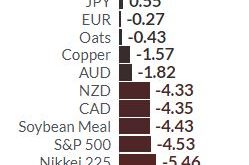

◆ Gold is the top performing asset in the world in the first half of 2020, outperforming all stock markets including the S&P 500 and the Nasdaq and outperforming “safe haven” U.S. government bonds (see table above). Gold had an 18% gain in dollars in the first half of 2020 as risk assets, especially stock markets, fell sharply with the S&P down 4.5% and other stock markets down more than 10% (see table). Gold gained 18.6% in euros and by 25% in British...

Read More »“The illusions of Keynesianism create a morally corrupt society” – Part II

Part I can be found here Claudio Grass (CG): Overall, apart from the obvious economic consequences of the crisis, do you also see geopolitical and social ones, on a wider scale? Given all these “moving parts”, from the upcoming US election and internal frictions in the EU to the Hong Kong tensions and the rising public discontent in Latin America, where do expect the chips to fall once this is over? Jayant Bhandari (JB): What I have told you about India to a large...

Read More »World’s Ultra Wealthy Urged By Financial Advisers and Largest Banks to “Hold More Gold”

◆ World’s wealthy are being urged by their financial advisers to hold more gold as they question the strength of the stock market rally and are concerned about the long-term impact of global central banks’ cash splurge. ZURICH /LONDON (via Reuters) – As stock markets roar back from the coronavirus led rout, advisers to the world’s wealthy are urging them to hold more gold, questioning the strength of the rally and the long-term impact of global central banks’ cash...

Read More »Defaults Are Coming, Market Report, 22 June

We are reading now about possible regulations for air travel. In brief: passengers might be forced to spend hours at the airport. Authorities will perform medical checks, including possibly needles to draw blood, no lounges, no food or drink on board the plane, masks required at all times, and even denied the use of a bathroom except by special permission. We would wager an ounce of fine gold against a soggy dollar bill that people will hate this. The majority of...

Read More »WARNING: The U.S. Banking System ISN’T as Strong as Advertised

Despite a year of tumult on Wall Street and Main Street, the banking system seems to be holding up remarkably well… for now. Whereas previous financial crises were marked by a surge in bank failures, hardly any have gone under so far in 2020. The Federal Deposit Insurance Corporation (FDIC) reports that only 1% of FDIC-insured banks are on the “problem list” for financial weakness. “Banks are safe,” according to FDIC chair Jelena McWilliams. “There are no concerns...

Read More »The War On Cash – COVID Edition Part II

The digital “toll” It doesn’t require too dark an imagination to realize the gravity of the concerns over the digital yuan. China is a true pioneer when it comes surveillance, censorship and political oppression and the digital age has given an incredibly efficient and effective arsenal to the state. Adding money to that toolkit was a move that was planned for many years and it is abundantly clear how useful a tool it can be for any totalitarian regime. The ability...

Read More »Growing Dollar Demand, Silver Weirdness, Market Report, 15 June

The Federal Reserve has become more aggressive again, after several years of acting docile. As you can see on this chart of the Fed’s balance sheet, it has very rapidly expanded from a baseline from (prior to) 2015 through 2018, of about $4.4 trillion. After which, it had attempted to taper, getting down to $3.8 trillion last summer. Then it was obliged to reverse itself well before responding to the COVID lockdown. Since then, its balance sheet has gone vertical....

Read More »Fed Chairman: “We’re Not Even Thinking About Thinking About Raising Rates”

Jerome Powell Market volatility has suddenly spiked in recent days came after the Federal Reserve vowed last Wednesday to keep its benchmark rate near zero through 2022. That’s an unusually long period for the Fed to be projecting rate policy. It reflects the fact that it will take many months and perhaps years for the tens of millions of jobs that were recently lost to return. During his press conference, Chairman Powell stumbled and stammered his way into stating...

Read More »A Dollar Crash Is Coming

◆The world is having serious doubts about the once widely accepted presumption of American exceptionalism. The era of the U.S. dollar’s “exorbitant privilege” as the world’s primary reserve currency is coming to an end. In the 1960s French Finance Minister Valery Giscard d’Estaing coined that phrase largely out of frustration, bemoaning a United States that drew freely on the rest of the world to support its overextended standard of living. For almost 60 years, the...

Read More »Reject the “Next Generation EU Plan”

The Václav Klaus Institute urging the Czech Government to reject the dangerous Ursula von der Leyen´s plan It is rather rare that I share articles on my channel that are not from my own pen. The following article is therefore an exception and for good reason. It is written by none other than the former President of the Czech Republic Václav Klaus, with whom I have a long-standing relationship, based on great respect and many shared values. The arguments he presents...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org