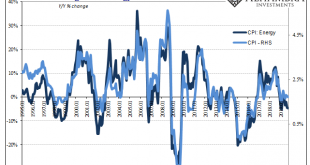

After constantly running through what the FOMC gets (very) wrong, let’s give them some credit for what they got right. Though this will end up as a backhanded compliment, still. After having spent all of 2018 forecasting accelerating inflation indices, from around New Year’s Day forward policymakers notably changed their tune. Inflation pressures that were in December 2018 building underneath leading officials to fear a harmful breakout, by January 2019 they were...

Read More »Dollar Remains Soft as Risk-On Sentiment Continues

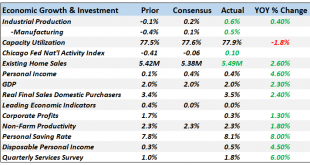

Markets have seized on the possibility of a partial trade deal as well as some hopes that a hard Brexit will be avoided The main event for the day will be President Trump’s meeting with Vice Premier Liu He These market movements (if sustained) will take pressure off of the Fed to cut rates this month The notion of a “pathway” to a Brexit deal continues to capture investors’ imagination The EU will discuss sanctions on Turkey at next week’s summit; oil is up on news...

Read More »Monthly Macro Monitor: Doom & Gloom, Good Grief

When I first got in this business oh so many years ago, my mentor told me that I shouldn’t waste my time worrying about the things everyone else was worrying about. As I’ve related in these missives before, he called those things “well worried”. His point was that once everyone was aware of something it was priced into the market and not worth your time. That has proven to be valuable advice over the years and I think still relevant today. We continue to hear, on an...

Read More »The Scientism of Trade Wars

One year ago, last October, the IMF published the update to its World Economic Outlook (WEO) for 2018. Like many, the organization began to talk more about trade wars and protectionism. It had become a topic of conversation more than concern. Couched as only downside risks, the IMF still didn’t think the fuss would amount to all that much. Especially not with world’s economy roaring under globally synchronized growth. Even though there were warning signs already by...

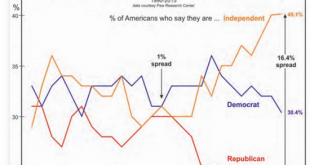

Read More »Will the Clintons Destroy the Democratic Party?

History is full of ironies, and perhaps it will suit the irony gods for The Donald to take down the Republican Party and the Clinton dynasty to destroy the Democratic Party. Let’s start by stipulating my bias: I would cheer the collapse of both self-serving, venal political parties, which have stood by for decades as the rich have become immeasurably richer and the politically powerful few have disempowered the many. The transparent “populist” bleatings of both...

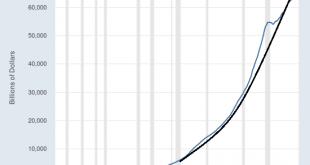

Read More »Our Time/Labor Is Finite, But Money Is Infinite

Once we understand this mechanism, we understand that labor can never get ahead. I’ve been pondering a comment longtime correspondent Drew P. emailed me in response to my post, What’s Holding Up the Market?: “Our time/labor is finite, but money is infinite.” Drew explained that creating new fiat currency and injecting it into a closed system (our financial system) controls and restrains the value of our time and labor, past, present and future. This is a profound...

Read More »From JOLTS Series Shift To Series of Rate Cuts

I’ve said all along that they would be dragged into them kicking and screaming. After all, the Federal Reserve undertook its last rate hike in December 2018 – just as the markets were making clear he was completely mistaken in his view of the economy. What followed was the ridiculous “Fed pause” which pretty much everyone outside of the central bank and the Economics profession knew wasn’t the end of it. You know the story. When he finally gave in at the end of July,...

Read More »Dollar Soft Despite Heightened Geopolitical Risks

The dollar staged a stunning comeback yesterday as risk-off took hold on rising geopolitical risk; those risks remain high US-China tensions have risen ahead of trade talks that begin Thursday The US abruptly announced that it would withdraw its troops from northeast Syria US reports September PPI; German IP came in better than expected UK Prime Minister Johnson told Chancellor Merkel that a deal is “essentially impossible” Chinese markets re-opened for trading...

Read More »The Consequences Of ‘Transitory’

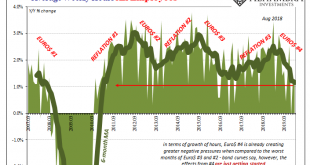

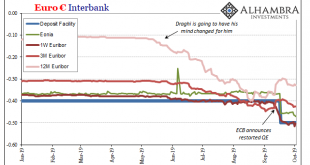

Europe’s QE, as noted this weekend, is off to a very rough start. In the bond market and in inflation expectations, the much-ballyhooed relaunch of “accommodation” is conspicuously absent. There was a minor back up in yields between when the ECB signaled its intentions back in August and the few weeks immediately following the actual announcement. Other than that, and that wasn’t much, you wouldn’t have known QE is already back on the table. It barely registered,...

Read More »What’s Holding Up the Market?

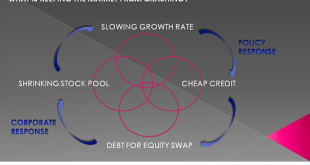

The Fed’s nearly free money for financiers policies in support of the Super-Rich do not exist in a vacuum–the disastrous consequences are already baked in. What’s holding up the U.S. stock market? The facile answer is the Federal Reserve (“the Fed has our back,” “don’t fight the Fed,” etc.) but this doesn’t actually describe the mechanisms in play or the consequences of a market that levitates ever higher on the promise of more Fed money-for-nothing injected into...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org