Once we understand this mechanism, we understand that labor can never get ahead. I’ve been pondering a comment longtime correspondent Drew P. emailed me in response to my post, What’s Holding Up the Market?: “Our time/labor is finite, but money is infinite.” Drew explained that creating new fiat currency and injecting it into a closed system (our financial system) controls and restrains the value of our time and labor, past, present and future. This is a profound insight into why our financial system is inherently exploitive and why it is unsustainable. As citizens of Venezuela and other nations have discovered, the power to create infinite sums of currency devalues the fruits of our labor in the past, present and future. As new currency is injected into a

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, 5.) Charles Hugh Smith, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Once we understand this mechanism, we understand that labor can never get ahead.

I’ve been pondering a comment longtime correspondent Drew P. emailed me in response to my post, What’s Holding Up the Market?: “Our time/labor is finite, but money is infinite.” Drew explained that creating new fiat currency and injecting it into a closed system (our financial system) controls and restrains the value of our time and labor, past, present and future.

This is a profound insight into why our financial system is inherently exploitive and why it is unsustainable.

As citizens of Venezuela and other nations have discovered, the power to create infinite sums of currency devalues the fruits of our labor in the past, present and future. As new currency is injected into a stagnating economy, the purchasing power of labor’s earnings declines.

The only way to keep from sinking is to borrow money, which siphons off labor’s earnings via debt service to those who get the new fiat currency: the banks, financiers and corporations.

The near-infinite creation of new currency devalues past labor by destroying the value of pensions and savings, devalues the value of today’s labor and of labor’s future earnings.

Labor is stripped of value in two ways: the purchasing power of labor’s earnings are steadily devalued, and much of the remaining earnings are devoted to servicing debt that was taken on to stay afloat financially.

|

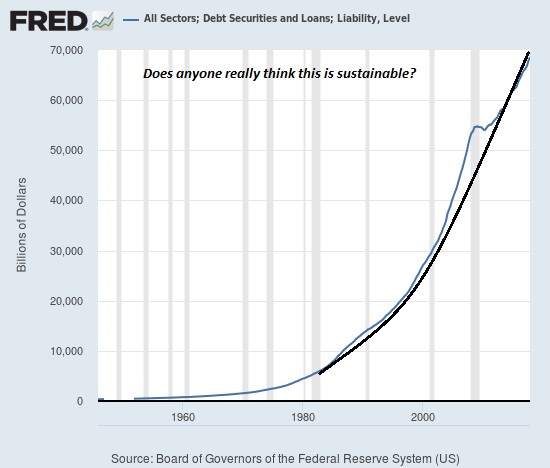

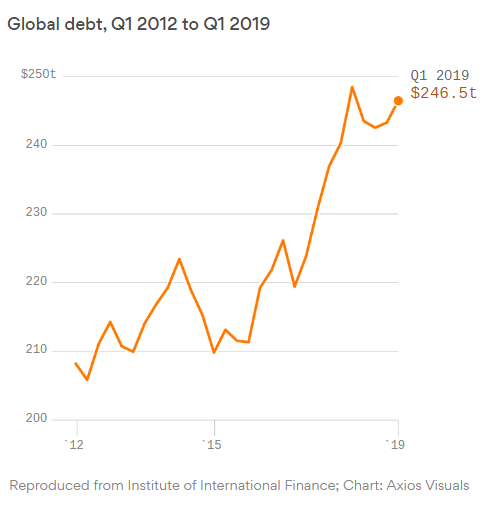

Meanwhile, those receiving the central banks’ free money for financiers can use this new currency (i.e. low-cost credit) to buy up income-producing assets and leverage speculations that reap enormous capital gains, as assets are never allowed to drop in value because “the Fed has our backs.” And why does “the Fed has our backs”? Because the system implodes once debt and currency creation stop expanding. Once we understand this mechanism, we understand that labor can never get ahead. No matter how hard one works, or how much one saves, the amount of “money” (fiat currency) that can be created and distributed to those at the top of the wealth-power pyramid will always be near-infinite, and the more credit / debt / currency that’s issued, the greater the loss of labor’s purchasing power. This simple mechanism–labor is finite but money is infinite–is driving the world’s social, political and financial unraveling. Global debt now totals $246 trillion, a staggering 320% of global GDP, and there is nothing restraining it from climbing to $300 trillion, $400 trillion and $500 trillion, while labor’s earnings are stealthily and relentlessly stripped of purchasing power. Here’s America’s debt binge, rising geometrically in near-infinite expansion: |

All Sectors; Debt Securities and Loans 1960-2019 |

| Here is global debt, a jagged line that moves ever higher:

Drew reminded me that without finite money, i.e. sound money, labor will continue to be enslaved to debt and a steady depreciation of the purchasing power of labor’s earnings. |

Global Debt, Q1 2012 to Q1 2019(see more posts on global debt, ) |

Tags: Featured,newsletter