The Census Bureau provided some updated inventory estimates about wholesalers, including its annual benchmark revisions. As to the latter, not a whole lot was changed, a small downward revision right around the peak (early 2021) of the supply shock which is consistent with the GDP estimates for when inventory levels were shrinking fast. What’s worth noting about the figures now is how much of a problem there is in terms of petroleum. By that I mean two ways. First, wholesale sales of petroleum have absolutely skyrocketed, no surprise. Just amazing the level of increase, keeping in mind much of it due to price changes rather than as-rapid volume expansion. According to the estimates now for February 2022, dollar-value sales of crude and whatnot were just about 50%

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, currencies, economy, Featured, Federal Reserve/Monetary Policy, FOMC, inflation, Markets, newsletter, rate hikes, supply chain, wholesale inventory, wholesale sales, Yield Curve, yield curve inversion

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The Census Bureau provided some updated inventory estimates about wholesalers, including its annual benchmark revisions. As to the latter, not a whole lot was changed, a small downward revision right around the peak (early 2021) of the supply shock which is consistent with the GDP estimates for when inventory levels were shrinking fast.

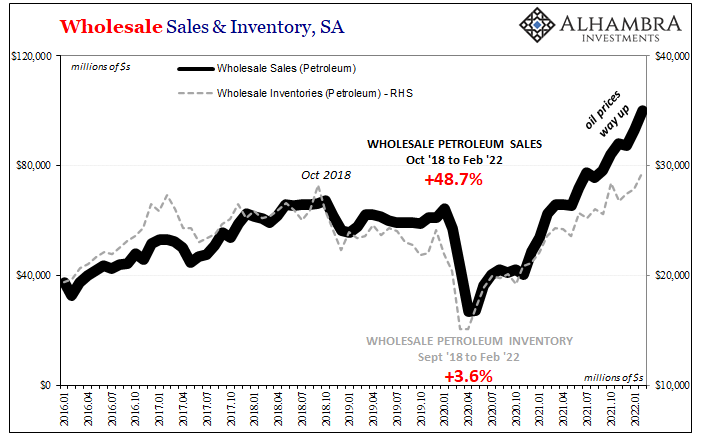

What’s worth noting about the figures now is how much of a problem there is in terms of petroleum. By that I mean two ways. First, wholesale sales of petroleum have absolutely skyrocketed, no surprise. Just amazing the level of increase, keeping in mind much of it due to price changes rather than as-rapid volume expansion. According to the estimates now for February 2022, dollar-value sales of crude and whatnot were just about 50% higher than the previous peak set back in October 2018 entering that “cycle’s” landmine event. For all that, inventories of the same commodity aren’t even 4% more than back in September 2018 (the prior top for inventory). |

|

| This disparity, obviously, reflected in price yet also of production (lack of). Unless the FOMC has a secret fracking code hidden within its rate hikes, what good will they otherwise do? (I know, I know; their true purpose is shock-psychology, therefore the rabidness of these hawks lately).

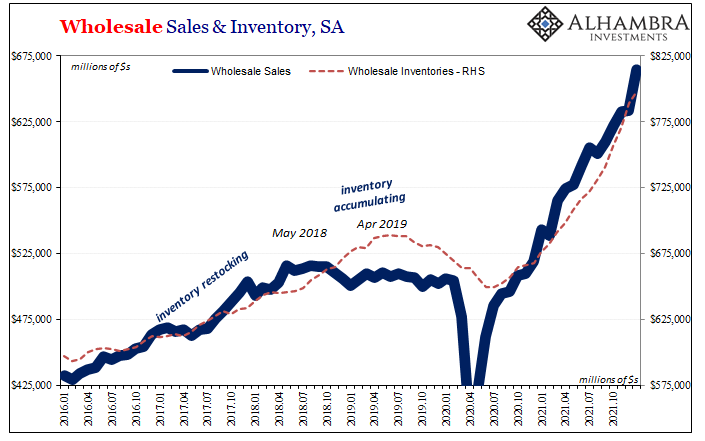

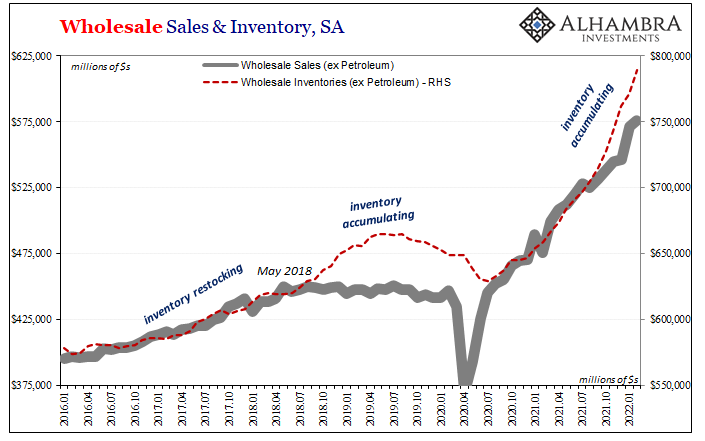

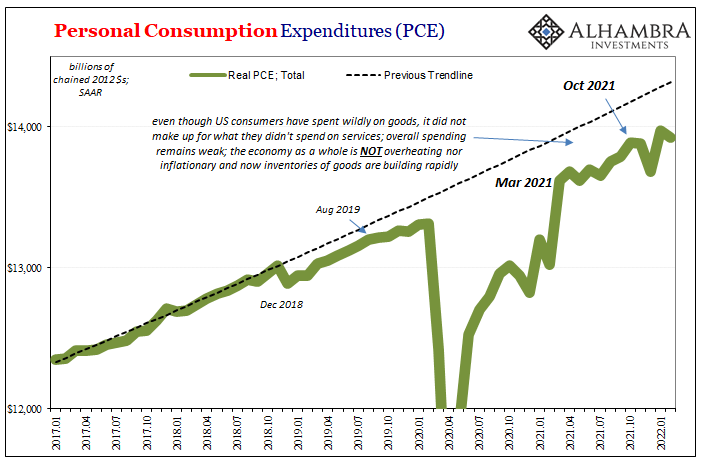

If you don’t account for the supply shock rather than actual inflation hidden within the oil patch, mismatch rebound in demand versus restricted supply, then the entire wholesale level of the supply chain appears to be itself relatively well balanced, so inflation. Even as inventories surge in historic fashion, overall wholesale sales have kept pace. Removing petroleum, however, you then see the wider economic problem. |

|

| Since crude inventories are not growing, not really, that means wholesale inventories outside of oil must be accumulating that much more rapidly. On the other side, since wholesale sales of petroleum remain wild, wholesale sales apart from those are a little less heated.

The remainder is a widening gap inventory over sales. And it really goes back to around last September and October (as the curves priced in addition to the stupidity of the debt ceiling). |

|

|

|

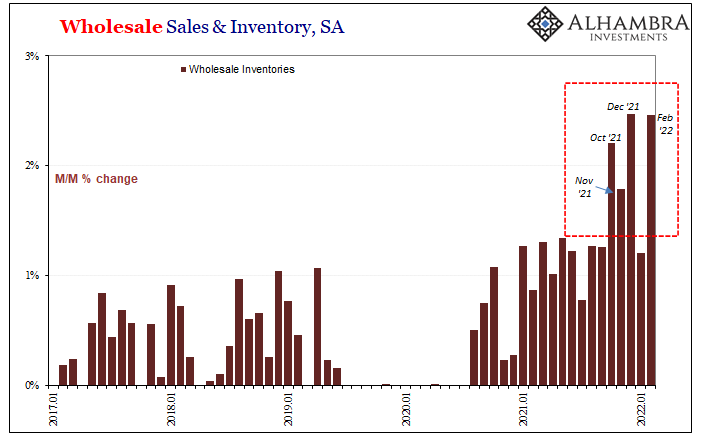

| These revisions to the wholesale inventory data now put four of the last five months as the four highest single-month increases on record (which includes price effects). Again, though wholesale sales remain brisk (also including price effects), they aren’t as brisk outside energy, as the supply chain scales have tipped more definitively toward accumulation of goods and product.

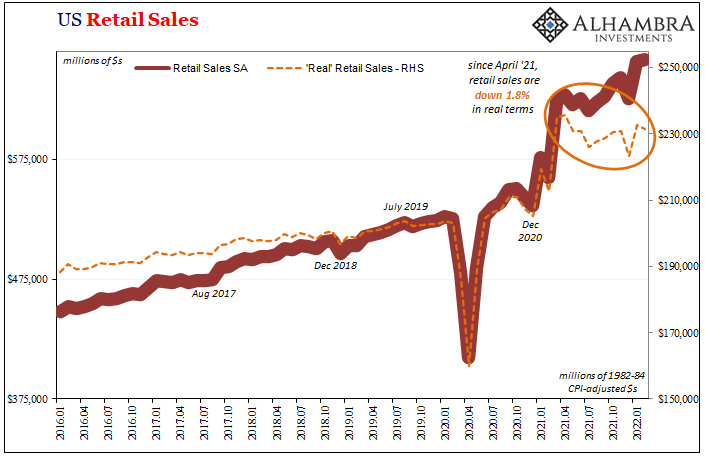

And there’s more coming. The second major problem indicated by the petroleum imbalance is demand destruction. Wholesalers are having no trouble whatsoever moving oil and gasoline up to the retail level though prices have surged dramatically. |

|

| Could that be partly responsible for a slightly less pace to wholesale sales elsewhere around the goods economy?

Demand destruction takes place when consumers forced to pay more for necessities like gasoline then can’t afford to spend on other things, such as the way they might have last year when stuck at home shopping online using Uncle Sam as everyone’s (debt-ridden) benefactor. |

|

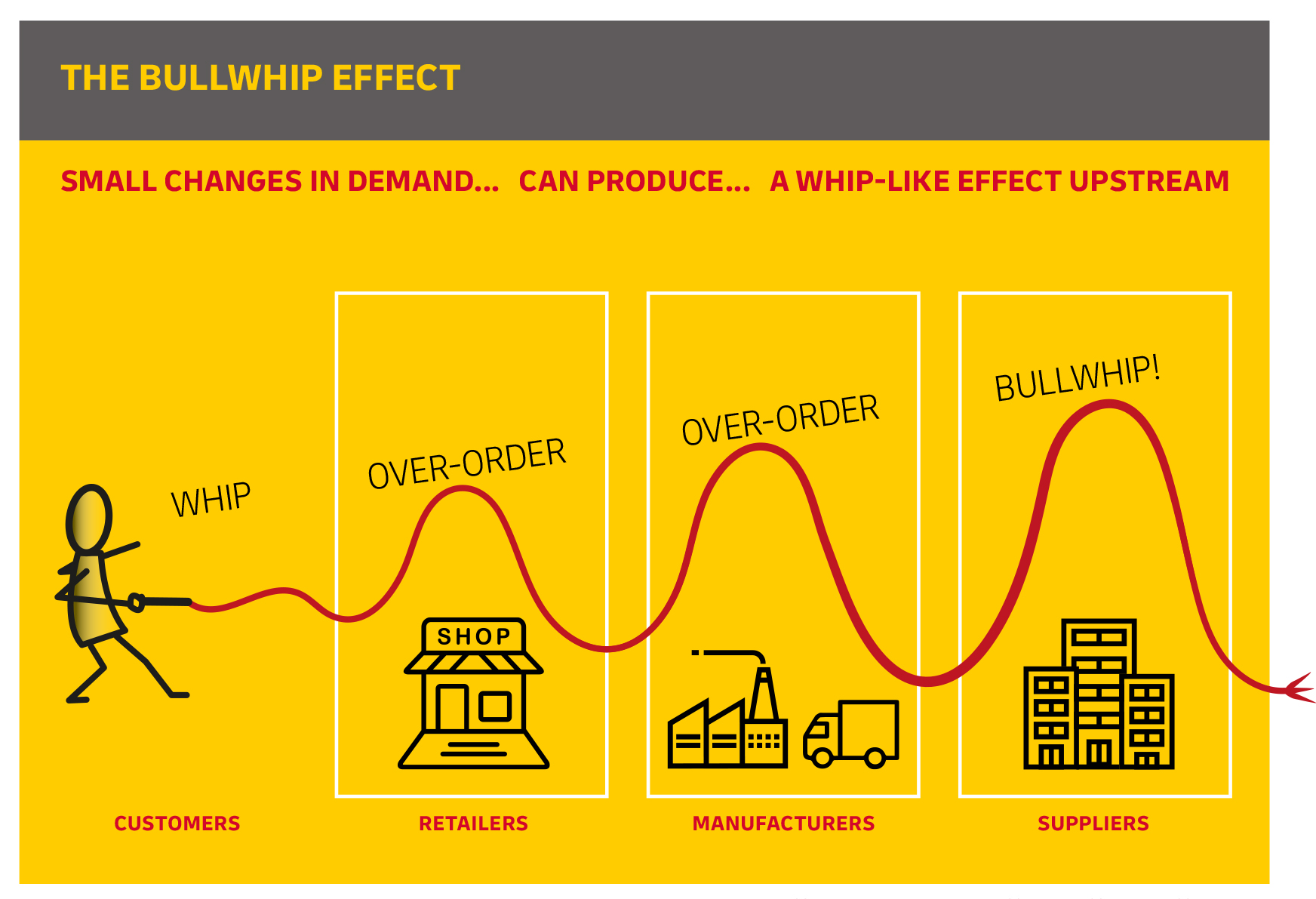

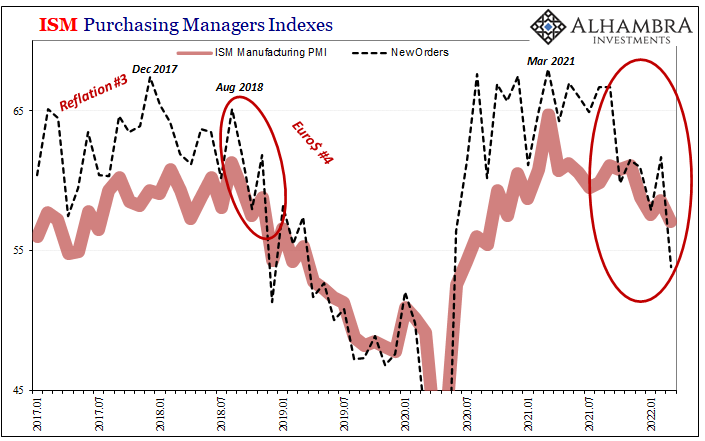

| More for gas and groceries, less from the feds, and the hot flame for the rest of last year’s goods economy begins to cool, if slowly at first. This, though, merely sets up for what economists call the bullwhip effect, and given the huge upswell in that goods economy from last year’s artificiality there’s more to the whip possible this time compared to others.

One whitepaper on this subject from 2020 co-authored by DHL wrote, “Time and again, it has been shown that industry’s favourite strategy in times of uncertainty is to stockpile,” and do so regardless of demand. |

|

Note: the graphic on bullwhip effect was taken from this paper

|

|

|

|

| Nearing two years later, oh yeah, just-in-case is just now timed to show itself.

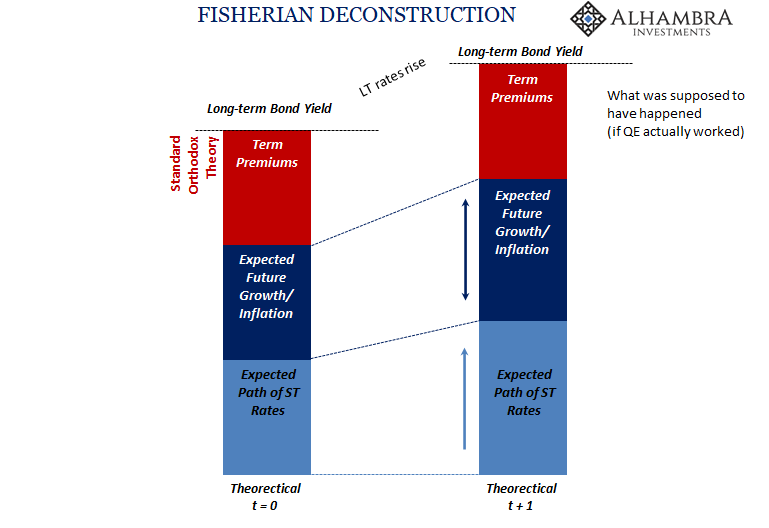

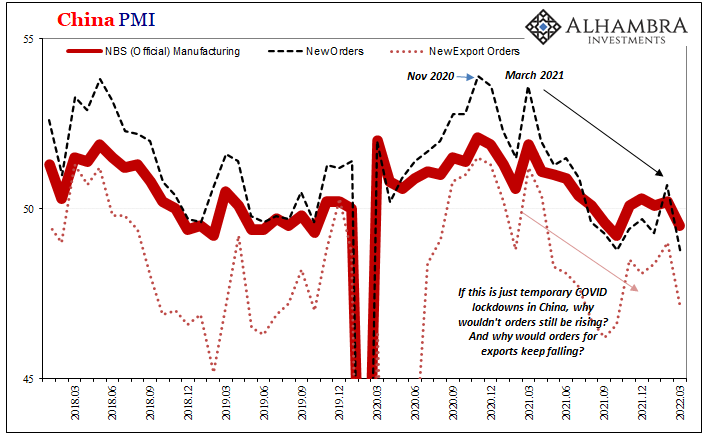

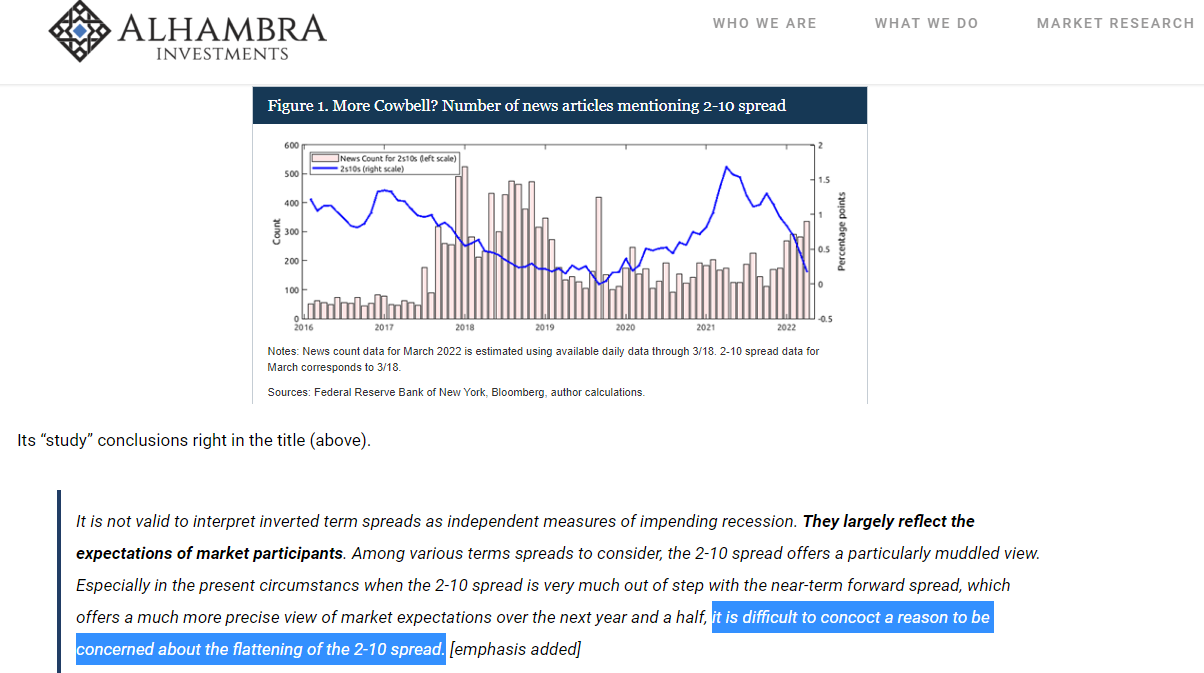

In 2022, as demand maybe starts to cool off, or has, and actually does more so in other places first like Europe, the case for just-in-case reverses only with the other end of the whip far more exposed. That’s the risk, anyway, and a(n honest) survey around the world shows a possible beginning to it – rather than omicron or Russia – from even before the Fed’s first move. For the FOMC, contrary to the ECB or PBOC, US policymakers will be hiking rates based on what they see of the petroleum imbalance alone, factoring that consumers and businesses will focus exclusively on it, too, while instead it likely will be everything else what makes the economic difference only in the other direction. Contrary to what nonsense Fed researchers keep serving, the case(s) behind curve inversion(s) just isn’t challenging to “concoct.” |

|

Tags: Bonds,currencies,economy,Featured,Federal Reserve/Monetary Policy,FOMC,inflation,Markets,newsletter,rate hikes,supply chain,wholesale inventory,wholesale sales,Yield Curve,yield curve inversion