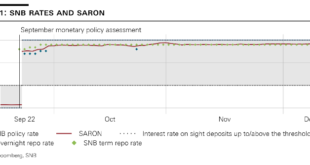

In my remarks, I will talk in more detail about the implementation of today’s monetary policy decision, which Thomas Jordan has already touched on. I will start, however, by giving you an overview of how we have steered interest rates since the switch to a positive SNB policy rate in September. The switch from a negative to a positive SNB policy rate required us to make an adjustment to the implementation of our monetary policy in the money market. The new approach...

Read More »Monetary policy assessment of 15 December 2022

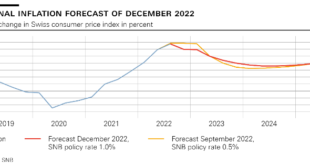

Swiss National Bank tightens monetary policy further and raises SNB policy rate to 1.0% The SNB is tightening its monetary policy further and is raising the SNB policy rate by 0.5 percentage points to 1.0%. In doing so, it is countering increased inflationary pressure and a further spread of inflation. It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term. To provide appropriate monetary...

Read More »Issuance calendar for Confederation bonds and money market debt register claims in 2023

The Swiss National Bank (SNB) and the Federal Finance Administration (FFA) advise as follows: The FFA plans to issue bonds with a face value of CHF 8 billion in 2023. Taking account of bonds maturing in 2023, the volume of bonds outstanding will increase by CHF 3.4 billion. The volume of outstanding money market debt register claims will be kept in a range between CHF 12 billion and 18 billion. Bond auctions take place monthly, except in August, while money market...

Read More »Andréa M. Maechler / Thomas Moser: Return to positive interest rates: Why reserve tiering?

Ladies and gentlemen It is with great pleasure that my colleague Thomas Moser and I welcome you to this year’s Swiss National Bank (SNB) Money Market Event in Geneva. We are very glad that so many of you have joined us this evening, be it on site or remotely. Since we last met in this setting a year ago, fighting inflation has become the most important task for central banks worldwide. Many countries have experienced a surge in inflation, the scale and pace of which...

Read More »Swiss National Bank, Banque de France, Monetary Authority of Singapore and BIS Innovation Hub to explore cross-border trading and settlement of wholesale CBDCs using DeFi protocols

Project Mariana explores automated market makers (AMM) for the cross-border exchange of hypothetical central bank digital currencies (CBDCs) in Swiss francs, euros and Singapore dollars between financial institutions to settle foreign exchange trades in financial markets. Mariana uses decentralised finance (DeFi) protocols to automate foreign exchange markets and settlement, potentially improving cross-border payments (and supporting a priority of the G20). Today,...

Read More »Turnover in foreign exchange and derivatives markets in Switzerland

BIS Triennial Survey: April 2022 survey The SNB has today published the results of the survey on turnover in foreign exchange and over-the-counter (OTC) derivatives markets in Switzerland. The data reflect the turnover in April 2022 of the banks surveyed. The survey is part of a global survey coordinated by the Bank for International Settlements (BIS) on foreign exchange and OTC derivatives trading. It is conducted every three years and in over 50 countries. This is...

Read More »Thomas Jordan: Current challenges to central banks’ independence

In the recent past, the political and economic backdrop has changed dramatically. Inflation is far too high almost everywhere, and central banks are raising their policy interest rates at a time when stocks of government debt are large. In some places, central bank independence is being publicly called into question. Threats to central banks’ independence, and thus to their ability to fulfil their monetary policy mandates, are particularly acute in the current...

Read More »Publication on the centenary of the Swiss National Bank’s main building in Zurich: The Pfister Building 1922-2022

To mark the centenary of the Swiss National Bank’s main building at Börsenstrasse 15, the SNB is publishing ‘The Swiss National Bank in Zurich: The Pfister Building 1922-2022’ (Verlag Scheidegger & Spiess). The volume showcases the architecture and documents the construction history of the building from its planning to the present day, including the structural adjustments made to meet changing requirements. It also sheds light on the rise of Zurich as a...

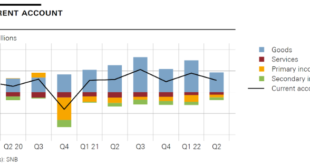

Read More »Swiss Balance of Payments and International Investment Position: Q2 2022

Overview In the second quarter of 2022, the current account surplus was CHF 11 billion, almost CHF 1 billion lower than in the same quarter of 2021. The receipts surplus in goods trade, especially merchanting and traditional goods trade (foreign trade total 1), declined. The expenses surpluses in services trade, primary income and secondary income were each lower than in the same quarter of 2021. . In the financial account, reported transactions recorded a net...

Read More »Thomas Jordan: Sixth Karl Brunner Distinguished Lecture – Introduction of Benjamin M. Friedman

Ladies and Gentlemen I am very pleased to welcome you all to the sixth Karl Brunner Distinguished Lecture. The Swiss National Bank established this annual lecture series in honour of the Swiss economist Karl Brunner, one of the leading monetary economists of the last century. Our aim with these lectures is to reach a broad audience, and to contribute to the public debate on issues related to central banking and economics more broadly. This year’s Karl Brunner...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org