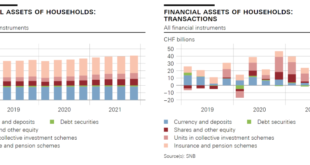

The Swiss National Bank is today publishing financial accounts data for Q4 2021. Data on household wealth are thus available for the whole of 2021; a commentary is provided below. This is followed by a detailed look at the development of the financial net worth of the Swiss economy’s institutional sectors since the onset of the coronavirus pandemic. Financial wealth of households increased significantly in 2021 Household financial assets increased by CHF 202 billion...

Read More »Andréa M. Maechler / Thomas Moser: Life after Libor: A new era of reference interest rates

A new era of reference interest rates began at the start of this year. Libor, which had been the key reference rate for several decades and several currencies, including the Swiss franc, ceased to exist in many currencies at the end of 2021. SARON has now fully replaced Swiss franc Libor. This speech explains why reference rates play a central role in financial markets and discusses the circumstances under which some interest rates either achieve or lose reference...

Read More »Swiss National Bank renews its commitment to adhere to the FX Global Code

The Swiss National Bank (SNB) has renewed the Statement of Commitment to the FX Global Code based on the revised version of the Code dated July 2021. By signing this Statement, the SNB attests that its internal processes are consistent with the principles of the FX Global Code. The SNB also expects its regular counterparties to comply with the agreed rules of conduct. The FX Global Code sets out principles of good practice in the foreign exchange market. It was first...

Read More »Swiss National Bank proposes reactivation of sectoral countercyclical capital buffer at 2.5%

After consultation with the Swiss Financial Market Supervisory Authority (FINMA), the Swiss National Bank has submitted a proposal to the Federal Council requesting that the sectoral countercyclical capital buffer (CCyB) be reactivated. The buffer is to be set at 2.5% of risk-weighted exposures secured by residential property in Switzerland (cf. appendix). The SNB’s proposal envisages a deadline for compliance with the increased CCyB requirements of 30 September...

Read More »BIS, SNB and SIX successfully test integration of wholesale CBDC settlement with commercial banks

Project Helvetia looks toward a future with more tokenised financial assets based on distributed ledger technology coexisting with today’s systems. Swiss National Bank and five commercial banks integrated wholesale CBDC in their existing back-office systems and processes. Tests covered a wide-range of transactions in Swiss francs – interbank, monetary policy and cross-border. Integrating a wholesale central bank digital currency (CBDC) into existing core banking...

Read More »Swiss National Bank expects annual profit of around CHF 26 billion for 2021

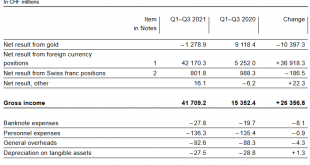

Confederation and cantons to receive distribution of CHF 6 billion According to provisional calculations, the Swiss National Bank will report a profit in the order of around CHF 26 billion for the 2021 financial year. The profit on foreign currency positions amounted to just under CHF 26 billion. A valuation loss of CHF 0.1 billion was recorded on gold holdings. The net result on Swiss franc positions amounted to over CHF 1 billion. The allocation to the provisions...

Read More »Swiss balance of payments and international investment position: Q3 2021

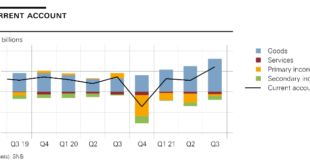

In the third quarter of 2021, the current account surplus amounted to CHF 24 billion, CHF 10 billion more than in the same quarter of 2020. The increase was mainly attributable to the significantly higher receipts surplus in goods trade. This surplus was due to traditional goods trade (foreign trade total 1), non-monetary gold trading, as well as to merchanting. Primary income counteracted the rise in the current account balance. While a receipts surplus was...

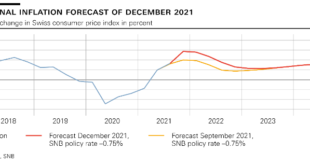

Read More »Monetary policy assessment of 16 December 2021: Swiss National Bank maintains expansionary monetary policy

The SNB is maintaining its expansionary monetary policy. It is thus ensuring price stability and supporting the Swiss economy in its recovery from the impact of the coronavirus pandemic. It is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and remains willing to intervene in the foreign exchange market as necessary, in order to counter upward pressure on the Swiss franc. In so doing, it takes the overall currency situation into...

Read More »Swiss National Bank, Banque de France and BIS conclude successful cross-border wholesale CBDC experiment

Central bank digital currencies (CBDCs) can be used effectively for international settlements between financial institutions, as shown in the newest wholesale CBDC experiment concluded by the Swiss National Bank (SNB), the Banque de France (BdF) and the Bank for International Settlements (BIS). The recently completed Project Jura explored settling foreign exchange (FX) transactions in euro and Swiss franc wholesale CBDCs as well as issuing, transferring and redeeming...

Read More »Interim results of the Swiss National Bank as at 30 September 2021

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Low Inflation, Crashes and Central Bank Money Printing The crisis caused by the Covid19 virus,is a typical crisis with low inflation (at least for now). During such a crisis, central bank money...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org