Swiss National Bank tightens monetary policy further and raises SNB policy rate to 1.5% The SNB is tightening its monetary policy further and is raising the SNB policy rate by 0.5 percentage points to 1.5%. In doing so, it is countering the renewed increase in inflationary pressure. It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term. To provide appropriate monetary conditions, the SNB also remains willing to be active in the foreign exchange market as necessary. For some quarters now, the focus has been on selling foreign currency. The SNB policy rate change applies from tomorrow, 24 March 2023. Banks’ sight deposits held at the SNB will be remunerated at the SNB policy rate of 1.5%

Topics:

Swiss National Bank considers the following as important: 1.) SNB Press Releases, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss National Bank tightens monetary policy further and raises SNB policy rate to 1.5%

The SNB is tightening its monetary policy further and is raising the SNB policy rate by 0.5 percentage points to 1.5%. In doing so, it is countering the renewed increase in inflationary pressure. It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term. To provide appropriate monetary conditions, the SNB also remains willing to be active in the foreign exchange market as necessary. For some quarters now, the focus has been on selling foreign currency.

The SNB policy rate change applies from tomorrow, 24 March 2023. Banks’ sight deposits held at the SNB will be remunerated at the SNB policy rate of 1.5% up to a certain threshold. Sight deposits above this threshold will be remunerated at an interest rate of 1.0%, and thus still at a discount of 0.5 percentage points relative to the SNB policy rate.

The past week has been marked by the events surrounding Credit Suisse. The measures announced at the weekend by the federal government, FINMA and the SNB have put a halt to the crisis. The SNB is providing large amounts of liquidity assistance in Swiss francs and foreign currencies. These loans are secured and subject to interest.

| Inflation has risen again since the beginning of the year, and stood at 3.4% in February. It is therefore still clearly above the range the SNB equates with price stability. The latest rise in inflation is principally due to higher prices for electricity, tourism services and food. However, price increases are now broad-based.

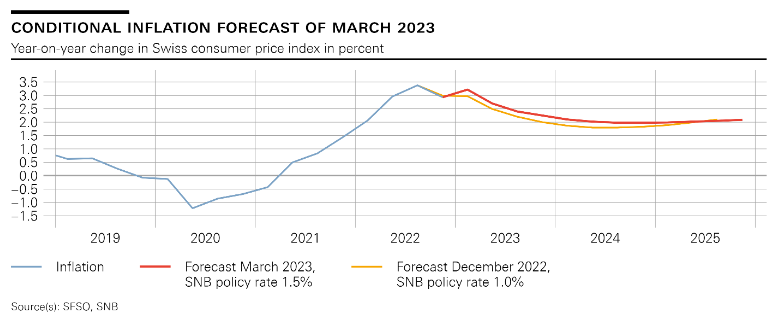

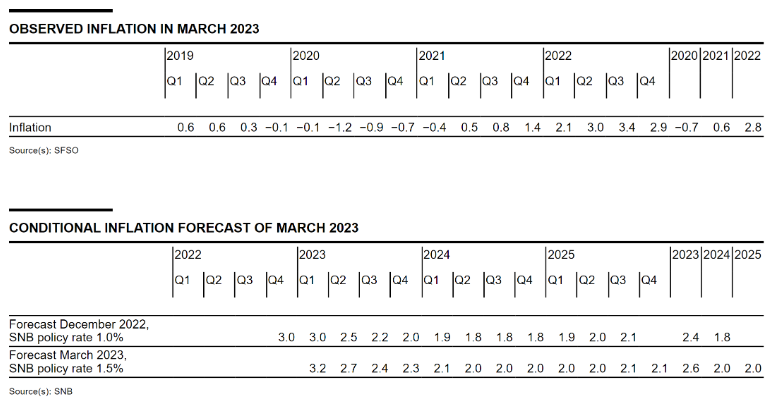

The SNB’s new conditional inflation forecast is based on the assumption that the SNB policy rate is 1.5% over the entire forecast horizon (cf. chart 1). Stronger second-round effects and the fact that inflationary pressure from abroad has increased again mean that, despite the raising of the SNB policy rate, the new forecast is higher through to mid-2025 than in December. The new forecast puts average annual inflation at 2.6% for 2023, and 2.0% for 2024 and 2025 (cf. table 1). At the end of the forecast horizon, inflation stands at 2.1%. Without today’s policy rate increase, the inflation forecast would be even higher over the medium term. The global economy hardly grew in the fourth quarter, while in many countries inflation remained clearly above central banks’ targets. Against this background, numerous central banks have tightened their monetary policy further. |

|

| The growth outlook for the global economy in the coming quarters remains subdued. At the same time, inflation is likely to remain elevated worldwide for the time being. Over the medium term, however, it should return to more moderate levels, not least thanks to monetary policy and due to the economic slowdown. This scenario for the global economy is subject to significant risks, in particular due to the recent turmoil in the global financial sector.

Swiss GDP stagnated in the fourth quarter. The services sector lost momentum, and value added in manufacturing declined slightly again. For 2022 as a whole, GDP grew by 2.1%. The labour market remained robust, and overall production capacity has been well utilised. Despite the slight upturn in economic activity in recent months, growth is likely to remain modest for the rest of the year. The subdued demand from abroad and the loss of purchasing power due to inflation are having a dampening effect. Overall, GDP is likely to increase by around 1% this year. Unemployment should remain at a low level, and the utilisation of production capacity is likely to decline somewhat. The forecast for Switzerland, as for the global economy, is subject to high uncertainty. In the short term, the main risks are an economic downturn abroad and adverse effects of the turmoil in the global financial sector. Mortgage growth has remained largely stable in recent months, whereas there are signs of a slowdown in residential real estate prices. The vulnerabilities on the mortgage and real estate More detailed information on the monetary policy decision can be found in the introductory remarks of the Governing Board. |

Tags: Featured,newsletter