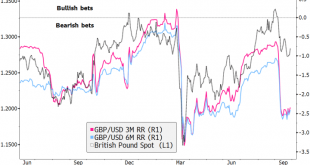

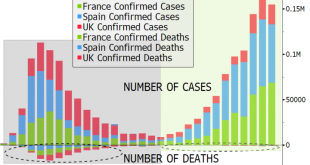

The dollar continues to soften as risk-off sentiment ebbs; the first presidential debate will take place tonight House Democrats have staked out their latest position at $2.2 trln; there is a fair amount of US data out today; Brazil has come under renewed pressure from fiscal concerns The pound continues to outperform as comments from the latest Brexit talks remain skewed to the positive side; latest eurozone CPI and retail sales readings have started coming out...

Read More »Dollar Soft as Markets Ignore Virus Numbers and Switch to Risk-On Mode

Virus numbers are rising across Europe and the US; the dollar is softening as risk-off sentiment ebbs It is a fairly quiet day in the US; there is a glimmer of hope about a fiscal deal in the US; recent US data support the widely held view that more stimulus is needed The final week of Brexit negotiations is upon us in Brussels and the pendulum is swinging towards optimism; Turkish assets may be one of the biggest causalities of the conflict between Armenia and...

Read More »EM Preview for the Week Ahead

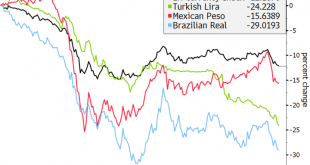

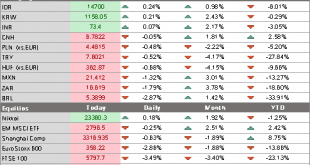

Persistent risk-off impulses weighed on EM last week and that may continue this week. The Asian currencies outperformed last week while MXN, ZAR, and COP underperformed, and we expect these divergences to continue. Despite optimism about a stimulus package in the US, we think it remains a long shot. Meanwhile, virus numbers are rising in Europe and the US, with data from both regions likely to continue weakening. AMERICAS Mexico reports August trade Monday. A...

Read More »Dollar Firm as Markets Digest Rising Virus Numbers

Markets are digesting the rising infection rates across Europe; the dollar is taking another stab at the upside Speculation is picking up that a compromise on a stimulus package could be reached; reports suggest House Democrats are working on a new $2.4 trln package as a basis for these negotiations Reports suggest Fed Governor Lael Brainard is a top candidate for Treasury Secretary if Biden were to win; today is a quiet day in the US Colombia is expected to cut...

Read More »The Silent Exodus Nobody Sees: Leaving Work Forever

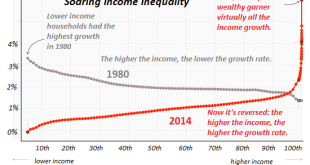

The “take this job and shove it” exodus is silently gathering momentum. The exodus out of cities is getting a lot of attention, but the exodus that will unravel our economic and social orders is getting zero attention: the exodus from work. Like the exodus from troubled urban cores, the exodus from work has long-term, complex causes that the pandemic has accelerated. These are the core drivers of the exodus from work. 1. labor’s share of the economy has been in...

Read More »Dollar Remains Firm Ahead of Powell Testimony

The dollar remains firm on continued safe haven flows but we still view this situation as temporary Fed Chair Powell appears before the House Financial Services Panel with Treasury Secretary Mnuchin; the text of Powell’s testimony was released already House Democrats plan to vote on a stopgap bill today; Fed manufacturing surveys for September will continue to roll out; Brazil COPOM minutes will be released UK CBI September industrial trends survey came in weak; BOE...

Read More »Inflation and “Socialism-Lite” Are Just What the Billionaires Want

After a bout of inflation and “socialism-light”, we could end up with even more extreme inequality when the whole rotten structure collapses. Imagine owning a Buffett-Bezos fortune of bilious billions, or even 10% of these mega-fortunes, i.e. between $5 billion and $20 billion. Heck, imagine owning 1% of these mega-fortunes, i.e. $500 million to $2 billion. You’re extremely rich so you can buy the best advice. Your capital is mobile, and so are you. You can live...

Read More »Dollar Gains from Risk-Off Trading Unlikely to Persist

Markets are starting the week in risk-off mode; the dollar is firm on some safe haven flows but this is likely to prove temporary US politics is coming in to focus as the election nears; we fear that the likely horse-trading and arm-twisting will take away any residual desire to get another stimulus package done The trend towards more restrictive measures continues with London in focus; between the virus numbers and Brexit risks, sterling remains under pressure China...

Read More »“Inflation” and America’s Accelerating Class War

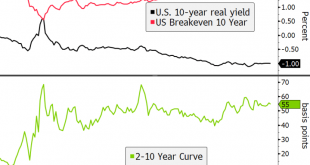

Those who don’t see the fragmentation, the scarcities and the battlelines being drawn will be surprised by the acceleration of the unraveling. I recently came across the idea that inflation is a two-factor optimization problem: inflation is necessary for the macro-economy (or so we’re told) and so the trick for policy makers (and their statisticians who measure the economy) is to maximize inflation in the economy but only to the point that it doesn’t snuff out...

Read More »Risk Appetite Ebbs Ahead of BOE Decision

The dollar has gotten some limited traction despite the dovish FOMC decision; the FOMC delivered no surprises We are seeing some more movement on fiscal stimulus; August retail sales disappointed yesterday Fed manufacturing surveys for September will continue to roll out; weekly jobless claims will be reported; Brazil left rates unchanged at 2.0% but introduced some additional dovish guidance BOE is expected to deliver a dovish hold; UK government reached a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org