The US has started the formal process of withdrawing from the WHO; the dollar continues to benefit from risk-off sentiment but remains stuck in recent ranges The White House is asking Congress to pass another trln stimulus plan by early August; President Trump hosts Mexican President AMLO for a two-day visit Chancellor Sunak addresses UK Parliament today; Brexit talks continue; Nigeria devalued its official exchange rate yesterday RBNZ is considering an extension of its home loan deferral scheme; the US is reportedly weighing proposals designed to undermine the Hong Kong dollar peg The US has started the formal process of withdrawing from the WHO. This is not a market-moving event, of course, but it is impactful for the US’s global image. Brazilian President

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The US has started the formal process of withdrawing from the WHO; the dollar continues to benefit from risk-off sentiment but remains stuck in recent ranges

- The White House is asking Congress to pass another $1 trln stimulus plan by early August; President Trump hosts Mexican President AMLO for a two-day visit

- Chancellor Sunak addresses UK Parliament today; Brexit talks continue; Nigeria devalued its official exchange rate yesterday

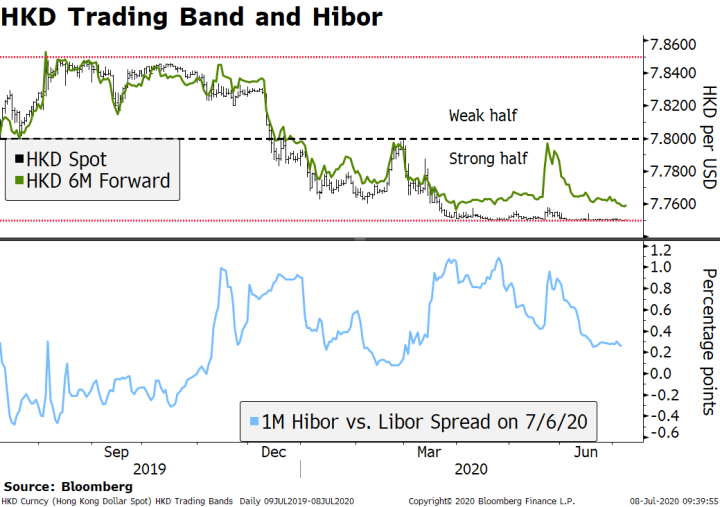

- RBNZ is considering an extension of its home loan deferral scheme; the US is reportedly weighing proposals designed to undermine the Hong Kong dollar peg

The US has started the formal process of withdrawing from the WHO. This is not a market-moving event, of course, but it is impactful for the US’s global image. Brazilian President Bolsonaro has tested positive for Covid-19, and is treating himself with hydroxychloroquine, the still controversial malaria treatment. In the US, Florida infections continue to rise, and dozens of hospitals are running out of ICU beds as a result.

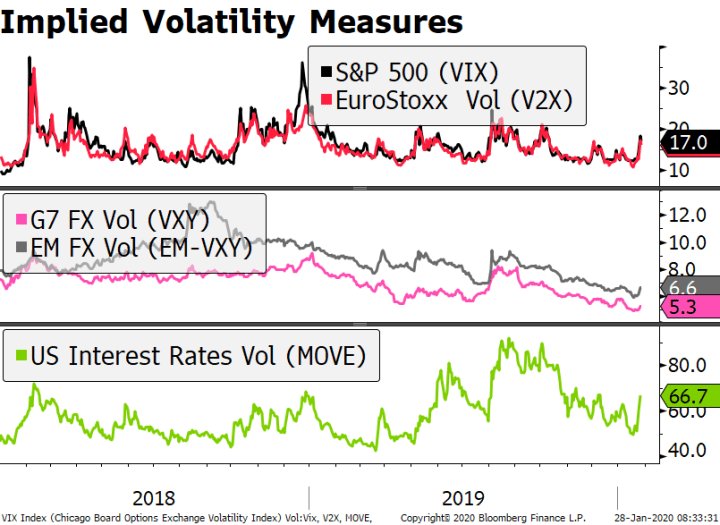

The dollar continues to benefit from risk-off sentiment but remains stuck in recent ranges. DXY is trading around 97 currently, which is the middle of the 96-98 range seen since late May. Similarly, the euro is trading just below $1.13 and is smack in the middle of the $1.12-1.14 range seen since early June. We look for continued swings in market sentiment this week but believe dollar weakness will likely resume when the pendulum of sentiment swings back the other way.

AMERICAS

The White House is asking Congress to pass another $1 trln stimulus plan by early August. The calendar is working against this, however. Congress is now on recess until July 20. The House then goes on its summer recess August 3 and the Senate goes a week later. Talks will continue just as the $600 per week bump in unemployment benefits expires at the end of this month, with an extension of this program likely to contentious. Other areas up for discussion are aid to state and local governments, liability reforms, and another possible round of stimulus checks. President Trump has pushed for a payroll tax cut, but both parties have expressed opposition to this.

May consumer credit is the only US data report today. It is expected to fall -$15.0 bln vs. -$68.77 bln in April. Bostic speaks today. Yesterday, Bostic, Daly, Barkin, Mester, Quarles, and Clarida hit all the dovish notes.

President Trump hosts Mexican President AMLO for a two-day visit beginning today. Canadian Prime Minister Trudeau was also invited to help mark the start of the USMCA but declined. Beyond the trade agreement, the two leaders will reportedly discuss the illegal drug trade and migration. A joint statement is expected. A White House dinner will be held tonight that will included CEOs from major companies in both countries.

EUROPE/MIDDLE EAST/AFRICA

Chancellor Sunak addresses UK Parliament today. Reports suggest he will outline further stimulus measures, including a GBP2 bln program to pay the wages of more than 200k young workers. It’s possible that Sunak will outline plans for increased spending or perhaps even a VAT cut. Over the weekend, he announced a GBP1.6 bln plan to support theaters, museums, and music venues, with much of it in the form of grants, as well as another GBP800 mln for hiring at job centers in an effort to help alleviate stresses in the labor market.

Brexit talks continue. The UK’s Frost and EU’s Barnier held informal talks during a private dinner last night. Official talks with their negotiating teams continue today. Despite some hints at a compromise yesterday in the area of fishing, it appears the two sides remain quite far apart in all key areas. Expect headline driven volatility to continue as talks progress.

Nigeria devalued its official exchange rate yesterday by 5.5% to 381 from 360 previously. This comes after central bank Governor Emefiele said last month that the bank plans to unify its multiple exchange rates in order to improve the transparency of its currency regime. Yet it’s worth noting that the new official rate falls far short of the black market rate, currently around 455-460. As such, the move really has little practical impact. With oil prices stalling out at levels well below where they started the year, the outlook for the Nigerian economy remains poor. Similarly, liquid reserves have stalled out around $36 bln and so we suspect dollar shortages will continue into H2. The central bank last devalued the naira in March to 360 from 307 previously, also to little effect.

ASIAThe Reserve Bank of New Zealand is reportedly considering an extension of its home loan deferral scheme. Back in March, the RBNZ and the New Zealand Bankers Association agreed to a 6-month mortgage deferral scheme due to the impact of the pandemic. Finance Minister Robertson said an extension is one option, but not the only one being discussed. A decision will reportedly be made next month. Next policy meeting is August 12 and an announcement on the scheme then seems likely. Press reports suggest the US is weighing proposals designed to undermine the Hong Kong dollar peg. Measures would be part of an effort to punish China for its recent moves to have great influence on Hong Kong. Yet this is not very well thought out, as any stresses on the peg would end up hurting Hong Kong citizens and institutions and not China’s ruling class. |

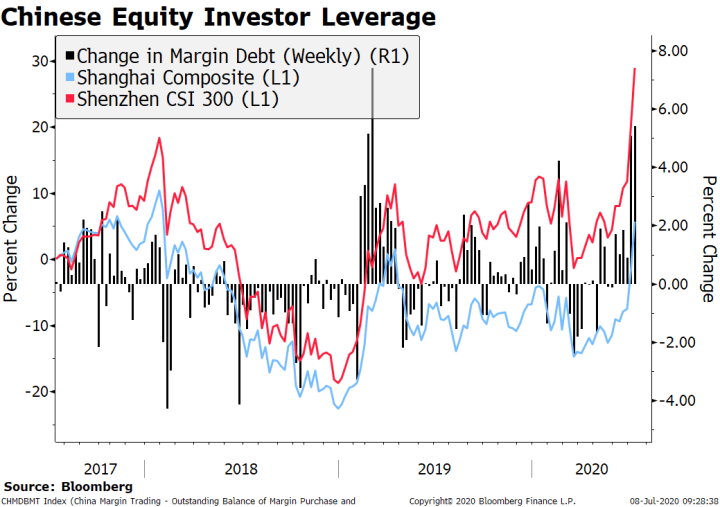

Chinese Equity Investor Leverage, 2017-2020 |

| Discussions have reportedly taken place amongst Secretary of State Pompeo’s aides and have not even progressed to more senior levels there or at Treasury. The notion sounds absurd to us and hardly worth discussion, and seen by the muted market reaction, investors seem to agree. A more meaningful option might be the idea of targeting local banks, but that too would hardly seem to punish China.

Chinese equities looked through the new threats by the US administration. The Shanghai Composite is up for the eight consecutive session, with gains of 1.7% overnight. As you would expect, the rally has been accompanied by commensurate increase in measures of leverage by local equity investors, surely inspired by the cheerleading from government-linked press outlets. |

HKD Trading Band and Hibor, 2019-2020 |

Tags: Articles,Daily News,Featured,newsletter