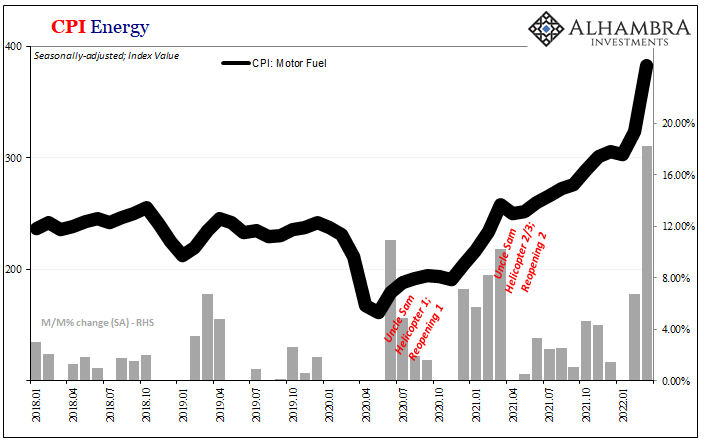

In any year when gasoline prices rise 18%, that’s not going to be good for anyone except maybe oil companies who extract its key ingredient from out of the ground (or don’t, as the case can be). Yet, annual rates of increase that size do happen. After August 2017 up to and including August 2018, the BLS’s CPI registered a seasonally-adjusted 20.5% year-over-year gain in its motor fuel component. Economic pain followed thereafter, though not entirely the fault of root WTI prices. What about when gasoline surges 18% in a single month? This just happened, according to the latest CPI numbers for the month of March 2022. The seasonally-adjusted index for motor fuel, which rose 6.7% already in February from January, well, it now looks like this: . No one has to

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, consumer expectations, Consumer Prices, CPI, currencies, economy, Featured, Federal Reserve/Monetary Policy, inflation, inflation expectations, Markets, newsletter, rate hikes, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| In any year when gasoline prices rise 18%, that’s not going to be good for anyone except maybe oil companies who extract its key ingredient from out of the ground (or don’t, as the case can be). Yet, annual rates of increase that size do happen. After August 2017 up to and including August 2018, the BLS’s CPI registered a seasonally-adjusted 20.5% year-over-year gain in its motor fuel component. Economic pain followed thereafter, though not entirely the fault of root WTI prices.

What about when gasoline surges 18% in a single month? This just happened, according to the latest CPI numbers for the month of March 2022. The seasonally-adjusted index for motor fuel, which rose 6.7% already in February from January, well, it now looks like this: |

|

| No one has to imagine the public outcry and anger. More than anything, this right here is the Fed’s rate hike scheme. And it’s ridiculous theater because raising the fed funds target range won’t get a single drop more oil out of the ground and into the hands of thirsty refiners.

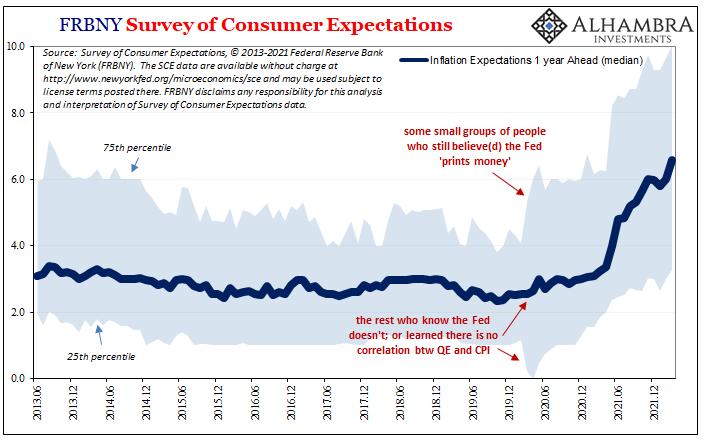

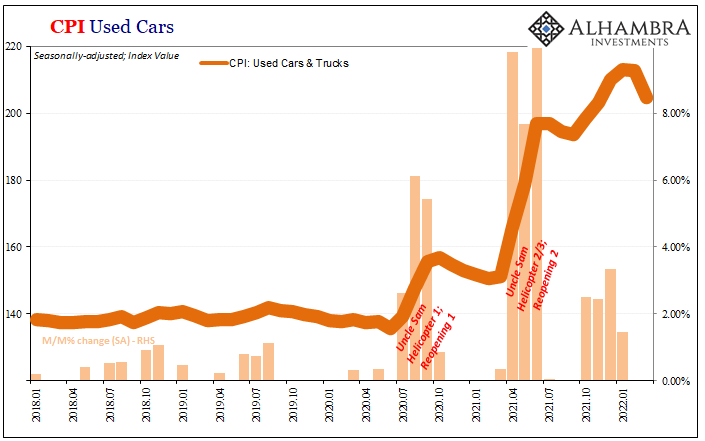

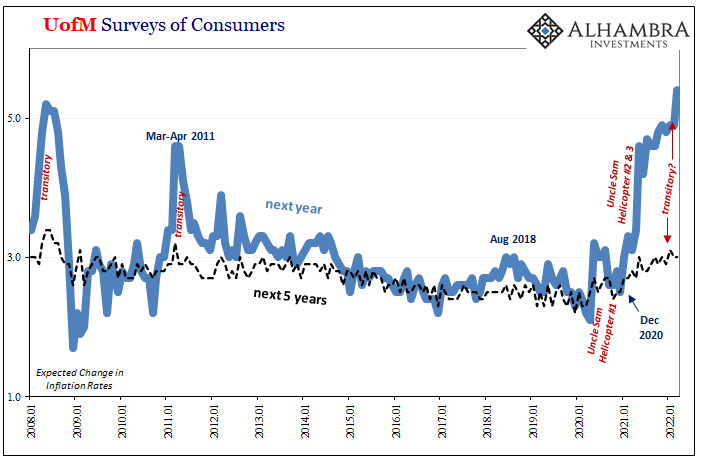

The last time pump prices changed anywhere close to that monthly rate it was June 2009 when the world was just coming off the absolute trough of the Great “Recession.” Before that, you have to look at June 2008 for when oil was already high and then went a lot higher (11% more than May 2008). That latter comparison may be why consumer price expectations from among consumers keep working out the way they have. According to any number of mainstream surveys, when asked about their short run perceptions, Americans reflect upon mostly energy prices, meaning gasoline, when formulating their picture of what overall prices could be a year ahead. |

|

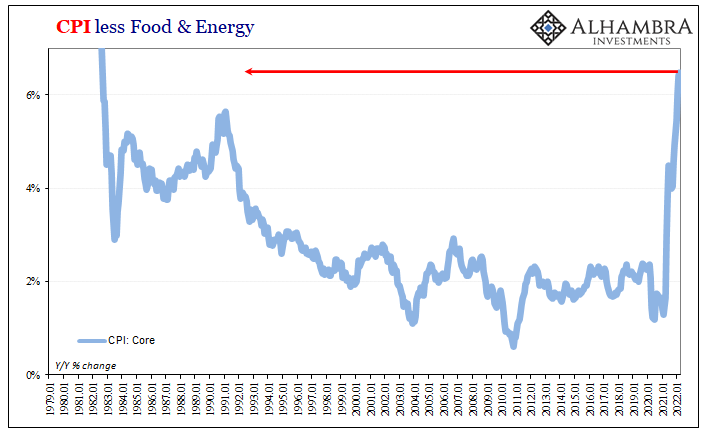

| Using the Federal Reserve Bank of New York’s panel series, for example, in this same month of March 2022 the median 1-year ahead expected consumer price increase jumped up to 6.6% from a flat 6.0% in February (above) in exactly the way anyone would expect of any broad survey of short run expectations.But, you’ll notice, that’s already less than the headline CPI which you’ve undoubtedly already heard hit another stinging 40-year high of 8.54%. In other words, even during the month when already-painful gasoline prices skyrocketed by almost another fifth, most consumers still expect consumer prices to be rising at a meaningfully lesser rate by next year anyway.

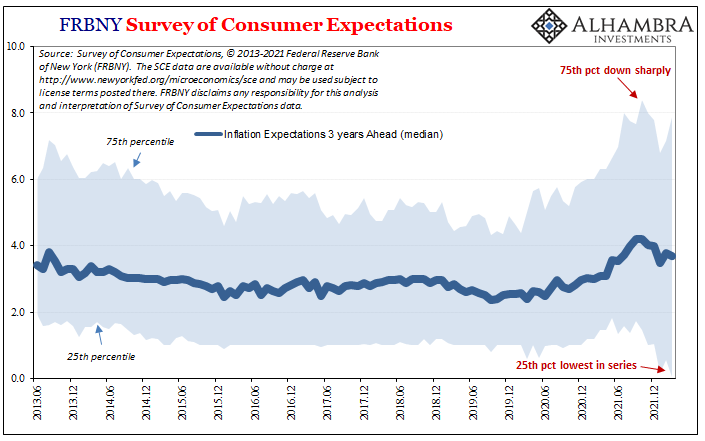

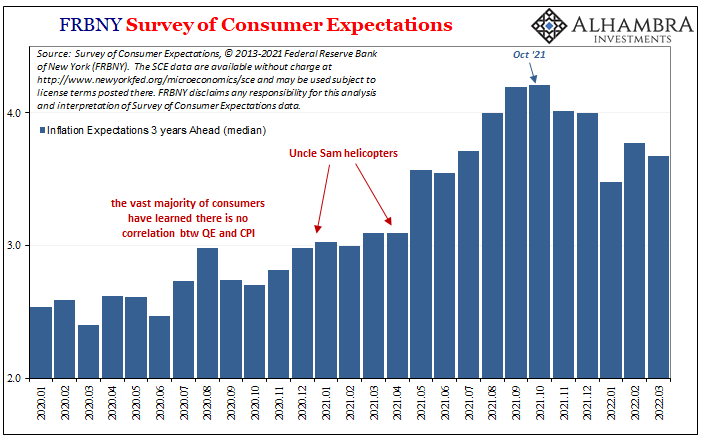

Still high, but why not as high or higher? The further you go in time (again, it doesn’t matter which survey), the less consumers expect from “inflation.” Sticking with FRBNY’s estimates, the 3-year ahead expectation actually fell slightly in March, already down substantially from its peak last October (below). |

|

| What reason for the decline? Another record low for how many at the bottom end of the survey range are really starting to think consumer price increases could very well disappear entirely during that stretch.

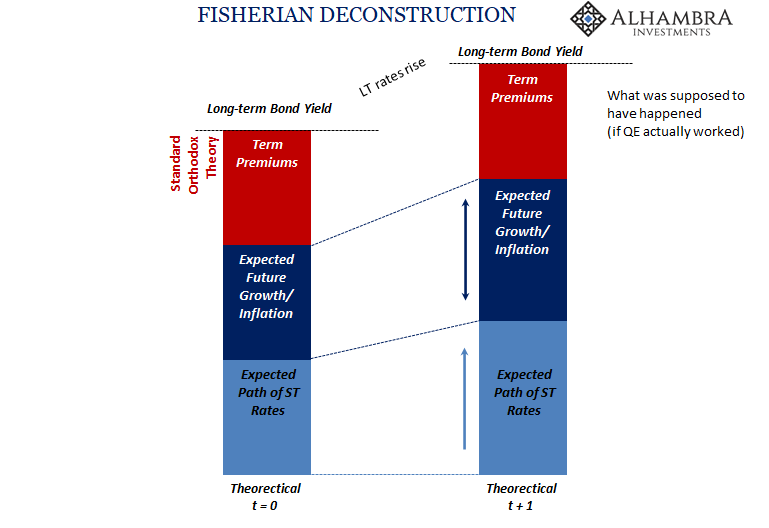

If the possibility sounds familiar, it really should. This, not 70s-style Great Inflation 2.0, is actually the vast majority of public, market, and rational sentiment. And I know what you’re thinking; those (humans) running the Fed (never straying from its regression models) have been perfectly clear about rate hikes, their professed need to stamp out inflation pressures before expectations become “unanchored” and it really does (according to this theory) turn into an unrelenting inflationary spiral (which is not how inflation works). |

|

| Yet, here is their very own data indicating the opposite. Either consumers are really, truly confident in those rate hikes’ collective ability to scale down price increases, or consumers are like bond market participants betting and believing something else more likely will. After all, it’s not as if the FOMC’s coming fifties are going send empty shipping containers from Long Beach back to China.

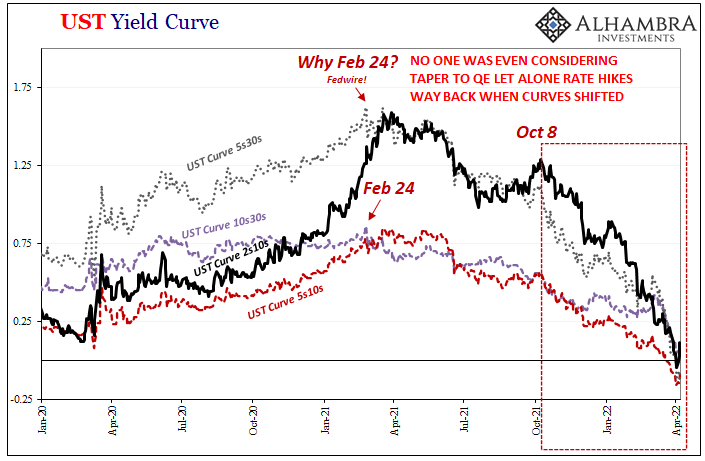

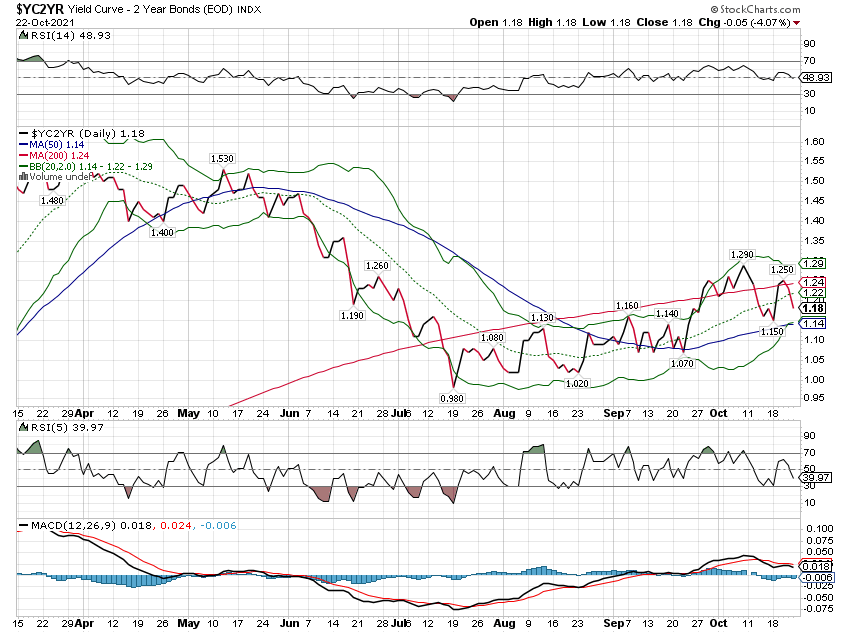

Demand destruction. There is what is right now a very small chance such a possibility may already be in the March 2022 CPI numbers. Rather than pile higher as yields have done recently, and you can hear the always-thorough Mike Green explain his view about why that’s been the case on the Eurodollar University podcast, today, at least, the yield curve steepened and un-inverted a bit more than it had over the past week. But it was the “wrong” kind of un-inversion steepening, the bad steepening, where front end rates fell more than they did in the back. On the day the CPI was released. |

|

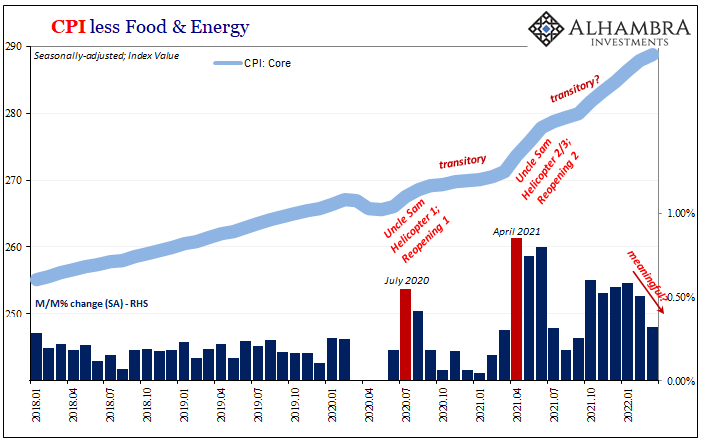

| In terms of the CPI specifically, this was likely the work of the “core” rate which while reaching its own four-decade annual high (second above), it was only a few bps higher than February’s and potentially more important the monthly increase in March from February was the least in six months (immediately above).

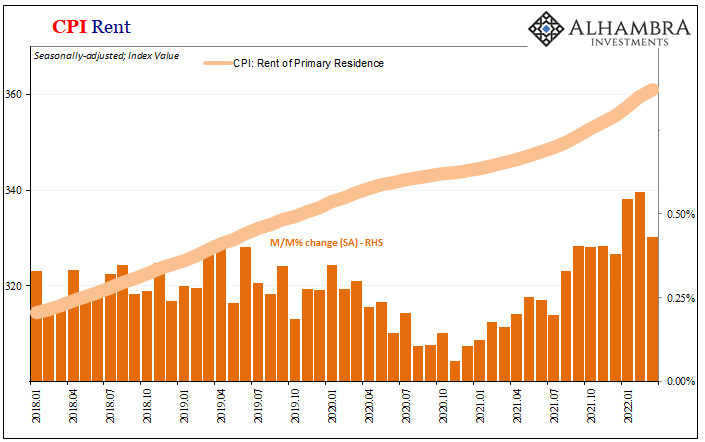

In fact, the month-over-month change of 0.32% was downright ordinary despite everything else said about “inflation” given the full set. While maybe just a one-month reprieve, even rent price gains took a tiny step lower at the same time used car prices actually declined, on average, the second month in a row. |

|

| None of those conclusive prove anything, of course, but right now it’s the suggestion about what it could potentially mean in a short run of otherwise overwrought “inflation” given the longer run expectations from consumers and markets which continue to see an eventual light at the end of the transitory tunnel. And you know what they say when you think you see that light; be careful it isn’t from an onrushing freight train.There’s a whole lot of certainty the supply shock will come to an end even if no one can yet say when. The problem, as expressed in the coincident timing and distortion of market curves like longer run consumer price expectations, is just how it is likely to come to an end. | |

| The CPI data, despite its attention-grabbing headline, didn’t do much to disprove that possibility. A couple more months like this one, even the Fed’s much-publicized, highly-political rate hikes would then fall under the same suspicion. |

Tags: Bonds,consumer expectations,Consumer Prices,CPI,currencies,economy,Featured,Federal Reserve/Monetary Policy,inflation,inflation expectations,Markets,newsletter,rate hikes,Yield Curve