Ladies and Gentlemen I welcome you all to the ceremony of the Carl Menger Award, given by the Verein für Socialpolitik. I do so in the name of the sponsors of the award, namely the Deutsche Bundesbank, the Oesterreichische Nationalbank and the Swiss National Bank, as well as on behalf of the selection committee. This important award is given in recognition of outstanding research work relating to monetary economics and monetary policy. The city selected as the venue...

Read More »Thomas Jordan: Monetary policy under new constraints: challenges for the Swiss National Bank

The pandemic and the war in Ukraine have fundamentally changed the constraints on monetary policy. Uncertainty has increased strongly in many respects, and there has been a sharp rise in inflation. In June 2022, the SNB raised its policy rate for the first time in 15 years and announced that further increases may be necessary in the foreseeable future. The decision was taken against a backdrop of high uncertainty. Interpreting the current data is difficult,...

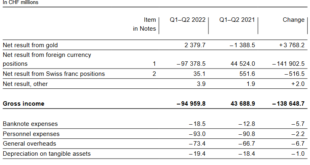

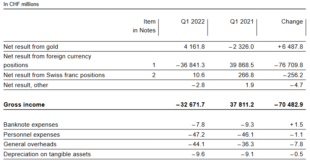

Read More »Interim results of the Swiss National Bank as at 30 June 2022

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Low Inflation, Crashes and Central Bank Money Printing The crisis caused by the Covid19 virus,is a typical crisis with low inflation (at least for now). During such a crisis, central bank money...

Read More »Confederation and SNB facilitate exchange of Ukrainian currency at Swiss commercial banks

Together with the Federal Department of Finance (FDF) and Swiss commercial banks, the SNB has developed a solution to enable individuals with protection status S to exchange Ukrainian banknotes for Swiss francs up to a limited amount. As of 27 June 2022, adults with protection status S will be able to make a one-off exchange of up to UAH 10,000 at selected UBS and Credit Suisse branches. This currently corresponds to a value of approximately CHF 300. The exchange...

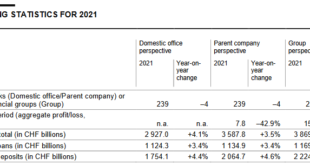

Read More »Annual banking statistics for 2021

The Swiss National Bank has today published data on the annual financial statements of banks in Switzerland for the 2021 financial year. For the first time, the published data also comprises bank office data (Domestic office perspective) in addition to the data from individual financial statements (Parent company perspective) and consolidated financial statements (Group perspective). The Domestic office perspective shows data on the business of banks including their...

Read More »Fritz Zurbrügg: Introductory remarks, news conference

In my remarks today, I will present the key findings from the new Financial Stability Report, published this morning by the Swiss National Bank. Economic environment In the period between the publication of the last Financial Stability Report and the end of 2021, economic and financial conditions for the Swiss banking system remained favourable. GDP has returned to, or even exceeded, pre-crisis levels in most countries and unemployment rates have receded globally....

Read More »Тhomas Jordan: Introductory remarks, news conference

Ladies and gentlemen It is my pleasure to welcome you to the Swiss National Bank’s news conference. In my remarks, I will begin by explaining our monetary policy decision and our assessment of the economic situation. After that, Fritz Zurbrügg will present the key messages from this year’s Financial Stability Report. Andréa Maechler will then comment on the situation on the financial markets and the implementation of monetary policy. We will – as ever – be pleased to...

Read More »Andréa M. Maechler: Introductory remarks, news conference

I will begin my remarks with a review of developments on the financial markets over the past half-year. I would then like to discuss the lowering of the threshold factor mentioned by Thomas Jordan. Situation on the financial markets Volatility on the financial markets has increased again significantly since the beginning of the year (cf. chart 1). This was driven by the sharp rise in inflation abroad and by attendant expectations regarding a speedier tightening of...

Read More »SNB Governing Board: Federal Council appoints Martin Schlegel as Vice Chairman of the Governing Board

Petra Gerlach and Attilio Zanetti become Alternate Members of the Governing Board At its meeting of 4 May 2022, the Federal Council appointed Martin Schlegel as Vice Chairman of the Governing Board of the Swiss National Bank with effect from 1 August 2022. He will succeed Fritz Zurbrügg on the Governing Board when the latter steps down at the end of July 2022. Martin Schlegel has been a member of the Enlarged Governing Board and Deputy Head of Department I since 1...

Read More »Interim results of the Swiss National Bank as at 31 March 2022

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Low Inflation, Crashes and Central Bank Money Printing The crisis caused by the Covid19 virus,is a typical crisis with low inflation (at least for now). During such a crisis, central bank money...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org