By: Rachel Koning Beals – News Editor Marketwatch Gold’s sharp decline over the past month serves as little surprise to the investors who want the asset to perform in just this fashion—that is, as an alternative to assets perceived as risky, like stocks. They’re betting that the opposite will be true as well, that gold will resume its role as protector and diversifier, even inflation hedge, when what they see as bloated...

Read More »Monetary Paradigm Reset, Report 5 August 2018

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Explaining a new paradigm can be both simple and impossible at the same time. For example, Copernicus taught that the other planets and Sun do not revolve around the Earth. He said that all the planets revolve around the Sun, including Earth. It isn’t hard to say, and it isn’t especially hard to grasp. Indeed, one of its...

Read More »Gold to Enter New Bull Market – Charles Nenner

Gold to Enter New Bull Market – Charles Nenner “Gold is going to enter a new bull market” “The first cycle will bottom after the summer” “$1,212 per ounce is our downside target” “It’s going to top $2,500 per ounce . . . in about two years or so” “Gold is in a bull market even though it came down from $1,900 per ounce” In our featured video today, Greg Hunter interviews Charles Nenner, President of The Charles Nenner...

Read More »A Dire Warning, Report 29 July 2018

Let’s return to our ongoing series on the destruction of capital, and how to identify the signs. Steve Saville posted a thoughtful article this week entitled The “Productivity of Debt” Myth. His article provides a good opportunity to add some additional thoughts. We have written quite a lot on this topic. Indeed, we have a landing page for marginal productivity of debt (MPoD) with four articles so far. Few economists...

Read More »Physical Gold Is The “Best Defence” Against “Escalating Currency Wars”

Physical Gold Is The “Best Defence” Against “Escalating Currency Wars” As governments around the world debase their currencies, you need an asset that can ride out the hard times. And nothing fits the bill like gold writes John Stepek of Money Week We’ve always said that you should have a bit of physical gold in your portfolio (about 5%-10%, depending). And note that, by gold, we do mean gold, not gold miners. If you...

Read More »Crying Wolf, Report 22 July 2018

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Quantity Theory Revisited The price of gold fell another ten bucks and that of silver another 28 cents. Perspective: if you’re waiting for the right moment to buy, the market is offering you a better deal than it did last week (literally, the price of gold is a 7.2% discount to the fundamental vs. 4.6% last week). If you...

Read More »Solutions without Historical Templates: Cryptocurrencies and Blockchains

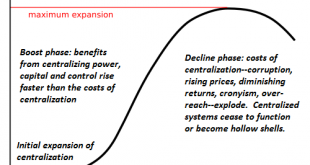

Crypto-blockchain technologies are leveraging the potential of computers and the web for direct political-social innovation. We’re accustomed to three basic templates for system-wide solutions or improvements: 1. an individual “builds a better mousetrap” and starts a company to exploit this competitive advantage; 2. a company invents something that spawns a new industry (the photocopier, the web browser, for example)...

Read More »Chinese Gold Market: Still in the Driving Seat

With the first half of 2018 now behind us, it’s an opportune time to look at whats been happening in the Chinese Gold Market. As a reminder, China is the largest gold producer in the world, the largest gold importer in the world, and China’s Shanghai Gold Exchange is the largest physical gold exchange in the world. For various reasons such as cross-border trade rules, VAT rules and deep liquidity, nearly all physical...

Read More »Bitcoin — when mainstream?

Since the beginning of the year, Bitcoin has seen its price cut in half and beyond. Other crypto assets have fallen even more. Although the king of the crypto world has rebelled from time to time over recent months, Bitcoin’s occasional price increases have always been met with follow-up downturns. The crypto market is still mainly populated by private investors. Institutional investors, especially Wall Street, are not...

Read More »The Great Gold Upgrade, Report 15 July 2018

In part I the Great Reset, we said that a reset is a terrible thing. The closest example is the fall of Rome in 476AD, in which more than 90% of the population of the city fled or died. No one should wish for this to happen, but we are unfortunate to live under a failing monetary system. Debt is growing exponentially. A way must be found to transition to the use of gold. We covered a few ways that won’t work. The Fed...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org