For about ten bucks a month, Netflix will give you all the movies you can watch, plus tons of TV show series and other programs, such as one-off science documentaries. They don’t offer all movies, merely more than you can watch. Oh, and there are no commercials. They don’t just give you old BBC reruns, which you know they can get for a pittance. Netflix is spending money (well Federal Reserve Notes) producing its own...

Read More »Rep. Alex Mooney: Bring Back Gold!

This article originally appeared here. Washington has been quite the circus lately. Bret Kavanaugh’s appearance in front of the Senate Judiciary Committee prompted dozens of interruptions from Democrats and numerous protests from leftists. During Twitter CEO Jack Dorsey’s testimony to the House Commerce Committee, journalist Laura Loomer demanded to be verified on the social media platform, and Representative Billy Long...

Read More »Why the Fed Denied the Narrow Bank, Report 9 Sep 2018

It’s not every day that a clear example showing the horrors of central planning comes along—the doublethink, the distortions, and the perverse incentives. It’s not every year that such an example occurs for monetary central planning. One came to the national attention this week. A company called TNB applied for a Master Account with the Federal Reserve Bank of New York. Their application was denied. They have sued....

Read More »Illicit Arbitrage Cut by Tax Cuts and Jobs Act, Report 3 Sep 2018

This week, we are back to our ongoing series on capital destruction. Let’s consider the simple transaction of issuing a bond. Party X sells a bond to Party Y. We will first offer something entirely uncontroversial. If the interest rate rises after Y buys the bond, then Y takes a loss. Or if the interest rate falls, then Y makes a capital gain. This is simply saying that the bond price moves inverse to the interest...

Read More »Why Am I Fighting for the Gold Standard?

Life is good. They could not have imagined what we have now, back in the dark ages. So I have never understood why people prep for a return to the dark ages. The only thing I can think of is that they don’t really picture what life is like. 14 hours a day of back-breaking labor to eke out a subsistence living. Subject to the risks of rain, sun, and insects. Prepping makes no sense to me. I don’t know if I would choose...

Read More »Another Gold Bearish Factor, Report 26 August 2018

Last week, we said that the consensus is that gold must go down (as measured in terms of the unstable dollar) and then will rocket higher. We suggested that if everyone expects an outcome in the market, the outcome is likely not to turn out that way. We also said that this time, there is likely less leverage employed to buy gold and that gold is less leveraged as well. And this, combined with a contrarian perspective on...

Read More »Annual Mine Supply of Gold: Does it Matter?

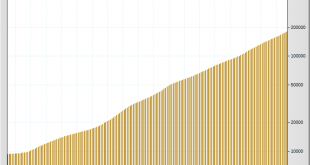

The topic of how much extractable gold is left in the world has become increasingly discussed within the last few years. This is because of increased focus on ‘peak gold’ and also a concern about remaining levels of unextracted gold reserves. Peak gold is a term referring to the phenomenon of annual gold mining supply peaking (i.e. the rate of gold extraction increases until it peaks at maximum gold output and...

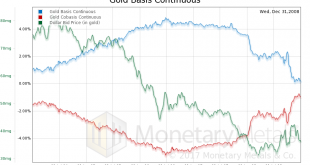

Read More »In Next Crisis, Gold Won’t Drop Like 2008, Report 19 August 2018

Last week, we discussed the tension between forces pushing the dollar up and down (measured in gold—you cannot measure the dollar in terms of its derivatives such as euro, pound, yen, and yuan). And we gave short shrift to the forces pushing the dollar down. We said only that to own a dollar is to be a creditor. And if the debtors seem in imminent danger of default, then creditors should want to escape this risk. The...

Read More »Who Would Invest in a Gold Bond?

Berkshire Hathaway CEO Warren Buffet famously dismissed gold. “Gold has two significant shortcomings, being neither of much use nor procreative.” I have recently written about how a government with gold mining tax revenues can use gold. The benefits of issuing gold bonds include reducing risk, and getting out of debt at a discount. Pretty useful, eh? As to his second point, one should never confuse suppressed with...

Read More »Monetary Consequence of Tariffs, Report 12 August 2018

Last week in Monetary Paradigm Reset, we talked about the challenge of explaining a new paradigm. We said: “The hard part of accepting this paradigm shift, was that people had to rethink their entire view of cosmology, theology, and philosophy. In the best case, people take time to grapple with these challenges to their idea of man’s place in the universe. Some never accept the new idea.” We were talking about the fact...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org