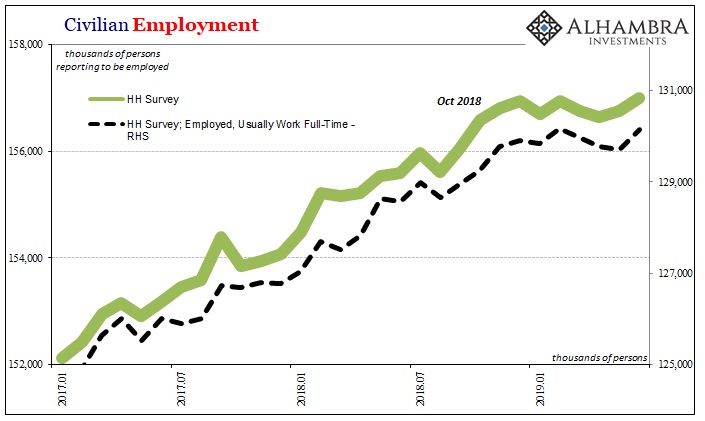

It’s only a confusing when you just accept the booming economy of the unemployment rate. From this perspective, 2018 was, and more so 2019 is, a downright conundrum. By all mainstream accounts, this just shouldn’t be happening. Home sales are running at a pace similar to 2015 levels – even with exceptionally low mortgage rates, a record number of jobs and a record high net worth in the country. Not only that, 2015 levels were substantially less than 2005 levels despite more than 30 million new Americans coming of age and being added to the prospective labor pool in between. The problem is work, not people. The unemployment rate says full employment; the housing market begs to differ for both the long run and now

Topics:

Jeffrey P. Snider considers the following as important: 5.) China, 5.) The United States, 5) Global Macro, currencies, economy, Featured, Federal Reserve/Monetary Policy, housing, Housing Market, Inventory, larry yun, Markets, nar, newsletter, Real estate, resales, sales of existing homes

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

It’s only a confusing when you just accept the booming economy of the unemployment rate. From this perspective, 2018 was, and more so 2019 is, a downright conundrum. By all mainstream accounts, this just shouldn’t be happening.

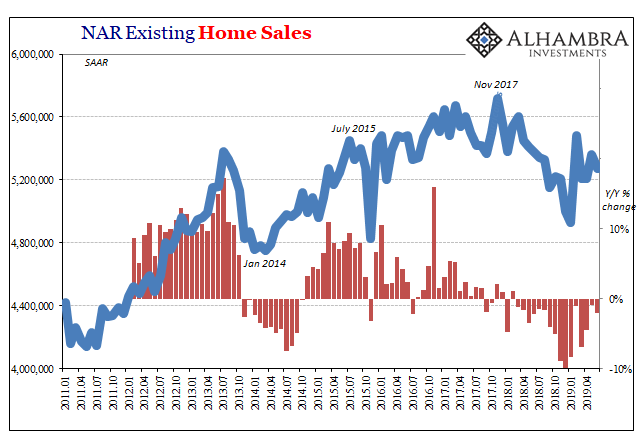

Not only that, 2015 levels were substantially less than 2005 levels despite more than 30 million new Americans coming of age and being added to the prospective labor pool in between. The problem is work, not people. The unemployment rate says full employment; the housing market begs to differ for both the long run and now short run. The National Association of Realtors (NAR) reported another lower monthly sales estimate. Existing home sales were 5.27 million (SAAR) in June 2019, down from 5.36 million in May. It was 2% less than the number of resales figured in June 2018, the sixteenth consecutive month of lower annual comps. The real estate market peaked all the way back in November 2017 (there’s that month again) at an annual rate of more than 5.7 million. |

NAR Existing Home Sales, Jan 2011 - May 2019 |

| Having blamed rate hikes and mortgage interest for 2018’s “unexpected” set back in what should have been a booming market, with that whole booming economy, NAR’s chief Economist Larry Yun seems exasperated by the lingering bust. It’s not a bust like the last big one a decade ago, but there should be no bust of any kind right now.

Not if the unemployment rate has been anything to go by.

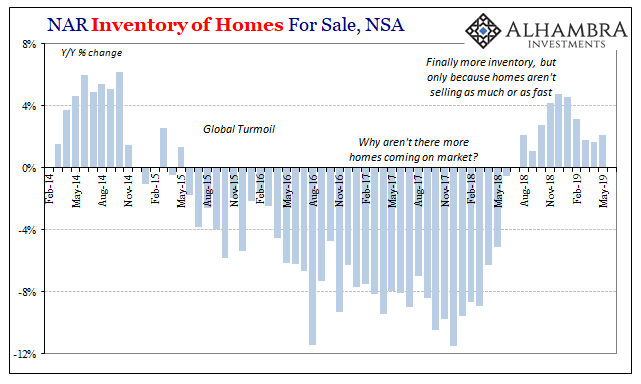

Exactly. Finally some sense from the very trade organization whose task it is to sell realtors to the public. They can’t blame interest rates any longer, mortgage costs have been coming down since last November. And they can’t blame inventory, not really (they still do), as the lower sales pace has meant an increase of available homes slowing down price gains. |

NAR Inventory of Homes For Sale, Feb 2014 - May 2019 |

Everything appears to be lined up in favor of the real estate market only starting with the unemployment rate, as noted by NAR President John Smaby.

And yet, something is keeps holding back both buyers and sellers. To Dr. Yun’s belated credit, he states exactly why there will be rate cuts starting next week. Jay Powell and the rest of the FOMC really want to travel to New York and embrace the computers that trade stocks on the NYSE, but they can’t because they’ve got to keep their wary eye on housing. For all that might make them feel good about everything with the S&P where it is, there’s a lot more unsettling over here in the NAR’s backyard. It should be robustly rebounding from transitory weakness, but instead the housing market is suggesting a “lack of confidence” about a whole lot more than home buying. |

Civilian Employment, Jan 2017 - July 2019 |

Tags: currencies,economy,Featured,Federal Reserve/Monetary Policy,Housing,Housing market,Inventory,larry yun,Markets,nar,newsletter,Real Estate,resales,sales of existing homes