Risk sentiment is taking a breather today after a strong run; the dollar is getting some modest traction Fed tweaked its municipal bond program; weekly jobless claims are expected to rise 1.843 mln; Brazil and Mexico are seeing record high daily death counts ECB is expected to ease today; Germany agreed on a new fiscal package that exceeded expectations BOE warned that UK banks should plan for a possible hard Brexit; Swiss deflation is deepening Australia reported...

Read More »Dollar Broadly Weaker After Reports of Possible Brexit Compromise

The dollar remains under pressure; there is a debate as to the root causes of recent dollar weakness May auto sales will be the only US data release today; protests in the US are further denting Trump’s re-elections prospects, at least according to betting odds The G7 meeting planned at Camp David this month was postponed after German Chancellor Merkel declined his invitation Press reports suggest a possible compromise in the UK-EU trade negotiations; oil futures...

Read More »Dollar Firm as US-China Tensions Continue to Rise

Tensions between the US and China continue to rise; the dollar is finding some traction Fed Beige Book contained no surprises; NY Fed President Williams said the Fed is “thinking very hard” about targeting yields; weekly jobless claims are expected at 2.1 mln vs. 2.438 mln last week Germany reports May CPI; ECB is likely to ease next week; BOE continues to show its dovish colors; Poland is expected to keep rates steady at 0.5% Japan’s Cabinet Office maintained its...

Read More »Asia Lockdowns vs. Re-Openings

By Ilan Solot and Kieran Chard We apply the five-factor model used to analyse lockdowns and openings in developed markets and in Latin America to Asian Markets. It evaluates the restrictions imposed by different countries in the region, how they compare in terms of severity of lockdown, and where they are heading in the spectrum of reopening. The scale we use measures grade restrictions from 1 (open) to 4 (closed) across the following five factors: (a)...

Read More »Hong Kong Turbulence Likely to Rise as US-China Relations Worsen

Recent moves by China call into direct question the “one country, two systems” approach. Hong Kong assets have held up surprisingly well but we see turbulence ahead as US-China relations are set to deteriorate further. POLITICAL OUTLOOK Legislation was introduced last week that allows Beijing to directly impose a national security law on Hong Kong. Local legislative approval would be circumvented but Chief Executive Lam said Hong Kong authorities would fully...

Read More »Restricted Market Trading Comments

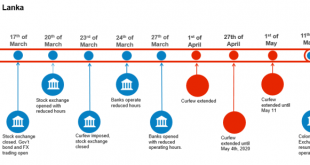

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot Covid-19 related measures for restricted markets remain largely unchanged this week. Philippines, Bangladesh and Kuwait have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below Sri Lanka: The Colombo Stock Exchange (CSE) resumed operations on May 11, 2020 following an extended period of closure. Foreign exchange trading is still permitted...

Read More »Dollar Firm as China’s Hong Kong Gambit Triggers Risk-Off Trading

Legislation was introduced that allows Beijing to directly impose a national security law on Hong Kong; US-China tensions are still rising; the dollar is bid as risk-off sentiment takes hold There are no US data reports or Fed speakers today; Canada reports March retail sales; Mexico reports mid-May CPI ECB publishes the account of its April 30 meeting; UK reported April retail sales and public sector net borrowing; parts of the UK curve remain negative China...

Read More »Dollar Firm as US-China Tensions Flare

The virus news stream is mixed; the dollar has stabilized; US-China tensions continue to ratchet up We will get some more US economic data for May; weekly jobless claims are expected at 2.4 mln Eurozone and UK reported firm preliminary May PMI readings; BOE officials continue to take a very dovish tone South Africa is expected to cut rates 50 bp to 3.75%; Turkey is expected to cut rates 50 bp to 8.25% Japan and Australia reported preliminary May PMIs; Korea reported...

Read More »Dollar Treads Water Ahead of FOMC Minutes

The virus news stream is mixed; the dollar has stabilized a bit FOMC minutes will be released; Canada reports April CPI and March wholesale trade sales; the news from Brazil keeps getting worse Another group of EU nations will release their own plan in a rebuttal of France and Germany; UK reported April CPI data Japan reported March core machine orders; Australia reported weak preliminary April retail sales China kept its benchmark Loan Prime Rates unchanged;...

Read More »Restricted Market Trading Comments

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot Covid-19 related measures for restricted markets remain largely unchanged this week. Philippines, Bangladesh and Kuwait have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below Sri Lanka: The Colombo Stock Exchange (CSE) resumed operations on May 11, 2020 following an extended period of closure. Foreign exchange trading is still permitted...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org