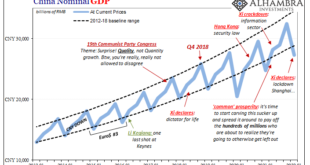

The first chapters to China’s new story now playing out in Shanghai were written down in October 2017. Planning for them had begun years earlier, their author Xi Jinping requiring more research before committing them to paper. Communist authorities there had grown increasingly concerned about the lack of growth potential for its political system by then utterly dependent for a quarter-century on the economy growing. So long as other places around the world wanted...

Read More »China, Japan, And The Relative Pre-March Euro$ Calm In February

The month of February 2022, the calm before the latest storm. Russians went into Ukraine toward the month’s end, collateral shortage became scarcity, maybe a run right at February’s final day, and then serious escalations all throughout March – right down to pure US Treasury yield curve inversion. Given that setup, it was unsurprising to find Treasury’s February TIC data mostly unremarkable. Top to bottom, there wasn’t really much that changed. No huge negatives,...

Read More »I Told You It *Wasn’t* Money Printing; How The Fed Helped Cause, But Can’t Solve, Our Current ‘Inflation’

Trust the Fed. Ha! It’s one thing for money dealers to look upon Jay Powell’s stash of bank reserves with remarkable disdain, more immediately damning when effects of the same liquidity premiums in the real economy create serious frictions leaving the entire world exposed to the consequences. When all is said and done, the Federal Reserve has created its own doom-loop from which it won’t likely escape. The 2022 FOMC has made itself plain, incredibly hawkish to an...

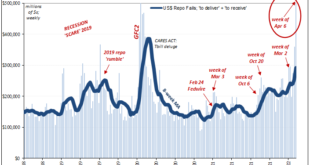

Read More »Yield Curve Inversion Was/Is Absolutely All About Collateral

If there was a compelling collateral case for bending the Treasury yield curve toward inversion beginning last October, what follows is the update for the twist itself. As collateral scarcity became shortage then a pretty substantial run, that was the very moment yield curve flattening became inverted. Just like October, you can actually see it all unfold. According to the latest FRBNY data taken from Primary Dealers, repo fails during the week of April 6 (most...

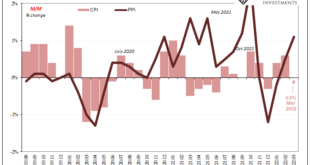

Read More »China More and More Beyond ‘Inflation’

If only the rest of the world could have such problems. Chinese consumer prices were flat from February 2022 to March, even though gasoline and energy costs predictably skyrocketed. According to China’s NBS, gas was up 7.2% month-over-month while diesel costs on average gained 7.8%. Balancing those were the prices for main food staples, especially pork, the latter having declined an rather large 9.3% last month from the month before. Keeping energy but removing...

Read More »China’s Imports Outright Declined In March, And COVID Was The Reason Why But Not Really

The guy said this was going to be the future. Not just of China, for or really from the rest of the world. Way back in October 2017, at the 19th Communist Party Congress newly-made Emperor Xi Jinping blurted out his grand redesign for Socialism with Chinese Characteristics. A country once committed to quantity of economic growth above everything else would, moving forward, come to prioritize instead the quality of it. This message was a clear signal, way back when,...

Read More »You Know What They Say About The Light At The End Of The Tunnel

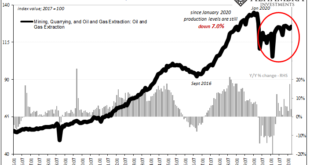

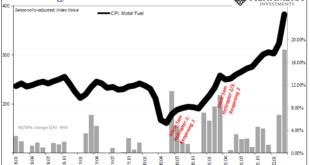

In any year when gasoline prices rise 18%, that’s not going to be good for anyone except maybe oil companies who extract its key ingredient from out of the ground (or don’t, as the case can be). Yet, annual rates of increase that size do happen. After August 2017 up to and including August 2018, the BLS’s CPI registered a seasonally-adjusted 20.5% year-over-year gain in its motor fuel component. Economic pain followed thereafter, though not entirely the fault of...

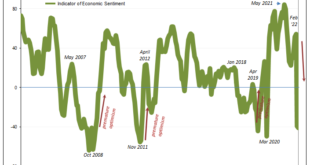

Read More »Produzentenfenster Globale Rezessionsuhr

German optimism was predictably, inevitably sent crashing in March and April 2022. According to that country’s ZEW survey, an uptick in general optimism from November 2021 to February 2022 collided with the reality of Russian armored vehicles trying to snake their way down to Kiev. Whereas sentiment had rebounded from an October low of 22.3, blamed on whichever of the coronas, by February the index had moved upward to 54.3. It currently stands at -41.0, collapsing...

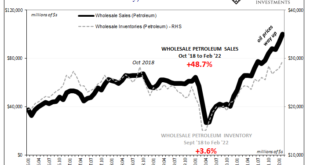

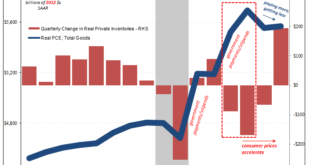

Read More »Concocting Inventory

The Census Bureau provided some updated inventory estimates about wholesalers, including its annual benchmark revisions. As to the latter, not a whole lot was changed, a small downward revision right around the peak (early 2021) of the supply shock which is consistent with the GDP estimates for when inventory levels were shrinking fast. What’s worth noting about the figures now is how much of a problem there is in terms of petroleum. By that I mean two ways. First,...

Read More »Worry Walls Don’t Explain Repeated Falls

Someone once said that the stock market is always climbing a wall of worry. Maybe that had been true in some long-ago day, but whether or not it might nowadays is beside the point. The nugget of truth which makes the prosaism memorable is the wall rather than the climber. There’s always something going on somewhere to get worked up over. And it matters to far more than financial actors, the entire global economy must surmount what can seem like an unending series of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org