Only when speculative sizzle attracts no buyers / marks will the bottom be in. There hasn’t been a truly organic bottom in stocks in decades. Fifteen years of relentless central bank manipulation since the 2008-09 Global Financial Meltdown has persuaded punters that central banks will always save us should the market turn down because relentless central bank suppression of interest rates and expansion of liquidity (a.k.a. free money for financiers) are now necessary and thus predictably permanent. Central banks have rescued punters from every market drop. This has pushed moral hazard to near-infinity: since we know the Fed et al. will rescue us, no matter how stupid or venal or risky our bets, then why not increase the leverage, risk and fraud at every turn?

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Only when speculative sizzle attracts no buyers / marks will the bottom be in.

Only when speculative sizzle attracts no buyers / marks will the bottom be in.

There hasn’t been a truly organic bottom in stocks in decades. Fifteen years of relentless central bank manipulation since the 2008-09 Global Financial Meltdown has persuaded punters that central banks will always save us should the market turn down because relentless central bank suppression of interest rates and expansion of liquidity (a.k.a. free money for financiers) are now necessary and thus predictably permanent.

Central banks have rescued punters from every market drop. This has pushed moral hazard to near-infinity: since we know the Fed et al. will rescue us, no matter how stupid or venal or risky our bets, then why not increase the leverage, risk and fraud at every turn?

Indeed, why not? With the central banks providing a permanent backstop, it would be foolish not to increase the size and risk of every bet.

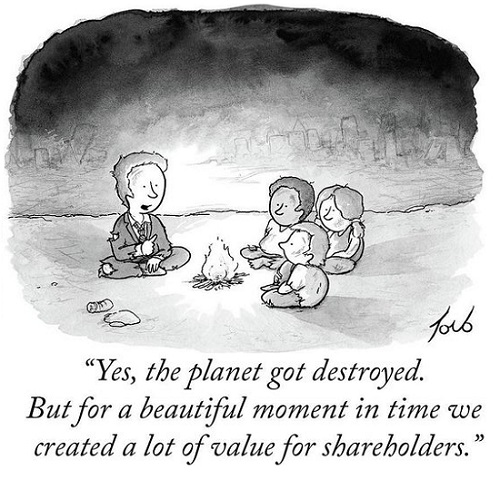

Given this central bank-enforced supremacy of moral hazard, the only possible consequence has been the rise of speculation to truly dizzying heights, extremes of leverage and risk that are completely decoupled from the real-world economy.

In this Fed-managed fun house, cryptocurrencies started as jokes became worth billions of dollars–and despite a complete lack of utility, past present or future, these are still worth tens of billions of dollars.

The spectrum of similarly decoupled-from-utility speculations stretches across the entire global financial system.Valuations are based on central bank liquidity rather than real-world metrics such as sales, margins, profits or (gasp) improvements in productivity and real-world utility.

The speculative frenzy boils down to a simple dynamic: Sell the sizzle to a greater fool and pocket the profit. The greater the sizzle, size, leverage and risk, the greater the profits.

In this Fed-managed fun house, investing in increasing efficiency, productivity and utility–improving human life– is for losers. Why bother investing in ventures which are inherently risky when you can mint millions in the Fed fun house without creating any new goods, services or jobs?

This Fed fun house dynamic has decoupled markets from the real-world economy and from any real-world grasp of risk. Risk? There isn’t any because the Fed et al. will always “pivot” to save us.

This Fed fun house dynamic has decoupled markets from the real-world economy and from any real-world grasp of risk. Risk? There isn’t any because the Fed et al. will always “pivot” to save us.

Unfortunately for punters, central bank manipulation is akin to holding a beach ball under water. Everything is stable and predictable as long as the ball is held safely beneath the surface.

But consequences have their own consequences, and eventually central bank manipulation sets a banquet of unintended and uncontrollable consequences: perverse incentives, diminishing returns and mean reversion to name a few, and the beach ball slips from their grasp with destabilizing volatility.

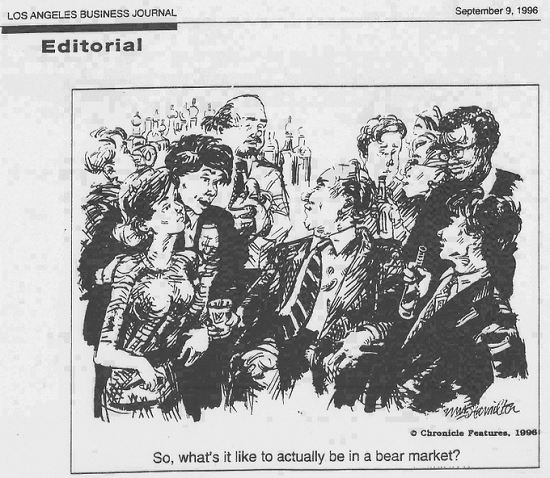

The last organic (i.e. unmanipulated) bottom in equities was arguably 45 years ago in the late 1970s.Punters and investors gave up. Brokers sat at their desks staring at phones that had stopped ringing. The speculative animal spirits of the go-go 1960s had finally turned to dust.

The speculative frenzy of the present is exponentially larger, which means its collapse will be exponentially more destabilizing and consequential to valuations. A truly tradeable bottom is only possible when speculations based on moral hazard, greater fools and central bank backstops all dissipate into the ether.

Utility-free assets that are currently worth tens of billions will go to near-zero. Assets based on bubbles in liquidity and cupidity will lose 75% to 95% of their current valuations as they recouple with reality.

Only when speculative sizzle attracts no buyers / marks will the bottom be in. Until then, everyone gambling in the Fed fun house confident the Fed is going to save them is playing with firecrackers in a dynamite factory.

Tags: Featured,newsletter