Re-shutdowns continue to spread across the US; the dollar has come under pressure again Jobs data is the highlight ahead of the long holiday weekend in the US; weekly jobless claims will be reported FOMC minutes were revelatory; the Fed for now will rely on “outcome-based” forward guidance and asset purchases to achieve its goals; US House passed the latest China sanctions bill The UK offered a home to nearly 3 mln Hong Kong citizens; Russia President Putin will likely be around for much longer, but the real risk is a new round of sanctions Japan’s ruling LDP is discussing how to attract finance professionals from Hong Kong; Korea reported June CPI Re-shutdowns continue to spread across the US. New York and California banned or delayed reopening of certain

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Re-shutdowns continue to spread across the US; the dollar has come under pressure again

- Jobs data is the highlight ahead of the long holiday weekend in the US; weekly jobless claims will be reported

- FOMC minutes were revelatory; the Fed for now will rely on “outcome-based” forward guidance and asset purchases to achieve its goals; US House passed the latest China sanctions bill

- The UK offered a home to nearly 3 mln Hong Kong citizens; Russia President Putin will likely be around for much longer, but the real risk is a new round of sanctions

- Japan’s ruling LDP is discussing how to attract finance professionals from Hong Kong; Korea reported June CPI

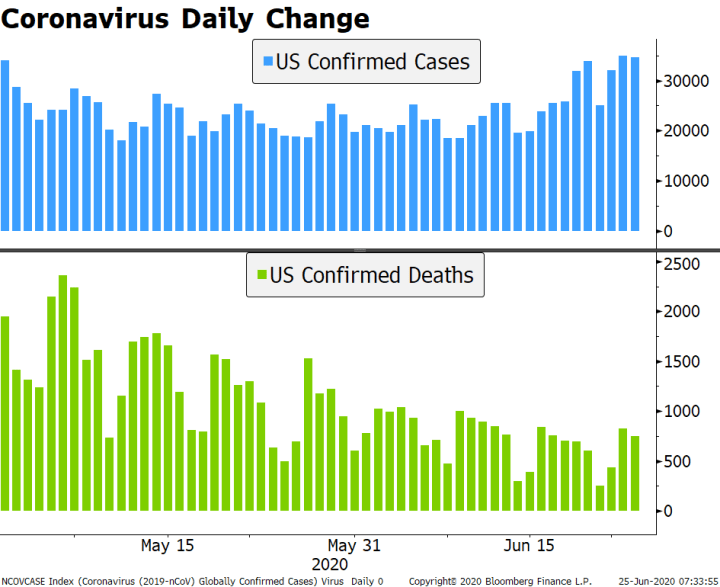

Re-shutdowns continue to spread across the US. New York and California banned or delayed reopening of certain services such as indoor dining. Meanwhile, hospitalization rates continue to increase in states such as Texas and Arizona where the case count has spiked recently. Elseward, Tokyo is seen an increase in its outbreak with 100 new cases registered overnight. On the positive side, there has seen some good news from early trials of experimental vaccines from Pfizer and BioNTech. Also, the UK is gearing up for “Super Saturday” as pubs restaurants, and hotels reopen this weekend.

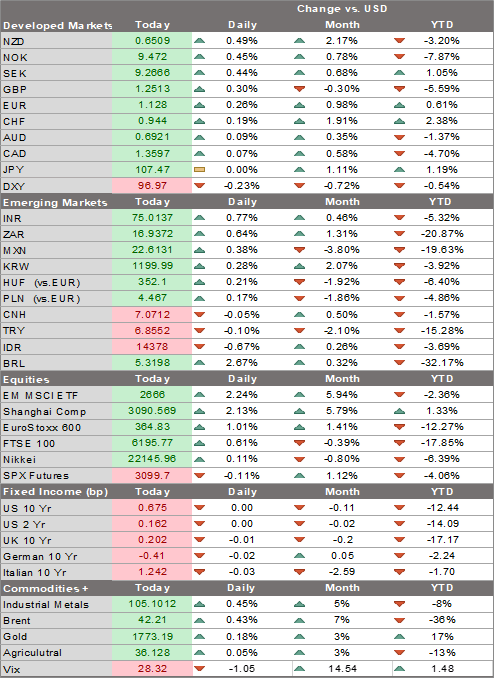

The dollar has come under pressure again. After DXY traded Tuesday at the highest level since June 2, it is down three straight days and is on track to test the June 23 low near 96.385. A break below that would set up a test of the June 10 low near 95.716. The euro is testing the $1.13 area while sterling is testing the $1.25 area. USD/JPY recorded an outside down day yesterday after failing to make a clean break above 108, setting the pair up for further losses.

AMERICAS

Jobs data is the highlight ahead of the long holiday weekend in the US. Consensus sees a gain of 3.058 mln jobs in June, up from 2.509 mln in May. Unemployment is expected to fall to 12.5% from 13.3% in May, but the data have been rife with errors the past two months. Yesterday, ADP reported a lower than expected 2.369 (vs. 2.9 mln consensus) private sector jobs while the ISM employment component of 42.1 suggests manufacturing jobs are still contracting. Note that continuing claims for the June survey week fell -767k. Compare this to May, when continuing clams for the survey week fell -4.1 mln and May NFPs came in at +2.5 bln. All these clues suggest market consensus around 3 mln is way too optimistic. Indeed, we see significant risks that the US economy will underperform Europe and Japan in Q3.

Weekly jobless claims will be reported. Initial claims are expected at 1.35 mln vs. 1.48 mln last week, while continuing claims are expected at 19.0 mln vs. 19.522 mln last week. The fact that initial claims are still hovering close to 1.5 mln suggests the labor market is still under some stress. Indeed, taken at face value, the movement in both claims series would suggest that workers are still becoming unemployed and this is eating into the numbers of those becoming employed again. May trade (-$53.2 bln expected) and factory orders (8.7% m/m expected) will also be reported.

The FOMC minutes were surprisingly revelatory. Typically, Fed minutes reveal little new about the deliberations, but the ones for the June 10 meeting yielded some nuggets. First of all, Chair Powell opened the meeting expressing concerns with the “deeply troubling events of the last two weeks. Injustice, prejudice, and the callous disregard for life had led to social unrest and a sense of despair.” Powell has often noted that the pandemic impact has been felt disproportionately by lower income minorities, whilst touting that a broad-based recovery lifts all boats. As the virus continues to spread in the US, we think means a rising likelihood that rates will be left lower for longer.

Next, policymakers discussed the need to develop a more explicit form of forward guidance (either outcome- and calendar-based). Most seem to favor the former. Some felt the forward guidance should signal a willingness to allow inflation to temporarily overshoot its 2% target, while others felt guidance should focus on its full employment mandate given the current state of the labor market. Lastly, the Fed discussed yield curve yield caps or targets (the Fed’s version of yield curve control) in earnest. Some expressed concerns about how YCT could increase the Fed’s balance sheet by too much, leading to potential instability. In closing, the Fed noted that “Many participants remarked that, as long as the committee’s forward guidance remained credible on its own, it was not clear that there would be a need for the committee to reinforce its forward guidance with the adoption of a YCT policy.”

| The Fed for now will rely on “outcome-based” forward guidance and asset purchases to achieve its goals. Regarding YCT, nearly all policymakers “indicated that they had many questions regarding the costs and benefits of such an approach” and agreed that YCT needed further study. Thus, it’s clear that while YCT is a potential tool in the future, there seems to be enough doubts to make it very unlikely near-term. For one thing, the US yield curve has largely remained below 50 bp since the end of March. If there were to be a bearish steepening that risked tightening financial conditions, we suspect yield curve targeting would become more likely. Still, it’s clear from the minutes that the Fed will likely keep rates low for a long, long time.

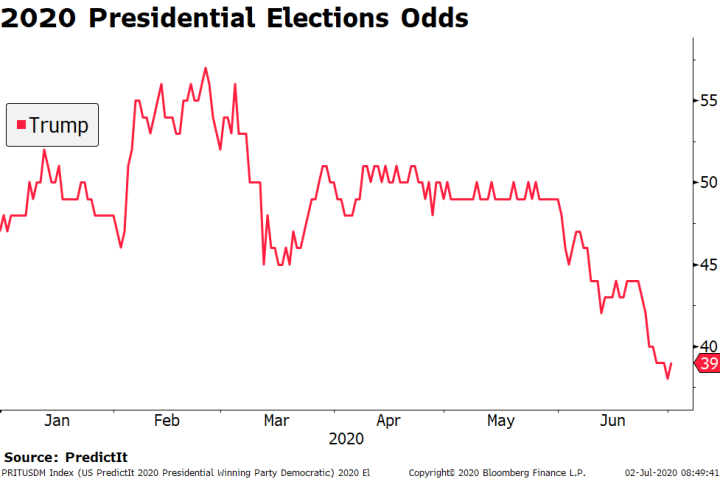

The US House passed the latest China sanctions bill. It focuses on officials involved in the new security legislation in Hong Kong, but also related to the Muslim minorities in the Xinjian region. On balance, this seems like a favorable outcome for markets compared to the alternative of a significant escalation in the trade war. But we doubt it will stop there. The risk of US-China trade war escalation is some function of Trump’s odds of winning the election. That is, the worse he does in polls, the greater the temptation for him to pull on this lever. |

Presidential Elections Odds, 2020 |

EUROPE/MIDDLE EAST/AFRICAUK Prime Minister Johnson offered a home to nearly 3 mln Hong Kong citizens. Under his plan, the status of British National Overseas (BNO) passports would be upgraded to offer a path to UK citizenship. BNO passports are held by 350k in Hong Kong, with 2.5 mln more eligible for them. Those with BNO status will be allowed to come to the UK without the current six month limit, instead allowing them to live and work in the UK. After that, they can apply for settled status, after which they can apply for citizenship after another year. Johnson said “The enactment and the imposition of this national security law constitutes a clear and serious breach of the Sino-British joint declaration. It violates Hong Kong’s high degree of autonomy and is in conflict with Hong Kong’s Basic Law.” Russia President Putin will likely be around for much longer, but the real risk is a new round of sanctions. As widely expected, Russians voted (with 78% in favor) to extend his mandate two more terms after this current ends, or as far as 2036. The turnout was 65%. This is a non-event and widely expected, as Putin would not hold a referendum without knowing he would win. The big risk now is the allegations that Russia placed bounties against US and UK military personnel in Afghanistan. These allegations could easily rekindle conversations about sanctions against Russia in the near term and, in the event of a Biden victory, it will certainly come back to haunt them. ASIAReports suggest Japan’s ruling LDP is discussing how to attract finance professionals from Hong Kong. Some may decide to leave the territory due to increasing infringements from the mainland. However, Japan has its own set of problems, including a large bureaucracy and a higher tax burden. Head of an LDP panel on foreign labor said the party is looking to produce an interim report on the matter in the fall and a fuller report by year-end. However, she acknowledged the uphill battle ahead, noting “If Japan had a lot of advantages, this would already be happening.” Reports suggest Australia is “very actively” looking into offering Hong Kong citizens safe haven as well. The risk of so-called “Brain Drain” from Hong Kong is very real and should be viewed as yet another negative for the territory. Korea reported June CPI. Headline inflation was flat y/y vs. -0.2% expected and -0.3% in May. Still, it remains well below the 2% target. Bank of Korea last cut rates 25 bp to 0.5% in late May but signaled that this was close to the effective lower bound. Governor Lee has said since that the bank is considering unconventional policies to support growth but gave no further details. Next policy meeting is July 16 and will be closely watched for clues. Policymakers will also have to contend with the recent rise in virus numbers. |

Change vs. USD |

Tags: Articles,Daily News,Featured,newsletter