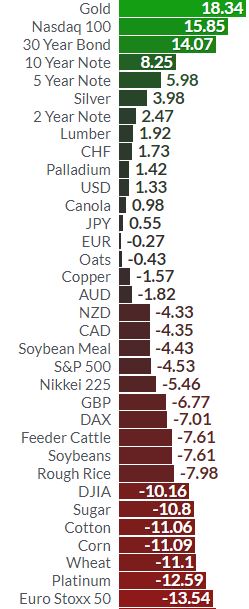

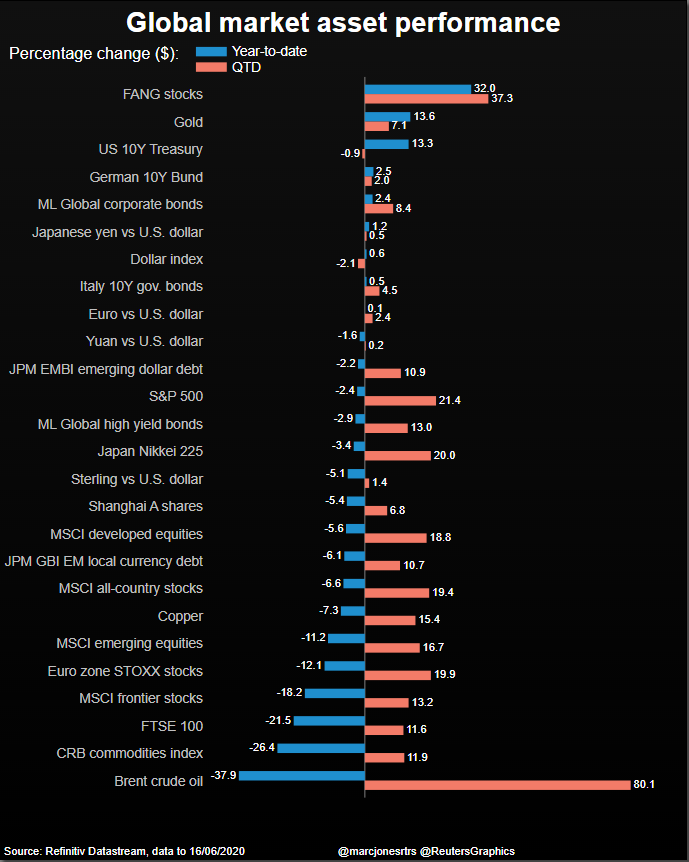

◆ Gold is the top performing asset in the world in the first half of 2020, outperforming all stock markets including the S&P 500 and the Nasdaq and outperforming “safe haven” U.S. government bonds (see table above). Gold had an 18% gain in dollars in the first half of 2020 as risk assets, especially stock markets, fell sharply with the S&P down 4.5% and other stock markets down more than 10% (see table). Gold gained 18.6% in euros and by 25% in British pounds as the UK economy had the worst contraction since 1979 and the pound was further devalued. . The historical data in the last 20 to 40 years shows that seasonally gold and silver tend to do poorly in June and very well in the summer months in July and August and extending into September. Indeed late June and

Topics:

Mark O'Byrne considers the following as important: 6a.) GoldCore, 6a) Gold & Bitcoin, Daily Market Update, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| ◆ Gold is the top performing asset in the world in the first half of 2020, outperforming all stock markets including the S&P 500 and the Nasdaq and outperforming “safe haven” U.S. government bonds (see table above).

Gold had an 18% gain in dollars in the first half of 2020 as risk assets, especially stock markets, fell sharply with the S&P down 4.5% and other stock markets down more than 10% (see table). Gold gained 18.6% in euros and by 25% in British pounds as the UK economy had the worst contraction since 1979 and the pound was further devalued. |

|

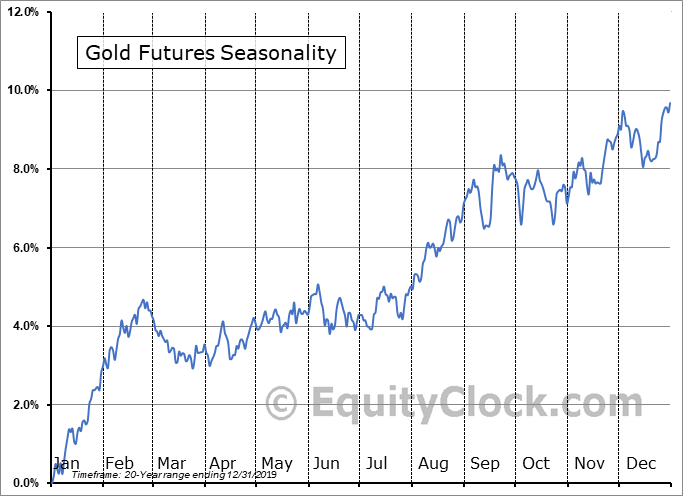

| The historical data in the last 20 to 40 years shows that seasonally gold and silver tend to do poorly in June and very well in the summer months in July and August and extending into September. Indeed late June and early to mid July tend to see quite a degree of selling and weakness prior to strong gains from mid July and into August and September (see chart above).

New record gold price highs over $1,915/oz are becoming the consensus now as the virus prompts reactionary measures including massive and unprecedented stimulus, fiscal spending and bail outs of corporate Americas and corporations globally. Governments and central banks are desperately trying to minimize the damage economic and societal lockdowns are having on an already massively indebted, to the tune of around $300 trillion, global economy. Prudent investors will continue to diversify into gold and more undervalued silver in the form of physical bullion coins and bars in vaults globally and into more high risk paper and electronic gold including crypto products and gold and silver exchange traded funds (ETFs). |

Gold Futures Seasonality, 2019 |

Tags: Daily Market Update,Featured,newsletter