By Ilan Solot and Kieran Chard We apply the five-factor model used to analyse lockdowns and openings in developed markets and in Latin America to Asian Markets. It evaluates the restrictions imposed by different countries in the region, how they compare in terms of severity of lockdown, and where they are heading in the spectrum of reopening. The scale we use measures grade restrictions from 1 (open) to 4 (closed) across the following five factors: (a) schools/universities, (b) non-essential businesses, (c) borders, (d) social distancing and (e) severity of penalties/prosecution. Please see the below table for the breakdown of the measure’s ratings. . . . China China recorded the world’s first case on the December 31 in the Hubei province, taking just 24

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, developed markets, emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| By Ilan Solot and Kieran Chard

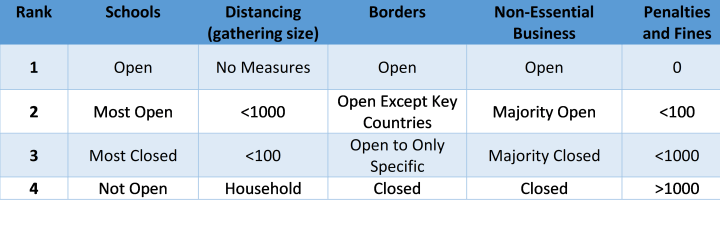

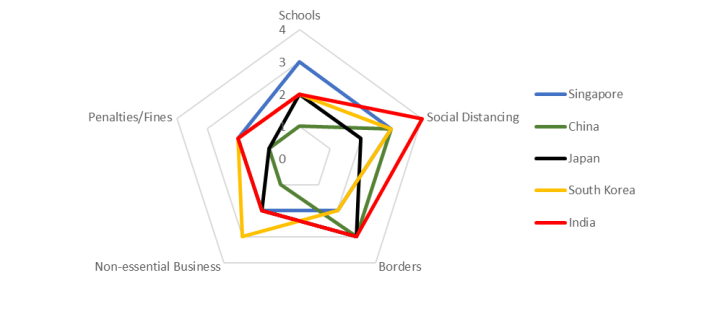

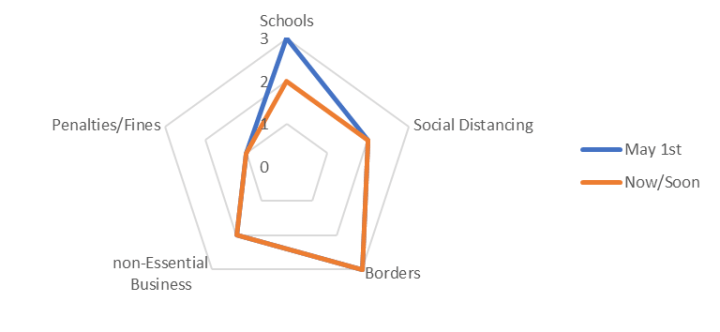

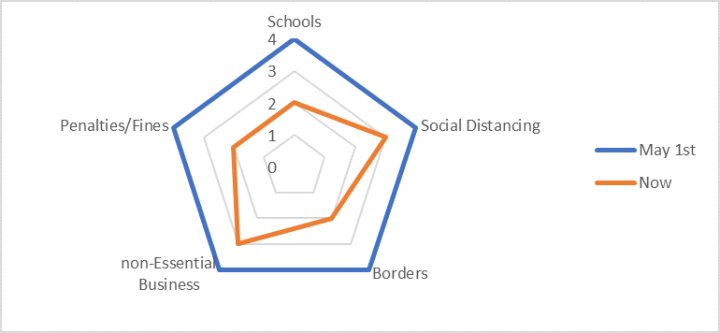

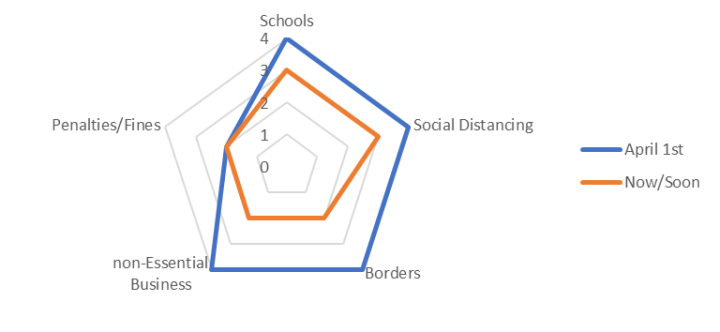

We apply the five-factor model used to analyse lockdowns and openings in developed markets and in Latin America to Asian Markets. It evaluates the restrictions imposed by different countries in the region, how they compare in terms of severity of lockdown, and where they are heading in the spectrum of reopening. The scale we use measures grade restrictions from 1 (open) to 4 (closed) across the following five factors: (a) schools/universities, (b) non-essential businesses, (c) borders, (d) social distancing and (e) severity of penalties/prosecution. Please see the below table for the breakdown of the measure’s ratings. |

|

| China

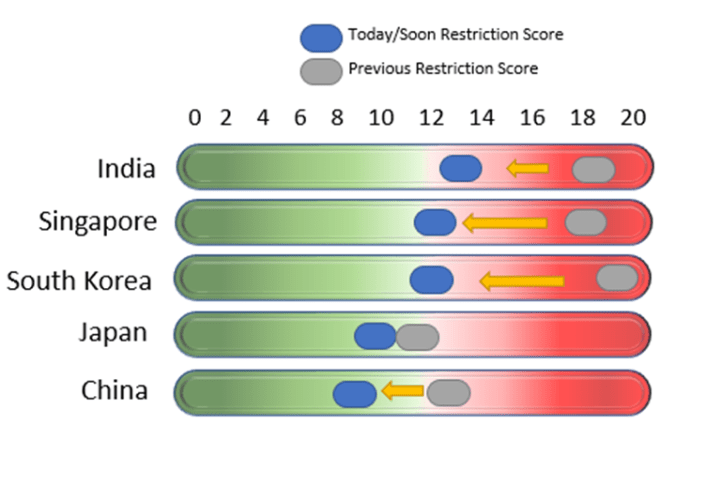

China recorded the world’s first case on the December 31 in the Hubei province, taking just 24 days to reach 1000 recorded cases. Re-opening of the economy started in mid-February and mobility measures have gradually eased, with essential sectors going first. Now most schools are open across the country, as are most businesses. Social distancing remains in place at a local level and travel restrictions remain tight. Of note, Jinlin province has seen two cities go back under lockdown due to newly reported cases. A structure has been put into place for the tracing of the virus, and China seems well in control over the pandemic. The government has implemented an estimated 2.5% of GDP (RMB2.6 tln) in fiscal measures by the time of writing and increased the limit for local government bonds by the equivalent of 1.3% of GDP. Policies announced include increased provisions for prevention and control, production of PPE, and an acceleration to the unemployment insurance scheme. PBOC has provided ample market liquidity while also being cautious not to spur speculative excess by reducing its policy interest rates at a measured pace. More recently, the officials have set the USD/CNY fixing higher, allowing the currency to depreciate – though this is likely more of a political decision than a monetary policy one. Since the initial outbreak on the 31st of December, the dollar has appreciated 2.5% against yuan. |

|

| Japan

Japan recorded its first known case on January 16 but did not begin imposing restrictions relating to borders until March 5. The 1000th case was reported on March 20. The Japanese government did not enforce a lockdown, but it announced a state of emergency for 8 out of 47 prefectures. The measure was recently lifted, signalling the start of further re-opening, which the government hopes to be completed by August. Schools are gradually re-opening and domestic travel will be allowed in mid-June. Prosecution for not following the rules has not been implemented due to Japan’s complicated history of repressive government actions. Japan has taken enormous fiscal measures action to combat the pandemic slowdown, adding up to around 40% of GDP. Note, however, that the true stimulus is a fraction of this headline amount. On April 7, an emergency economic package 21.1% of GDP was unveiled, with 16% of GDP allocated to protect unemployed and businesses. Other measures include key cash handouts to households and businesses. This week, the latest package totalling the equivalent of $1.1 trln was quickly put together after another round of dismal economic data and polls showing ebbing support for Prime Minister Abe’s government. Funds will be directed towards struggling companies, rent subsidies, and healthcare assistance. It will be funded by a second supplementary budget worth less than the headline number, suggesting that the actual stimulus in the package could be worth less than announced. The BOJ announced new provisions in mid-March, aiming to safeguard financial stability and ensure the orderly functioning of markets. It stepped up the bond and ETF purchasing programmes, removing its upper guidance on JGB purchases, amongst other measures. It enhanced its US dollar swap line with the FED by lowering the pricing to 25 bps, as well as establishing swap arrangements with other Asian countries. |

|

| South Korea

South Korea recorded its first case on January 20, just 20 days after the outbreak was discovered in the Hubei province. The country recorded its 1000th case 35 days later. South Korea’s large-scale testing and tracking of the virus was pivotal to allowing them to isolate cases early and come out with a better outcome from the crisis than most countries. Early isolation meant that mobility restrictions were not required. Initial plans were for schools to open from May 13, but opposition from the public caused a delay to the end of May/ early June. Businesses including non-essential ones are currently open. Borders remain closed for non-essential travel from abroad with a 14-day quarantine imposed. Fiscal measures include two supplementary budgets, several ad hoc measures, and another package is supposedly in the works. The first budget was passed on March 17; it included KRW 10.9 trln on disease prevention and loan guarantees. A second budget passed on April 30 included an increased KRW 8 trln emergency relief payment programme for households, alongside an additional KRW 10.1 trln spending on wage subsidies. On the Monetary policy side, BOK lowered base rate by 75 bps to 0.50% and has made unlimited amounts available through OMOs. After the most recent cut (yesterday), officials made it clear that further easing would probably rely more on unconventional measures rather than rate cuts, ensuring that the government’s funding costs remain low. Regulators eased collateral requirements and the BOK treasury bond purchases of up to KRW3 trln. On March 24, a KRW 100 trln stabilization plan was announced totalling 5.3% of GDP, which expanded expanding lending of both state-owned and commercial banks. This was followed by a bond market stabilisation fund to purchase corporate bonds and commercial paper. On the April 22, president Moon announced a key industry stabilisation fund totally 1.25% of GDP (KRW 40 trln) aimed at the key industries, for which funds will be raised through a government bond issuance. The BOK also re-established its bilateral swap line with the Fed, worth $60 bln, to ensure that funding makers remain stable. Overall Q1 real GDP declined by -1.2% q/q and slowed to 1.3% y/y from 2.5% y/y in Q4 2019. |

|

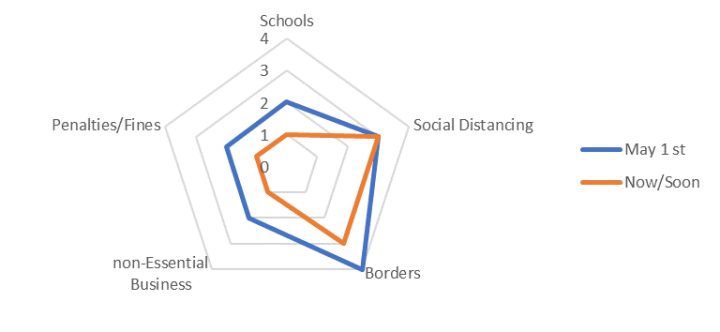

| Singapore

Singapore recorded its first case on the January 23. It took 68 days for the 1000th case to be reported on the April 1. Social distancing provisions were intensified through April to reduce an increase in transmissions. Schools are still shut but are planned to gradually re-open on June 2. That is when a broader economic re-opening is set to take place. Social distancing should still be enforced with people only leaving homes for essential activities, and always wearing a mask. On the May 19, the government announced that borders will gradually re-open with safeguards in place to allow Singaporeans to conduct essential activities abroad and for foreigners to enter. Singapore’s response includes four fiscal packages, with the first announced in mid-February and the last one this week. The total spending will add up to close to 20% of GDP. The care and support package included support to households with SGD5.7 bln dedicated to this, including a cash handout for all residents, wage subsidies and additional support. The most recent package also focuses on workers and households, hoping to improve the country’s employment outlook. On March 31, the MAS announced a package to help individuals and SME’s facing cashflow difficulties. A second package on April 30 extended this for a broader range. They also announced a swap line with the Fed worth US$60 bln to ensure funding markets remain stable. |

India

India recorded its first case of Covid-19 on the January 30. It breached 1000 case mark on March 29 and passed the 100,000-case mark on May 18. On March 24, India went on complete lockdown for 21 days, then extended the restrictions in mid-May. The latter included international and regional travel bans and closing of schools and universities, as well as non-essential business. The government started to relax some measures in mid-April for certain areas, then allowed further reopening in early May. Schools remain closed, but businesses are gradually reopening. Internal borders for essential travel are now permitted, but international borders remain closed, while social distancing is still encouraged with the mass gathering ban still in place.

An initial fiscal package totalling 0.8% of GDP was announced on March 26 directed at supporting lower income households. In mid-May, new measures for business totalling 2.7% of GDP were announced as well as an expansion of the support for lower income households. In terms of monetary policy, the RBI reduced the repo rate and reverse repo rates by 115 and 155 bps this year to 4.0% and 3.75%, respectively. RBI implemented new liquidity measures worth 1.8% of GDP, including an ECB-style LTRO. On March 16, the RBI announced a second FX swap in addition to the previous one, this one with a notional $2 bln amount and a for a duration of 6 months.

Tags: developed markets,Emerging Markets,Featured,newsletter