Redefined Terms and Absurd Targets At one time, the Federal Reserve’s sole mandate was to maintain stable prices and to “fight inflation.” To the Fed, the financial press, and most everyone else “inflation” means rising prices instead of its original and true definition as an increase in the money supply. Rising prices are a consequence – a very painful consequence – of money printing. Fed Chair Jerome Powell apparently does not see the pernicious effects of inflation (at least he seems to be looking around… [PT]) Photo credit: Andrew Harrer / Bloomberg Naturally, the Fed and all other central bankers prefer the definition of inflation as a rise in prices which insidiously hides the fact that they, being the

Topics:

Antonius Aquinas considers the following as important: 6) Gold and Austrian Economics, 6b) Austrian Economics, Central Banks, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Redefined Terms and Absurd TargetsAt one time, the Federal Reserve’s sole mandate was to maintain stable prices and to “fight inflation.” To the Fed, the financial press, and most everyone else “inflation” means rising prices instead of its original and true definition as an increase in the money supply. Rising prices are a consequence – a very painful consequence – of money printing. |

|

| Naturally, the Fed and all other central bankers prefer the definition of inflation as a rise in prices which insidiously hides the fact that they, being the issuers of currency, are the real culprit for increased prices.

Be that as it may, the common understanding of inflation as rising prices has always been seen as pernicious and destructive to an economy and living standards. In the perverted world of modern economics, however, the idea of inflation as an intrinsic evil has been turned on its head and monetary authorities the world over now have “inflation targets” which they hope to attain. America’s central bank is right in line with this lunacy. According to the Fed’s “May minutes”, it wants

Translated into understandable verbiage, the Fed wants everyone to pay at least 2% higher prices p.a. for the goods they buy. Yes, by some crazed thinking US monetary officials believe that consumers paying higher prices is somehow good for economic activity and standards of living! Of course, anyone with a modicum of sense can see that this is absurd and that those who espouse such policy should be laughed at and summarily locked up in an asylum! Yet, this is now standard policy, not just with the Fed, but with the ECU and other central banks. |

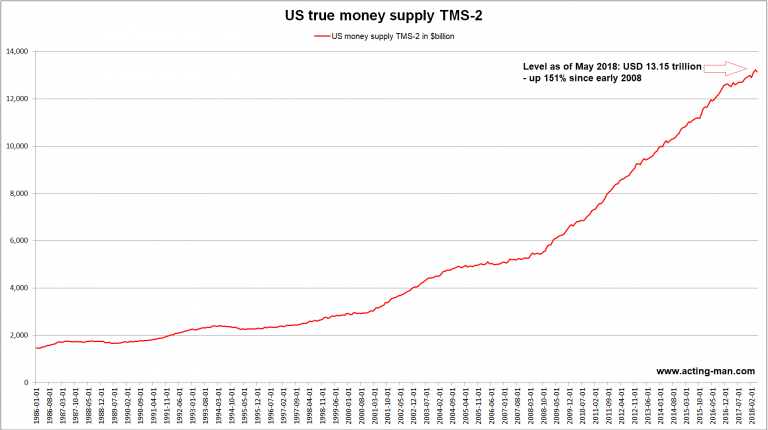

US true broad money supply TMS-2 since 1986 - 2018US true broad money supply TMS-2 since 1986. The domestic US money supply has increased by a stunning USD 7.85 trillion since 2008, or more than 150%. This was the by far largest ten-year surge in the US money supply of the entire post WW2 era. Naturally, there have been enormous effects on prices, they have just not shown up in CPI yet. This is in the nature of the process: new money always enters the economy at discrete points and propagates from there. One can certainly see the effects on asset prices, from stocks to real estate (the bubble in RE prices has in the meantime also been resurrected in its entirety). When and to what extent CPI statistics will be affected is not preordained. Experience shows that this tends to happen with a considerable lag. Note also: while money does clearly have a purchasing power that is diminished by money printing, the “general level of prices” is actually a fiction. It cannot be “measured” or “calculated”, as that would require a constant with which to measure it. Since both the supply of and demand for money and the supply of and demand for goods and services fluctuate, no such constant exists in the real world. [PT] |

Economic QuackeryThe baneful consequence of this economic quackery is being felt by American workers as admitted by the Labor Department. Instead of spurring expansion, inflation is eating into and depressing wages:

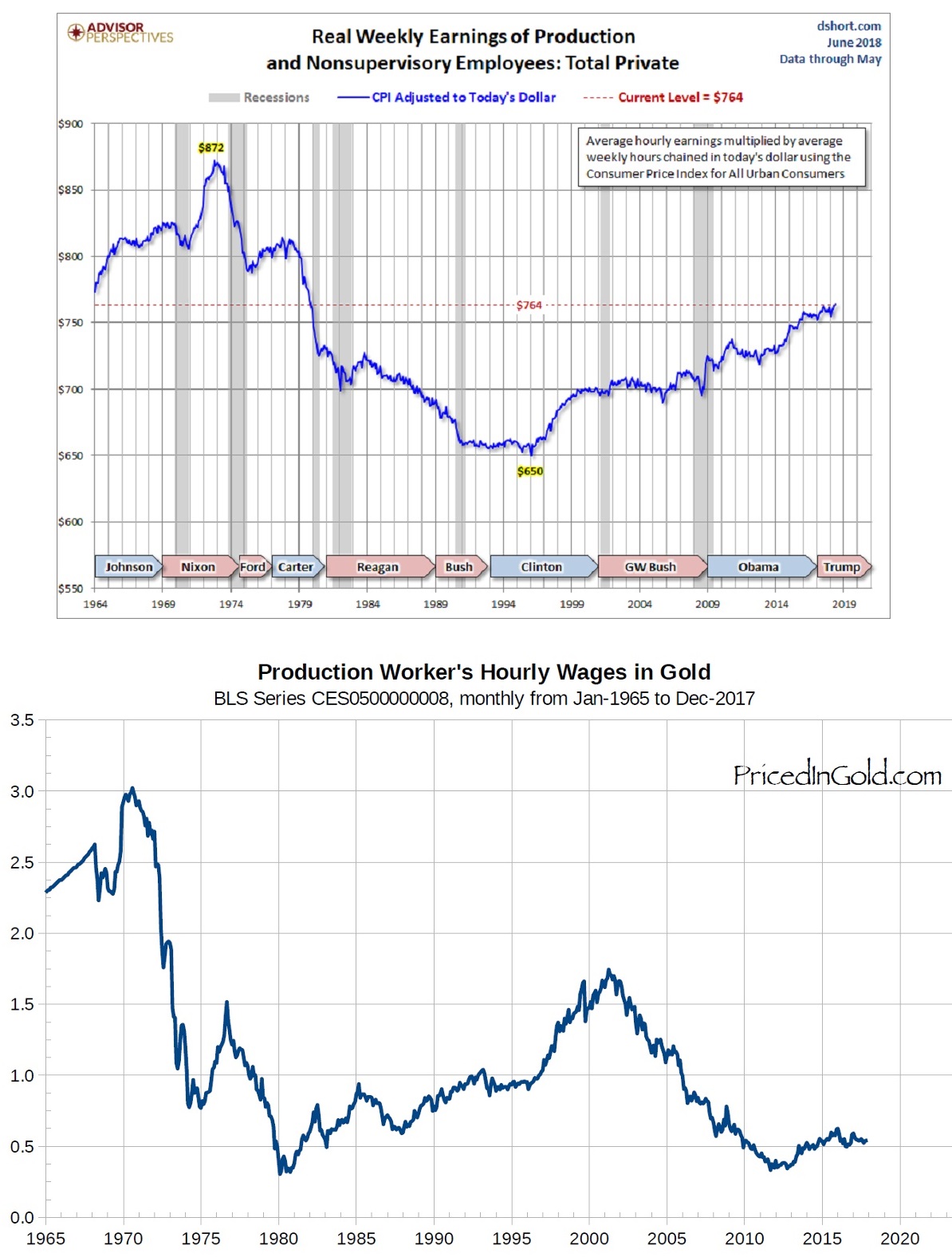

While the decline in nominal wages is not significant, the manner in which the government now calculates inflation has been skewed to understate its impact. Under the previous calculation, the current US inflation rate is probably closer to 5%. [ed note: different baskets of goods and services are relevant for different people; the “average” of CPI is essentially relevant for no-one. The de facto impossible calculation was frequently altered in the past several decades, with the aim of lowering the government’s COLA expenses – i.e., inflation adjustments to various non-discretionary entitlement spending items – PT] Wage stagnation is not new. Average real wages peaked more than 40 years ago and have fallen in real terms ever since. Not surprisingly, the drop in wages in real terms began soon after the US went off the last vestiges of the gold standard in 1971. As sound theory has long ago demonstrated, the idea of economic growth through money printing is absurd. Increases in living standards and real wages can only come about through savings, investment, and capital accumulation. Workers who have superior tools and equipment are obviously more productive than those that do not. Yet, capital goods have to be produced and production takes place over time. Savings allow for funding the production process. |

Real wages – Top: weekly wages; Bottom: hourly wagesReal wages – Top: weekly wages of production and non-supervisory workers deflated by CPI; Bottom: hourly wages of the same group of workers deflated by gold prices. Note: weekly earnings are also adjusted by hours worked per week, which have decreased from 38.8 hours in 1965 to 33.8 hours today. Nevertheless, hourly wages deflated by CPI also remain well below the peak attained in the late 1960s. The stark reality is probably better illustrated by deflating wages by gold prices, as this is a market-based indicator. If one uses the true money supply as the deflator, the decline is even larger. [PT] |

The level of wages is also closely linked to savings. The greater the savings in an economy, the easier it is for entrepreneurs to bid for workers and increase wage rates. This is how wages rise – competition for labor among businessmen pushes up wage rates. The more savings entrepreneurs have, the higher they can bid for employees.

How and why wage rates rise and how employment is created had been understood by economists of yesteryear. Today, however, the profession is dominated by “inflationists” and monetary cranks who believe that nearly every economic problem can be solved by the printing press. Anyone who holds such ideas cannot be taken seriously.

While the Federal Reserve may think an inflation target will create prosperity, the reality for real wages is quite the opposite. The laws of economic science have not been repealed. An inflation target will lead to the impoverishment of not just workers, but lower living standards for all.

References:

* FOMC, minutes of the May meeting (PDF)

**Jeff Stein and Andrew van Dam, “For the Biggest Group of American Workers, Wages Aren’t Just Flat. They’re Falling.” The Washington Post. 16 June 2018 A10.

Charts by: acting-man.com, Doug Short/Advisorperspectives, pricedInGold.com; data by St. Louis Fed

Chart and image captions by PT

Tags: central banks,Featured,newsletter