James Rickards holds a gold bar in a vault near Zurich, Switzerland. The bar is a so-called LBMA “good delivery” bar which weigh 400 ounces (over 99.9% purity), and is worth about $700,000 at current market prices. In 1971 it was worth $14,000. ◆ WHY GOLD? That’s a question I’m asked frequently. It’s usually followed by a comment along the lines of, “I don’t get it. It’s just a shiny rock. People dig it out of the ground and then put it back in the ground. What’s the...

Read More »Technocracy vs Liberty

“I prefer true but imperfect knowledge, even if it leaves much undetermined and unpredictable, to a pretense of exact knowledge that is likely to be false.” Friedrich August von Hayek On Friday Dave from X22 and I discussed the planned “Cultural Revolution 2020” led by “the anointed” technocrats and whether we have to accept their reality as ours – or not? [embedded content] This work is licensed under a Creative Commons Attribution 4.0 International License....

Read More »Monetary Metals Provides Gold Loan to Sector Resources

The loan is denominated in gold with interest and principal paid in gold Scottsdale, Ariz., June 9, 2020—Monetary Metals® announced today that it has loaned gold to Sector Resources Canada Ltd., a British Columbia based gold mining company. The private transaction was conducted off-market, and the interest rate and terms were not disclosed. Monetary Metals’ innovative business model enables gold-owning investors to lease or lend gold to businesses that use gold....

Read More »Global Silver Investment Demand To Surge While Supply Weak (World Silver Survey 2020)

◆ WORLD SILVER SURVEY 2020 from the SILVER INSTITUTE GLOBAL SILVER DEMAND EDGED HIGHER IN 2019, WITH INVESTMENT DEMAND UP 12%, WHILE SILVER MINE SUPPLY FELL FOR THE FOURTH CONSECUTIVE YEAR Global silver demand was pushed higher in 2019, with a 12 percent increase in investment demand as retail and institutional investors focused their attention on the long-term investment appeal of the white metal. Favorable structural changes, such as vehicle electrification and a...

Read More »Pandemic, Economic Shutdowns, Debt Crisis and Gold At $5,000/oz

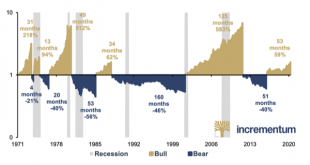

◆ GoldCore are delighted to publish the 14th edition of the annual “In Gold We Trust” report, “The Dawning of a Golden Decade” by by our friends Ronald-Peter Stoeferle & Mark J. Valek of Incrementum AG. Gold prices should rise to over $5,000/oz and may rise as high as $9,000/oz in the coming decade and by 2030, according to the respected report. Gold is “on everyone’s lips again” and “we are now in a new phase of the bull market”. The question that now occupies...

Read More »Is Your Pension ‘Good as Gold’?

Published on Independent Trustee Company (27/05/2020) ◆ With the current level of uncertainty in world markets we have received numerous requests for information on how self directed pension schemes (pre and post retirement) can hold gold and silver. It is accepted that if gold bullion is held via a gold certificates ( Perth Mint Certificates with GoldCore) or in Secure Storage in a variety of local or international locations with GoldCore, then it is not considered...

Read More »An unexpected blow to the ECB

Since the beginning of the year, the corona crisis has come to monopolize the news coverage to the extent that a lot of very important stories and developments either went underreported or were ignored altogether. One such example was the very surprising ruling out of the German Constitutional Court in early May, that challenged the actions and remit of the ECB. This decision could have severe repercussions if it were to be held up, but the reactions to it were...

Read More »When Is a Capital Gain Capital Consumption? Market Report, 25 May

The price of gold dropped a few bucks this week, but the price of silver jumped about half a buck. The drumbeat for the gold bull market is well underway, and it is beginning now for silver. So let’s do a quick update on the supply and demand fundamentals. Gold Basis and Co-basis and the Dollar Price Here is the graph of the gold basis. The basis has come in quite a bit—but it is still 3.6% annualized. We do not believe that this as a “true” reading. It is a sign of...

Read More »The Federal Counterfeiter

Suppose you wanted to run an enterprise the right way (we know, we know, this is pretty far-out fiction, but bear with us). And, your enterprise has a $1 million dollar piece of equipment that wears out after 10 years. You must set aside $100,000 a year, so that you have $1 million at the end of 10 years when the equipment needs replacing. There’s a word, now archaic, to describe the account in which you set aside this money. From Wikipedia: “A sinking fund is a...

Read More »Open Letter to Crispin Odey

Crispin Odey I am writing in response to the comments you made in a letter to investors yesterday, which were widely reported. You have set the gold community afire, with claims that are not new and not true. So I shall attempt to douse the flames. As everyone knows, President Roosevelt outlawed the ownership of gold in 1933. Although gold was legalized in 1975, fears linger today that the governments may repeat this heinous act. There is no reason for this fear. In...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org