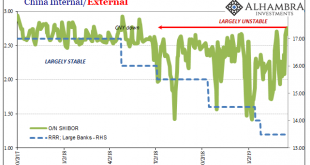

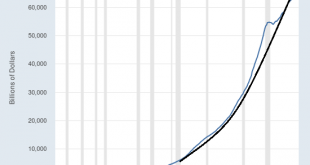

This will serve mostly as an update to what is going on inside the Chinese monetary system. The PBOC’s balance sheet numbers for February 2019 are exactly what we’ve come to expect, ironically confirmed today on the domestic end by the FOMC’s dreaded dovishness. Therefore, rather than rewrite the same commentary for why this continues to happen I’ll just link to prior discussions (here’s another). China...

Read More »Which Nations Will Crumble and Which Few Will Prosper in the Next 25 Years?

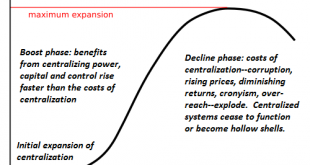

Adaptability and flexibility will be the core survival traits going forward. What will separate the many nations that will crumble in the next 25 years and those few that will survive and even prosper while the status quo dissolves around them? As I explain in my recent book Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic, the factors that will matter are not necessarily cultural or...

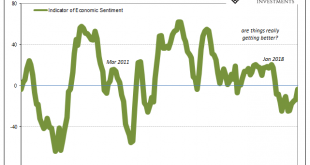

Read More »Slump, Downturn, Recession; All Add Up To Sideways

According to Germany’s Zentrum für Europäische Wirtschaftsforschung, or ZEW, the slump in the country’s economy has now reached its fourteenth month. The institute’s sentiment index has improved in the last two, but only slightly. As of the latest calculation released today, it stands at -3.6. That’s up from -24.7 back in October, though sentiment had likewise improved at one point last year, too. In July, the number...

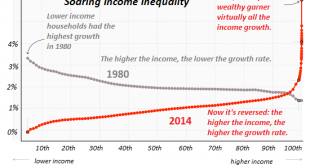

Read More »While the Nation Fragments Socially, the Financial Aristocracy Rules Unimpeded

America’s aristocracy is not formalized, and that’s the secret of its success. If there is one central irony in American history, it is this: the citizenry that broke free of the chains of British Monarchy, the citizenry that reckoned everyone was equal before the law, the citizenry that vowed never to be ruled by an aristocracy that controlled the government and finance as a means of self-enrichment, is now so...

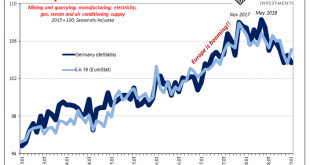

Read More »The World Economy’s Industrial Downswing

As economic data for 2019 comes in, the numbers continue to suggest more slowing especially in the goods economy. Perhaps what happened during that October-December window was a soft patch. Even if that was the case, we should still expect second and third order effects to follow along from it. Starting with Europe first, Germany’s deStatis had earlier reported factory orders and production levels in January 2019 while...

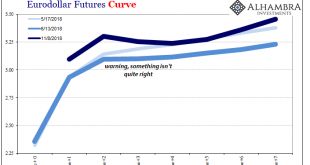

Read More »Chart(s) of the Week: Reviewing Curve Warnings

Quick review: stocks hit a bit of a rough patch right during the height of inflation hysteria. At the end of January 2018, just as the US unemployment rate had finally achieved the very center of attention, global markets were rocked by instability. Unexpectedly, of course. Over the next several weeks, share prices sagged and people blamed it on a number of things: Korean War, the unemployment rate itself (the economy...

Read More »The Coming Crisis the Fed Can’t Fix: Credit Exhaustion

Thus will end the central banks’ bombastic hubris and the public’s faith in central banks’ godlike powers. Having fixed the liquidity crisis of 2008-09 and kept a perversely unequal “recovery” staggering forward for a decade, central banks now believe there is no crisis they can’t defeat: Liquidity crisis? Flood the global financial system with liquidity. Interest rates above zero? Create trillions out of thin air and...

Read More »Monthly Macro Chart Review – March (VIDEO)

Alhambra CEO discusses the most important economic reports from the past month. [embedded content] Related posts: Monthly Macro Chart Review – March Monthly Macro Monitor – February (VIDEO) Monthly Macro Monitor – October 2018 (VIDEO) Monthly Macro Monitor – December 2018 (VIDEO) Monthly Macro Monitor – September 2018 Monthly Macro Monitor – January 2019 Monthly Macro Monitor...

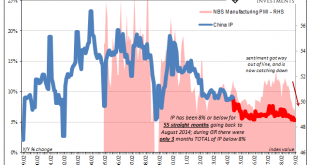

Read More »No Sign of Stimulus, Or Global Growth, China’s Economy Sunk By (euro)Dollar

Najib Tun Razak was elected as Malaysia’s Prime Minister in early 2009. Taking office that April amid global turmoil and chaos, Najib’s first official visit was to Beijing in early June. His father, also Malaysia’s Prime Minister, had been the first among Asian nations to open formal diplomatic relations with China thirty-five years before. Celebrating the milestone might’ve been the proposed purpose behind the state...

Read More »What Sort of “Democracy” Do We Have If Everyone’s Goal Is Maximizing Their Government Swag?

The “marketplace” of individuals and entities all seeking to maximize their share of the central-state swag doesn’t make a democracy. A democratic republic is a government in which power flows from citizens to their elected representatives. The American revolutionaries did not make a big distinction between republic and democracy, for in the context of the late 1700s, the dominant political structure was monarchy, and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org