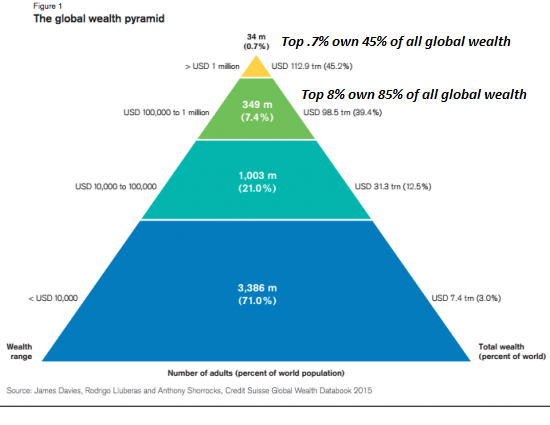

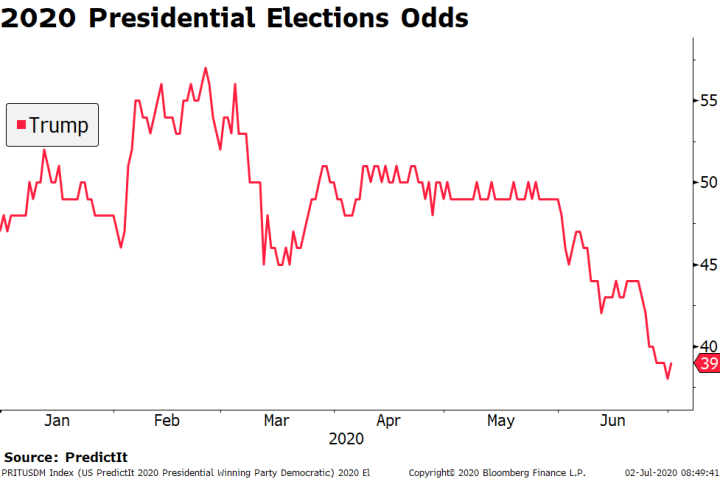

Given the extremes of the stock market’s frauds and even greater extremes of wealth/income inequality it has created, tell me again why the stock market will still exist in 2024? When I read a financial pundit predicting a bull market in stocks through 2024, blah-blah-blah, I wonder: what makes you think the stock market will even exist in 2024, at least in its current form? Given the current trajectory of the real economy into the Greatest Depression while the Federal Reserve’s entire raison d’etre is to send stocks soaring to the moon forever and ever, what are the odds that this disconnect leads to a political rebellion against the Fed and its wealth inequality machine, the stock market? Just as Communism was a god that failed, finance capitalism is also a

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

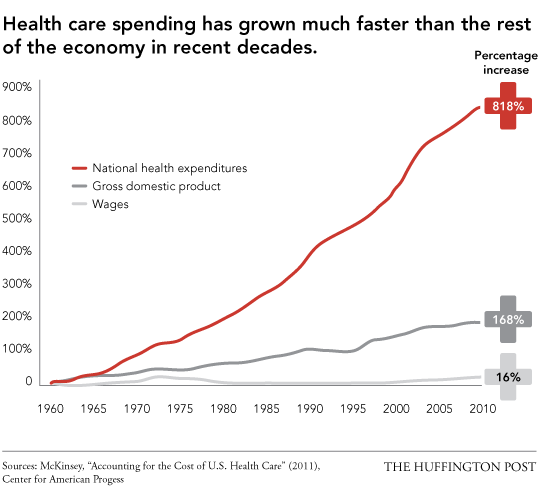

Given the extremes of the stock market’s frauds and even greater extremes of wealth/income inequality it has created, tell me again why the stock market will still exist in 2024? When I read a financial pundit predicting a bull market in stocks through 2024, blah-blah-blah, I wonder: what makes you think the stock market will even exist in 2024, at least in its current form? Given the current trajectory of the real economy into the Greatest Depression while the Federal Reserve’s entire raison d’etre is to send stocks soaring to the moon forever and ever, what are the odds that this disconnect leads to a political rebellion against the Fed and its wealth inequality machine, the stock market? Just as Communism was a god that failed, finance capitalism is also a god that failed, an extreme version of crony-capitalism that is nothing more than a mechanism for concentrating wealth and power at the expense of everyone toiling in the real-world economy. |

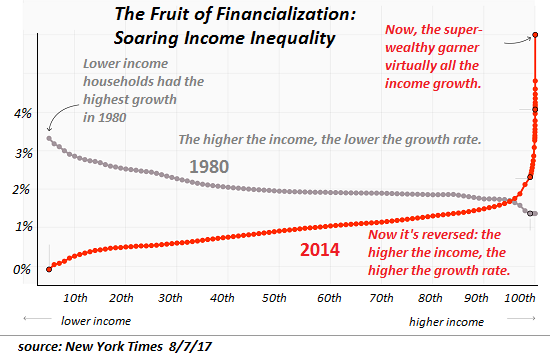

The Fruit of Financialization, 1980-2014 |

| And if we understand this, then we also understand that with its stock buybacks, high-frequency trading and after-hours manipulation, the stock market is nothing more than finance capitalism’s mechanism for increasing the concentration of wealth.

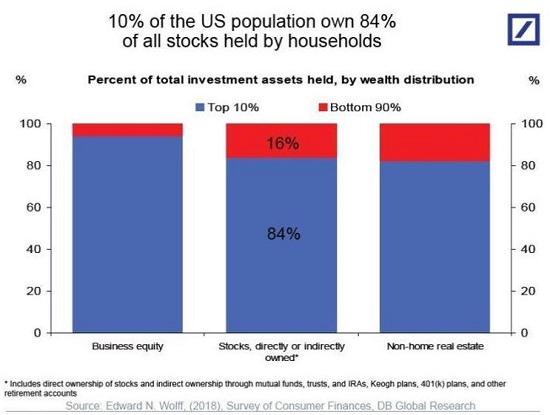

Should this awareness move from the few who currently understand the depravity and unsustainability of finance capitalism to the general public, why would they allow the skimming machine of the stock market to continue pillaging the nation? (The appeal of the stock market as a casino game amateurs can easily win is part of its marketing, but like the casinos in Las Vegas, the number of punters who reap consistent gains and hold onto their newfound wealth for five years or longer is near-zero. That’s the plan, of course; win a few bucks today and lose everything over time.) Once the novelty of toppling symbols of oppression (statues, etc.) wears thin, people might start showing some interest in the actual sources of real-world oppression, which will lead them to the Federal Reserve and finance capitalism’s primary skimming machine, the stock market. Recall that when a corporation spends $10 billion on stock buybacks, it creates zero jobs, zero productive capacity, zero goods and zero services: all it does is supercharge the wealth of those who already own most of the corporation’s stock. This is why stock buybacks were illegal until finance capitalism conquered the political machinery of governance. |

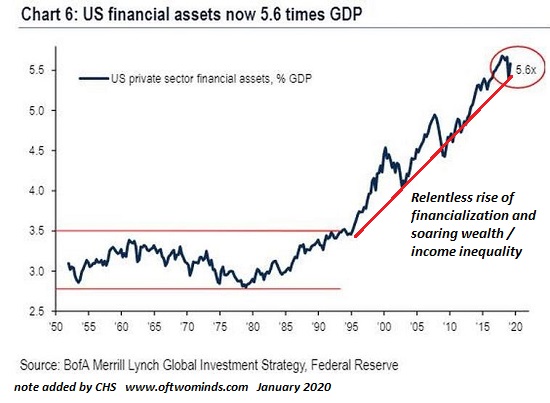

US financial assets now 5.6 times GDP |

| People who look into this fraud will discover the $10 billion was printed up by the Federal Reserve and made available to an elite of financiers and corporations. You might have noticed that your share of the $6.2 trillion the Fed has printed and given away as free money for financiers since 2008 is, well, zero. This was not an oversight; this asymmetry is the core feature of American central banking and finance: 100% for us, none for you.

High-frequency trading is another massive crony-capitalist fraud in which financiers, hedge funds and other pay-to-play nabobs of finance capitalism skim billions of dollars by manipulating the flow of stock market trade orders. Since they own the regulators and political class (and paid good money for them, too), this fraud is of course entirely legal. Should the Fed’s baby, the stock market, ever experience a flutter, the Fed’s proxy manipulators goose the market higher in after-hours or pre-market trading, where the low volume is tailor-made for manipulation. All this fraud and manipulation has given the Fed’s skimming machine a veneer of omnipotence, as if the Fed is eternal. It isn’t. Like the Bastille, the Fed can be torn down once the populace traces their impoverishment and powerlessness to the Fed and its wealth-concentrating skimming mechanisms, starting with the stock market. While the take-home earnings of the bottom 90% have stagnated for two decades, the wealth and income of the top 0.1% has skyrocketed. The top 5% of speculators, technocrats and insiders have done very well, and the next 5%–the apparatchik/professional class–have been thrown enough crumbs that they labor under the illusion that they’re “sharing the wealth”–a very convenient delusion for the top 0.1%. Given the extremes of the stock market’s frauds and even greater extremes of wealth/income inequality this skimming operation has created, tell me again why the stock market will still exist in 2024? The aristocrats in France reckoned the Bastille was eternal as well. It wasn’t, and neither is the looting machine known as the stock market. |

Percent of total investment assets held, by wealth distribution |

Tags: Featured,newsletter