The auto market can be challenging and unpredictable, but with the right strategies and insights, automotive business owners can thrive. This article will explore the financial savvy ways to succeed in the auto market, focusing on understanding the current landscape, saving money, using modern financial tools and AI, and navigating warranties and service contracts. By implementing these strategies, automotive entrepreneurs can build a solid foundation for long-term...

Read More »Rückläufige US-Erdölvorräte lassen Ölpreise steigen

Die Vereinigten Staaten weisen sinkende Ölreserven auf. Dies führt zu einem Druck auf die Preise. Trotz eines Anstiegs der Rohölvorräte im jüngsten EIA-Bericht sind die kommerziellen Erdölvorräte in den USA in den meisten Wochen der letzten anderthalb Jahre zurückgegangen und liegen unter dem saisonalen Durchschnitt der letzten fünf Jahre und sogar unter dem Fünfjahresdurchschnitt vor der Pandemie. Der kontinuierliche Rückgang der US-amerikanischen Erdölvorräte im...

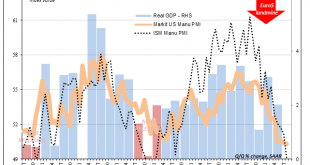

Read More »United States: The ISM Conundrum

Bond yields have tumbled this morning, bringing the 10-year US Treasury rate within sight of its record low level. The catalyst appears to have been the ISM’s Manufacturing PMI. Falling below 50, this widely followed economic indicator continues its rapid unwinding. Back in November 2018, at just about 59 the overall index had still been close to its multi-decade high. Over the next nine months through the latest update for August 2019, it has shed almost 10 points....

Read More »Latest Thoughts on the US Economic Outlook

The US economy is starting to show cracks from the ongoing trade war. While we do not want to make too much from one data point, we acknowledge that headwinds are building whilst US recession risks are rising. RECENT DEVELOPMENTS US ISM manufacturing PMI fell to 49.1 vs. 51.3 expected. This is the first sub-50 reading since August 2016 and the lowest since January 2016. The employment component fell to 47.4 from 51.7 in July, while new orders fell to 47.2 from 50.8...

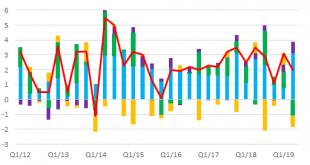

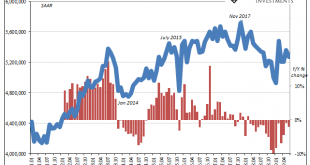

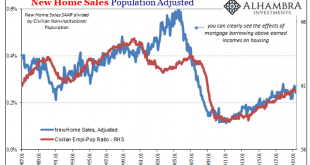

Read More »Real Estate Perfectly Sums Up The Rate Cuts

It’s only a confusing when you just accept the booming economy of the unemployment rate. From this perspective, 2018 was, and more so 2019 is, a downright conundrum. By all mainstream accounts, this just shouldn’t be happening. Home sales are running at a pace similar to 2015 levels – even with exceptionally low mortgage rates, a record number of jobs and a record high net worth in the country. Not only that, 2015...

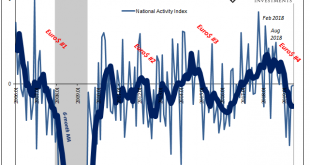

Read More »US Economic Crosscurrents Reach the 50 Mark

In the official narrative, the economy is robust and resilient. The fundamentals, particularly the labor market, are solid. It’s just that there has arisen an undercurrent or crosscurrent of some other stuff. Central bankers initially pointed the finger at trade wars and the negative “sentiment” it creates across the world but they’ve changed their view somewhat. A few billion in tariffs, even if we include what is to...

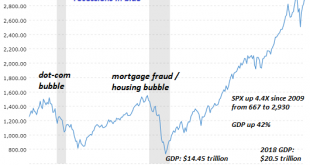

Read More »It’s Not Just the News That’s Fake–Everything’s Fake

That we fall for the fakes and cons is understandable, given that’s all we have left in the public sphere. What do we mean when we say corporate media is fake? We mean it’s a carefully crafted con, a set of narratives, cherry-picked data and heavily massaged statistics (the unemployment rate, etc.) designed to instill the reader’s confidence in a narrative that serves the interests not of the citizenry but of a select...

Read More »What Does It Mean That Real Estate, Not Equities, Is Driving Monetary Policy?

In the world of assets classes, I don’t believe it is equities which hold the Federal Reserve’s attention. After the 2006-11 debacle, the big bust, you can at least understand why policymakers might be more attuned to real estate no matter how the NYSE trades. It may be a decade ago, but that’s the one thing out of the Global Financial Crisis which was seared into the consciousness of everyone who lived through it....

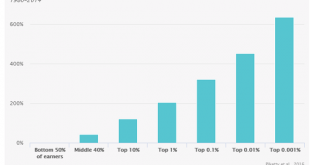

Read More »Our Ruling Elites Have No Idea How Much We Want to See Them All in Prison Jumpsuits

Even the most distracted, fragmented tribe of the peasantry eventually notices that they’re not in the top 1%, or the top 0.1%. Let’s posit that America will confront a Great Crisis in the next decade. This is the presumption of The Fourth Turning, a 4-generational cycle of 80 years that correlates rather neatly with the Great Crises of the past: 1781 (Revolutionary War, constitutional crisis); 1861 (Civil War) and 1941...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org