The dollar rally has been derailed by weak US data and rising recession fears The September jobs data was not a game-changer and so we are left waiting for more clues Believe it or not, the US economy remains solid; however, the US repo market has not fully normalized yet The Chinese trade delegation arrives in Washington Thursday for two days of trade talks Brexit optimism has worn off; there are several key EM events . The dollar rally has been derailed by weak US...

Read More »Big Trouble In QE Paradise

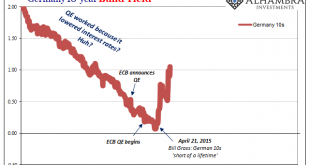

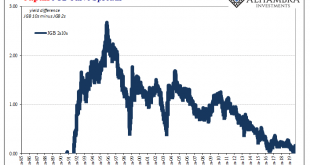

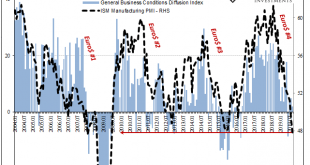

Maybe it was a sign of things to come, a warning how it wasn’t going to go as planned. Then again, when it comes to something like quantitative easing there really is no plan. Other than to make it sound like there is one, that’s really the whole idea. Not what it really is and what it actually does, to make it appear like there’s substance to it. After experimenting with NIRP for the first time and then adding a bunch of sterilized asset purchases in 2014, Europe’s...

Read More »Why The Japanese Are Suddenly Messing With YCC

While the world’s attention was fixated on US$ repo for once, the Bank of Japan held a policy meeting and turned in an even more “dovish” performance. Likely the global central bank plan had been to combine the Fed’s second rate cut with what amounted to a simultaneous Japanese pledge for more “stimulus” in October. Both of those followed closely an ECB which got itself back in the QE business once more. But all that likely coordinated “accommodation” was spoiled...

Read More »ISM Spoils The Bond Rout!!! Again

For the second time this week, the ISM managed to burst the bond bear bubble about there being a bond bubble. Who in their right mind would buy especially UST’s at such low yields when the fiscal situation is already a nightmare and becoming more so? Some will even reference falling bid-to-cover ratios which supposedly suggests an increasing dearth of buyers. Bid-to-cover, however, is irrelevant. That only tells you about one part of the buying equation, the number...

Read More »The Big Picture Doesn’t Include ‘Trade Wars’

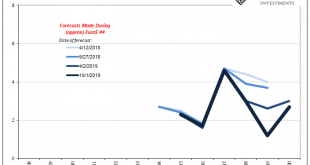

The WTO today downgraded its estimates for global trade growth. In April, the international organization had figured the total volume of world merchandise trade would expand by about 2.6% in all of 2019 once the year closed out on the anticipated second half rebound. Everyone took their lumps in H1 and the WTO like central bankers everywhere were thinking “transitory” factors. Last September, the same outfit was still forecasting trade growth would nearly reach 4% in...

Read More »ISM Spoils The Bond Rout!!!

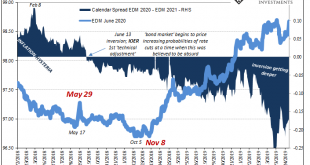

With China closed for its National Day Golden Week holiday, the stage was set for Japan to steal the market spotlight. If only briefly. The Bank of Japan announced last night that it had had enough of the JGB curve. The 2s10s very nearly inverted last month and BoJ officials released preliminary plans to steepen it back out. Japan’s central bank says that it might refrain from buying JGB’s at the long end. This is upside down from when YCC was first attached to QQE...

Read More »Musings on the Repo Market, Fed Policy, and the US Economy

The US repo market appears to finally be normalizing. The low pace of normalization is concerning and so a more permanent solution may be needed to head off similar problems at year-end. We do not think this issue has any implications for the economic outlook, which we continue to view as solid. RECENT DEVELOPMENTS The repo market provides an efficient, reliable, and predictable channel to raise short-term funding. It is but one part of a larger short-term funding...

Read More »Could Pricey Urban Meccas become Crime-Ridden Ghost Towns?

As the exodus gathers momentum, all the reasons people clung so rabidly to urban meccas decay. If there is any trend that’s viewed as permanent, it’s the enduring attraction of coastal urban meccas: despite the insane rents and housing costs, that’s where the jobs, the opportunities and the desirable urban culture are. Nice, but like many other things the status quo considers permanent, this could reverse very quickly, and all those pricey urban meccas could become...

Read More »Drivers for the Week Ahead

We continue to think that the US economy is in better shape than most appreciate, and that underpins our strong dollar call Tensions are likely to remain high after reports emerged last week that the US will look into limiting capital flows into China US September jobs data Friday will be the data highlight of the week; there is a heavy slate of Fed speakers this week UK, eurozone, and Japan are expected to report weak data this week RBA meets Tuesday and is expected...

Read More »Dollar Firm as US Economy Continues to Outperform

Uncle Sam hat and money. American hat. Hat independence day - Click to enlarge Political uncertainty is likely to persist in the US; the big unknown is whether this will impact the US economy US core PCE reading will be of particular interest and is expected to rise 1.8% y/y; Quarles (voter) and Harker (non-voter) speak Dovish BOE comments are weighing on sterling; France reported weak CPI and consumer spending data Tokyo September CPI was lower than expected; FTSE...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org