[This essay, which exposes the big-government policies of the Hoover administration, was first published in the Saturday Evening Post, June 25, 1932.] In the minutes of the Chicago City Council, May 12th last, is the perfect example of how commonly we regard public credit. From bad taxation, reckless borrowing and reckless spending, the city of Chicago had so far prejudiced its own credit that for months it had been unable to meet its municipal payrolls either out...

Read More »August’s Price Inflation Soared, and That Means Earnings Fell Yet Again

The federal government’s Bureau of Labor Statistics released new price inflation data today, and the news wasn’t good. According to the BLS, Consumer Price Index (CPI) inflation rose 8.3 percent year over year during August, before seasonal adjustment. That’s the seventeenth month in a row of inflation above the Fed’s arbitrary 2 percent inflation target, and it’s six months in a row of price inflation above 8 percent. Month-over-month inflation rose as well, with...

Read More »Promoting Natural Rights Instead of Conservatism: Looking at Rothbard and Jaffa

This is the story of a man, an intellectual, born after World War I, who spent studying his university years in New York and became acquainted and studied under German Jewish émigré who fled the Nazi regime in Germany, later becoming mentor and protégé. That man belonged to the political Right, taught in two different universities during his lifetime, the first one in the Eastern United States, the second in the Western part of the country, was cast out of more...

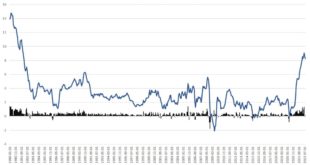

Read More »Short-Term Market Volatility Is Not Entirely Random

Over the present year we have experienced record-breaking price inflation, a series of interest rate hikes, and an overall fall in stock prices. It is widely accepted that there is a bubble. A good way for Misesians to measure this is by comparing the price of capital (stock prices) to its replacement cost (book value). A normal ratio for the overall market should be close to one. Such a ratio means that value is being properly imputed, and that the structure of...

Read More »Democracy without Foundations

In last week’s column, I criticized Jedediah Purdy for the ignorance of economic theory on display in his Two Cheers for Politics. Fortunately, the book contains much of interest, reflecting the author’s wide knowledge of the history of political philosophy. I have to say, though, that the main argument of the book strikes me as utterly unconvincing. Purdy starts off well. He asks, Why are people living today bound by past political arrangements to which they have...

Read More »We Cannot Interpret Economic Data Unless We Know Economic Theory

Most economic commentators believe that historical data is the key in assessing the state of the economy. Thus, if a statistic such as real gross domestic product or industrial production displays a visible increase, then the economy is stronger. Conversely, a decline in the growth rate says the economy is weakening. It seems that one can establish the state of economic conditions simply by looking at the data. The so-called data that analysts are examining, however,...

Read More »Inflation, the Price Level, and Economic Growth: Everything the Elites Tell You about It Is Wrong

Fundamentally, inflation is fraud. The central government or bank printing more money lessens the value of the money already in circulation. A truckload of sand isn’t particularly valuable in Saudi Arabia. An increased supply of money means ultimately that prices denominated in that money will go up. Unless you are the one to receive that new money at its point of entry, and thus keep pace with the inflation, the real value of your money holdings will go down. So, in...

Read More »By Compensating Slave Owners, Great Britain Negotiated a Peaceful End to Slavery

The 2018 announcement that the British government completed the payment of a loan that was borrowed to compensate slave owners for the abolition of slavery continues to evoke a flurry of emotions. Many find it outrageous that the British government would contemplate compensating planters rather than the enslaved. Such responses are expected because people are using current moral standards to judge historical realities. But an appreciation of the sociopolitical events...

Read More »Inflation: State-Sponsored Terrorism

I. Introduction Remember the quaint old days of 2019? We were told the US economy was in great shape. Inflation was low, jobs were plentiful, GDP was growing. And frankly, if covid had not come along, there is a pretty good chance Donald Trump would have been reelected. At an event in 2019, my friend and economist Dr. Bob Murphy said something very interesting about the political schism in this country. He said: If you think America is divided now, what would things...

Read More »Does Reducing Unemployment through Government Spending Boost the Economy?

Some experts hold that the key to economic growth is to strengthen the labor market, which is based on the view that because of the reduction in the number of unemployed workers, more individuals can afford to increase spending. As a result, economic growth follows suit. The Expanding Pool of Savings—Not Declining Unemployment—Is the Key for Economic Growth However, the key driver of economic growth is an expanding pool of savings, not the state of the labor market....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org