There’s an old saying on Wall Street that one should “buy the rumor, sell the news”, a pithy way to express the efficient market theorem. By the time an event arrives, whatever it may be, the market will have fully digested the news and incorporated it into current prices. And then the market will move on to anticipating the next event, large or small. What prompts this review of Wall Street folk wisdom is the most recent employment report. The BLS reported Friday,...

Read More »Spending Here, Production There, and What Autos Have To Do With It

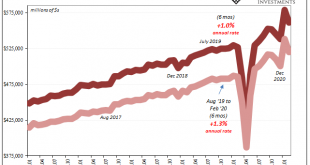

While the global inflation picture remains fixed at firmly normal (as in, disinflationary), US retail sales by contrast have been highly abnormal. You’d think given that, the consumer price part of the economic equation would, well, equate eventually price-wise. Consumers are spending, prices should be heading upward at a noticeable rate. To begin with, consumer spending – as pictured by the Census Bureau – was obviously boosted during January by the previous...

Read More »Looking Past Gigantic Base Effects To China’s (Really) Struggling Economy

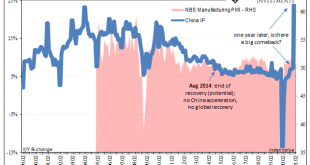

The Chinese were first to go down because they had been first to shut down, therefore one year further on they’ll be the first to skew all their economic results when being compared to it. These obvious base effects will, without further scrutiny, make analysis slightly more difficult. What we want to know is how the current data fits with the overall idea of recovery: is it on track, perhaps going better than thought, or falling short. Another set of huge positives...

Read More »JOLTS Revisions: Much Better Reopening, But Why Didn’t It Last?

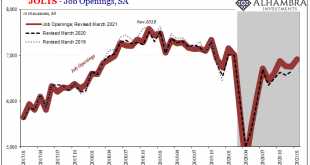

According to newly revised BLS benchmarks, the labor market might have been a little bit worse than previously thought during the worst of last year’s contraction. Coming out of it, the initial rebound, at least, seems to have been substantially better – either due to government checks or, more likely, American businesses in the initial reopening phase eager to get back up and running on a paying basis again. The JOLTS labor series annual revisions took about...

Read More »What Gold Says About UST Auctions

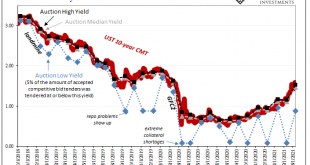

The “too many” Treasury argument which ignited early in 2018 never made a whole lot of sense. It first showed up, believe it or not, in 2016. The idea in both cases was fiscal debt; Uncle Sam’s deficit monster displayed a voracious appetite never in danger of slowing down even though – Economists and central bankers claimed – it would’ve been wise to heed looming inflationary pressures to cut back first. Combined, fiscal and monetary policy was, they said,...

Read More »4 Social Security Planning Steps BEFORE You’re Ready to Retire

Social Security is an important part of almost every retirement plan, whether you’ve saved enough or not. That’s why it’s important to know as much about your Social Security situation as possible. And you don’t want to wait until you’re about to retire to gather the facts and take appropriate steps. Social Security planning needs to start 5 years before your target retirement date. Check your estimated benefit amount The easiest way to check Social Security’s...

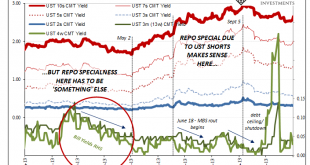

Read More »Deja Vu: Treasury Shorts Meet Treasury Shortages

Investors like to short bonds, even Treasuries, as much as they might stocks and their ilk. It should be no surprise that profit-maximizing speculators will seek the best risk-adjusted returns wherever and whenever they might perceive them. If one, or a whole bunch, has to first “borrow” a security the one doesn’t own in order to sell something at a high price betting the price to go down, you can likewise bet there’s someone out there in the financial landscape more...

Read More »There’s Two Sides To Synchronize

The offside of “synchronized” is pretty obvious when you consider all possibilities. In economic terms, synchronized growth would mean if the bulk of the economy starts moving forward, we’d expect the rest to follow with only a slight lag. That’s the upside of harmonized systems, the period everyone hopes and cheers for. What happens, however, when it’s the leaders rather than laggards who begin to shift toward the other way? It’s a question the global economy has...

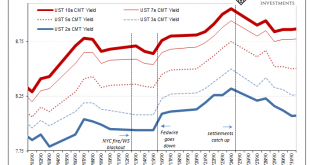

Read More »Three Things About Today’s UST Sell-off, Beginning With Fedwire

Three relatively quick observations surrounding today’s UST selloff. 1. The intensity. Reflation is the underlying short run basis, but there is ample reason to suspect quite a bit more than that alone given the unexpected interruption in Fedwire yesterday. At 12:43pm EST, most of FRBNY’s electronic services experienced an as-yet unexplained problem which interrupted service, including that of Fedwire. To this point, the New York branch has only confirmed the...

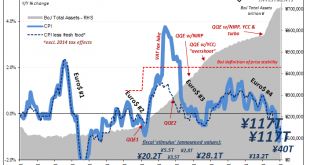

Read More »Nine Percent of GDP Fiscal, Ha! Try Forty

Fear of the ultra-inflationary aspects of fiscal overdrive. This is the current message, but according to what basis? Bigger is better, therefore if the last one didn’t work then the much larger next one absolutely will. So long as you forget there was a last one and when that prior version had been announced it was also given the same benefit of the doubt. Most people don’t like looking to Japan mainly because it is too depressing; unless one is an Economist who...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org