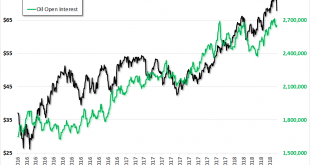

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Crude Oil Market Structure – Extremes in Speculative Net Long Positions On May 28, markets were closed so this Report is coming out a day later than normal. The price of gold rose nine bucks, and the price of silver 4 pennies. With little action here, we thought we would write 1,000 words’ worth about oil. Here is a chart...

Read More »Gold Back Above $1300 – Trump Cancels Historic Summit – Silver “Ready To Breakout”

– Trump Cancels Historic Summit with North Korea – US 10-Year Falls Below 3%, Gold Jumps Back Above $1300 – “Inflation Overshoot Could Be Helpful” – Latest FOMC Minutes– Gold Demand in Turkey as Lira falls sharply, true inflation near 40%– EU Crisis Looming as Italy Plan Outright ‘Money Printing’ with ‘Mini-Bots’– Silver Trading in Tight $1 range, Pressure Building for a Breakout Weekly Report by Daniel MarchEditor...

Read More »‘Nightmare Scenario’ For EU Bond Markets As Anti-Euro Italian Goverment Takes Power

by Ambrose Evans-Pritchard, Daily Telegraph Firebrand populists of Left and Right are poised to take power in Italy, forming the first “anti-system” government in a major West European state since the Second World War. Leaders of the radical Five Star Movement and the anti-euro Lega party have been meeting to put the finishing touches on a coalition of outsiders, the “nightmare scenario” feared by foreign investors and...

Read More »Gold Looks A Better Bet Than UK Property

Gold Looks A Better Investment Than UK Property Dominic Frisby of Money Week looks at the historical relationship between UK house prices and gold (including some great charts), and concludes that your money is better off in the yellow metal than bricks and mortar. Today we return to a subject that has been a favourite of mine over the years: UK house prices – but with a twist. We don’t consider them in the debased,...

Read More »Is Political Decentralization the Only Hope for Western Civilization?

Voting with their Feet A couple of recent articles have once more made the case, at least implicitly, for political decentralization as the only viable path which will begin to solve the seemingly insurmountable political, economic, and social crises which the Western world now faces. Fracture lines – tax and regulatory competition allows people to “vote with their feet” – and they certainly do. - Click to enlarge In...

Read More »Tales from “The Master of Disaster”

Tightening Credit Markets Daylight extends a little further into the evening with each passing day. Moods ease. Contentment rises. These are some of the many delights the northern hemisphere has to offer this time of year. As summer approaches, and dispositions loosen, something less amiable is happening. Credit markets are tightening. The yield on the 10-Year Treasury note has exceeded 3.12 percent. If yields...

Read More »Why the Fundamental Gold Price Rose – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Gold Lending and Arbitrage There was no rise in the purchasing power of gold this week. The price of gold fell $22, and that of silver $0.19. One question that comes up is why is the fundamental price so far above the market price? Starting in January, the fundamental price began to move up sharply, and the move...

Read More »Gold and Gold Stocks – Conundrum Alert

Moribund Meandering Earlier this week, the USD gold price was pushed rather unceremoniously off its perch above the $1300 level, where it had been comfortably ensconced all year after its usual seasonal rally around the turn of the year. For a while it seemed as though the $1,300 level may actually hold, but persistent US dollar strength nixed that idea. Previously many observers (too many?) expected gold to finally...

Read More »US 10-Year Surges, Emerging Markets Implode…Where Next for Gold?

US 10-Year Surges, Emerging Markets Implode…Where Next for Gold? US 10-Year Yields Top 3%, US Dollar Pushes Higher Brent Hits $80, Highest in 4 years Emerging Market Chaos, the Lira and Peso in Freefall Italy’s New Coalition Signal Their Plans, Yields Jump Japanese Economy Contracts, GDP Worst Since 2015 And Where Next for Gold? Gold and silver ended the week down (USD -2.2%, GBP -1.4%, and EUR -0.5%) as rising US...

Read More »Welsh Gold Being Hyped Due To The Royal Wedding?

Welsh Gold Being Hyped Due To The Royal Wedding? – Welsh gold and the misconceptions surrounding it – GoldCore speak to China Central Television (CCTV) – Welsh gold mired in misconceptions, namely that it is ‘rarest’ and most ‘sought after’ gold in world – Investors to be reminded that all mined gold is rare and homogenous – Nothing chemically different between Welsh gold and that mined elsewhere– Investors led to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org