We get the first February data from the US manufacturing sector this week; the US economy remains strong; FOMC minutes will be released Wednesday Canada reports some key data this week Preliminary eurozone February PMI readings will be reported Friday; UK has a busy data week Japan has a busy data week; Australia reports January jobs data Thursday Concerns about the coronavirus are likely to keep risk sentiment under pressure, as the ultimate impact is still...

Read More »Virus Concerns Resurface

Markets are reacting badly to upward revisions to coronavirus cases in China The euro fell to the weakest level since mid-2017 against the dollar UK housing data adds to relatively upbeat figures since the December elections Malaysia’s government is joining in the counter-cyclical fiscal effort The dollar is mixed on the day. The yen is 0.3% stronger, briefly trading above the ¥110.0 level on negative headlines about China’s coronavirus infections. The euro and...

Read More »Drivers for the Week Ahead

Risk-off sentiment intensified last week; the dollar continues to climb This is another big data week for the US; the US economy remains strong Fed Chair Powell testifies before the House Tuesday and the Senate Wednesday; the Senate holds confirmation hearings for Fed nominees Shelton and Waller Thursday President Trump will unveil his budget proposal for FY2021 beginning October 1 this Monday Eurozone and UK have heavy data weeks Riksbank meets Wednesday and is...

Read More »Dollar Firm Ahead of US Jobs Report

The number of confirmed coronavirus cases and deaths continue to rise; the dollar continues to climb The January jobs data is the highlight for the week; Canada also reports jobs data The Fed submits its semiannual Monetary Policy Report to Congress today; Mexico and Brazil report January inflation data The downdraft in eurozone industrial data continues; Russia cut rates 25 bp to 6.0% and signaled more easing ahead RBA upbeat but Governor Lowe warns of “significant...

Read More »Dollar Firm as Markets Await Fresh Drivers

China cut tariffs on $75 bln of US imports by half, while the US said it could reciprocate in some way The dollar continues to climb; during the North American session, only minor data will be reported; Brazil cut rates 25 bp Germany reported very weak December factory orders; all is not well in the German state of Thuringia Czech expected to keep rates steady; Philippines cut 25 bp; India remained on hold Australia reported December trade and retail sales The dollar...

Read More »Dollar Mixed as Some Risk Appetite Returns

The dollar continues to climb; one of side-effects of the virus has been a swelling of the amount of negative yielding debt globally The US primary season got off to a rocky start for the Democrats During the North American session, December factory orders will be reported; the US economy remains strong The UK reported January construction PMI The RBA held rates at 0.75%, as expected; Korea January CPI came in hot at 1.5% y/y The dollar is mixed against the majors as...

Read More »EM Preview for the Week Ahead

EM remains vulnerable to deteriorating risk sentiment as the coronavirus spreads. China announced a series of measures over the weekend to help support its financial markets, but this may not be enough to turn sentiment around yet. China markets reopen Monday after the extended Lunar New Year holiday and it won’t be pretty. AMERICAS Brazil reports January trade Monday. December IP will be reported Tuesday, which is expected to fall -0.8% y/y vs. -1.7% in...

Read More »Dollar Firm Ahead of BOE Decision

The World Health Organization called an emergency meeting today; the dollar continues to climb The FOMC meeting was a non-event; US advance Q4 GDP will be reported Risk-off sentiment has derailed curve steepening trades Implied rates still suggest that today’s BOE meeting is a coin toss Turkish central bank released its quarterly inflation report; Asian markets got hit hard again with rising virus concerns The dollar is broadly firmer against the majors ahead of the...

Read More »Tentative Stabilization

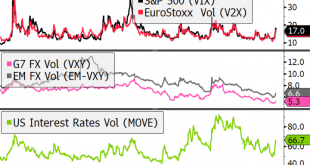

Risk-off continues in Asia, but moves have been less dramatic European market jittery but stable Implied rates now pricing in a full Fed cut by September The UK will announce its decision on Huawei’s access to the country’s 5G network The dollar is slightly stronger against most major currencies, so DXY continues on its very gradual grind higher. The index is up 1.6% since the start of the year. Of note, the Australian dollar is down 0.3% reaching at 3-month low at...

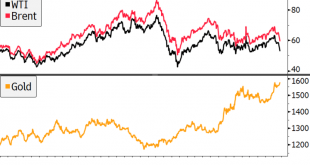

Read More »Sharp Sell-Off on Virus Concerns

Global stocks lower on virus fears, yen appreciates, and yield curves flatten Oil prices continue to fall while gold rises Italian assets outperform on favorable election results for ruling coalition German IFO survey disappoints, trimming nascent green shoots The dollar is mixed against DM and broadly stronger against EM. On the former, the yen is outperforming (+0.4%), heading to the sixth day of consecutive appreciation, now back below the ¥109.0 level. AUD and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org