyoming, on August 26, 2022, the chair of the Federal Reserve, Jerome Powell, said the Fed must continue to raise interest rates—and keep them elevated for a while—to bring the fastest inflation in decades back under control. Powell said that a tighter interest rate stance is likely to come at a cost to workers and overall growth. However, he holds that not acting would allow price increases to become a more permanent feature of the economy...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org