What’s unfettered in America is “Communism for the Rich” and the normalization of corruption that results from the auctioning of political power to protect monopolies and cartels. The irony of constantly being accused of being a communist is rather rich. When I point out that “free market capitalism” in America is neither a real market nor real capitalism, those who equate any criticism of “capitalism” as proof of communist leanings are triggered. Noting that Marx...

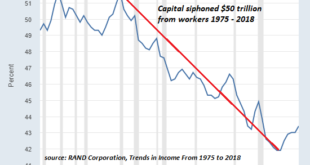

Read More »The Blowback from Stripmining Labor for 45 Years Is Just Beginning

The clueless technocrats are about to discover that unfairness and exploitation can’t be measured like revenues and profits, but that doesn’t mean they’re not real. Economists and financial pundits tend to make a catastrophically flawed assumption. They tend to believe the technocratic myth that all human behavior boils down to financial incentives, data and metrics, as if all people make decisions based on interest rates, tax breaks and greed, the desire to maximize...

Read More »How Things Fall Apart

That’s how things fall apart: insiders know but keep their mouths shut, outsiders are clueless, and the decay that started slowly gathers momentum as the last of the experienced and competent workforce burns out, quits or retires. Outsiders are shocked when things fall apart. Insiders are amazed the duct-tape held this long.The erosion of critical skills and institutional knowledge is invisible to outsiders, while everyone inside who saw the unstoppable decay...

Read More »The Monopoly – Labor “Let It Rot” Death Spiral

The only rational response to this reality is to opt out, lay flat and let it rot. In my previous post, The Bubble Economy’s Credit-Asset Death Spiral, I described the self-reinforcing feedback of expanding credit and soaring asset valuations and how the only possible result of this financial perpetual motion machine was a death spiral of collapsing debt service, collateral and credit impulse. But this didn’t exhaust the destructive dynamics of this self-reinforcing...

Read More »The Bubble Economy’s Credit-Asset Death Spiral

Who believed that central banks’ financial perpetual motion machine was anything more than trickery designed to generate phantom wealth? Central banks seem to have perfected the ideal financial perpetual motion machine: as credit expands, money pours into risk assets, which shoot higher under the pressure of expanding demand for assets that yield either hefty returns (junk bonds) or hefty capital gains as the soaring assets suck in more capital chasing returns. As...

Read More »This Is of Course Insane

Greed is a powerful motivation to be an ardent believer in the central banking cult. The ideal cult convinces its followers that it isn’t a cult, it’s simply the natural order of things.In current terms, this normalizes insane behaviors and beliefs. Sacrificing youth to appease the gods isn’t a cult; it’s simply the natural order of things. If we don’t sacrifice youth, bad things will happen, so we have to follow the natural order of things. Despite the lofty claims...

Read More »The “Oil Curse” and Splashy PR Announcements of Oil Production Cuts

It’s not just the price of oil that matters: how much disposable income consumers have left to buy more goods and services matters, too. The Oil Curse (a.k.a. The Resource Curse) refers to the compelling ease of those blessed with an abundance of oil/resources to depend on that gift for the majority of state/national revenues. The risks and demands of developing a diverse, globally competitive economy don’t seem worth the effort when the single-source wealth of oil...

Read More »The Uncertainty in China Is Kryptonite to Global Markets

Few seem alive to the potentially consequential financial risks arising from uncertainties evolving in China. One thing we know rather definitively is that markets don’t like uncertainty: uncertainty is Kryptonite to markets. Another thing we know is that the events unfolding in China are generating uncertainty on multiple levels.Whatever policy decisions are made, the potential consequences generate waves of profound uncertainty. Should authorities respond to...

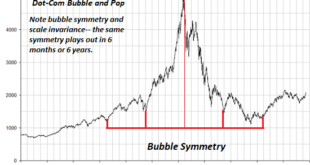

Read More »There’s No Bottom Until Frenzied Speculation Turns to Dust

Only when speculative sizzle attracts no buyers / marks will the bottom be in. There hasn’t been a truly organic bottom in stocks in decades. Fifteen years of relentless central bank manipulation since the 2008-09 Global Financial Meltdown has persuaded punters that central banks will always save us should the market turn down because relentless central bank suppression of interest rates and expansion of liquidity (a.k.a. free money for financiers) are now necessary...

Read More »FTX: The Dominoes of Financial Fraud Have Yet to Fall

Once assets are revealed as worth far less than claimed, insolvency is the inevitable result. If you haven’t plowed through dozens of post-collapse commentaries on FTX, I’m saving you the trouble: here’s a distillation of what matters going forward. If you’re seeking a forensic accounting of FTX, others have done this work already. If you’re seeking an ideological diatribe, you won’t find that here, either. What you will find is insight into the real innovation of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org