The spread of the coronavirus continues and is likely to weigh on risk assets and EM. Most markets in Emerging Asia are closed for all or part of this week due to the Lunar New Year holiday. China has extended the holiday until February 2 as it struggles to contain the virus. The Asian region is just starting to recover from the global trade tensions, and now it must cope with what is likely to be a sharp drop-off in tourism. Policymakers in the region may have...

Read More »Virus and Trade Tensions

Asian markets hit by a further outbreak of the coronavirus US steps up trade rhetoric against EU and pushes back against UK digital tax plan AUD stronger on solid Australian jobs report and pricing out of RBA easing CAD weaker on dovish BOC communication yesterday Norges Bank and Bank Indonesia keep rates on hold, as expected ECB meeting concludes shortly, markets await kickoff of strategic review The dollar is mixed against major currencies but mostly stronger...

Read More »Dollar Mixed as Risk-Off Impulses Spread from Virus

Reports that Wuhan coronavirus continues to spread hurt risk appetite overnight US President Trump and French president Macron agreed to take a step back from the digital tax dispute The dollar is taking a breather today; after last week’s huge US data dump, releases this week are fairly light The UK reported firm jobs data for November; BOJ kept policy steady, as expected Moody’s downgraded Hong Kong by a notch to Aa3 with stable outlook; data out of Asia suggest...

Read More »EM Preview for the Week Ahead

Market sentiment on EM remains positive after the Phase One trade deal was signed. Data out of China is also supportive for EM. Key forward-looking data this week are Taiwan export orders and Korea trade data for the first 20 days of January. The global liquidity story also remains beneficial for risk, with the ECB, Norges Bank, BOC, and BOJ all set to maintain steady rates this week. AMERICAS Mexico reports mid-January CPI Thursday, which is expected to rise 3.16%...

Read More »Dollar Soft Ahead of Retail Sales Data

There were no surprises in the US-China Phase One trade deal The dollar is drifting lower ahead of the key retail sales data; there are other minor US data out today Bank of England credit survey showed demand for loans fell in Q4 Turkey cut its one-week repo rate by 75 bps to 11.25%; South Africa is expected to keep rates steady at 6.5% Japan reported November core machine orders and December PPI; China’s credit numbers for December showed no big change in lending...

Read More »Some Thoughts on the Latest Treasury FX Report

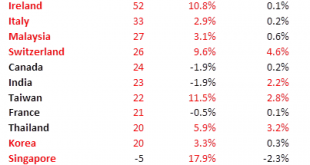

The US Treasury’s latest “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States” report no longer considers China a currency manipulator. The underlying message is that the Trump administration will continue to use an ad hoc “carrot and stick” approach to improve US access to the domestic markets of its major trading partners. This suggests there will still be many minor trade skirmishes this year. RECENT DEVELOPMENTS The latest...

Read More »EM Preview for the Week Ahead

EM has been able to get some traction as markets basically shrugged off the risk-off sentiment after the Iran attacks. This week’s planned signing of the Phase One trade deal should help boost EM further, but we remain cautious. The Iran situation is by no means solved, and we see periodic bouts of risk-off sentiment coming from smaller skirmishes. The World Bank also sounded a warning bell last week with its downward revisions to its global growth forecasts....

Read More »Dollar Builds on Gains as Iran Tensions Ease

Markets have reacted positively to President Trump’s press conference yesterday, while the dollar continues to gain traction The North American session is quiet in terms of US data Mexico reports December CPI; Peru is expected to keep rates steady at 2.25% German November IP was slightly better than expected but still tepid; sterling took a hit on dovish comments by outgoing BOE Governor Carney Israel is expected to keep rates steady at 0.25% China reported December...

Read More »EM Preview for the Week Ahead

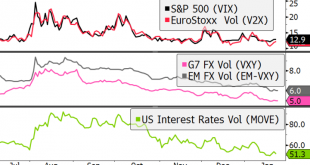

While the global economic backdrop remains favorable for EM, rising geopolitical risks will be a growing headwind. The EM VIX surged above 18% Friday as Iran tensions escalated, the highest since early December. With these tensions likely to persist, EM may remain under some pressure for the time being. High oil prices are positive for the exporters in Latin America and the Middle East but negative for the importers in Asia and Eastern Europe. AMERICAS Chile reports...

Read More »EM Preview for the Week Ahead

EM FX was broadly firmer last week, taking advantage of the dollar’s soft tone as well as another wave of risk-on sentiment. Bullishness on the global economy is quite strong, whilst we are perhaps a bit more skeptical given ongoing weakness in the UK, Japan, and the eurozone. Dollar bearishness may also be overdone given our more constructive outlook on the US economy, but technical damage has been done that must now be repaired. AMERICAS Brazil reports November...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org