USD/CHF holds on to recovery gains above 100-day SMA amid increasing hopes of the US-China trade deal. Comments from Fed’s Daly add to the pair’s strength. The US PMIs, JOLTS Job Openings to decorate the economic calendar while trade/Brexit headlines will mostly drive risk-tone. In addition to increasing hopes of an initial trade deal between the US and China, broad US Dollar (USD) strength also helps USD/CHF to take the bids near 0.9885 during the initial Asian session on Tuesday. While comments from the United States (US) diplomats set the initial risk-on sentiment during Monday, China’s consideration to send the President Xi Jinping for the “Phase One” boosted the odds that the world’s largest economies are closer to the much-awaited trade deal. Recently, the

Topics:

Anil Panchal considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- USD/CHF holds on to recovery gains above 100-day SMA amid increasing hopes of the US-China trade deal.

- Comments from Fed’s Daly add to the pair’s strength.

- The US PMIs, JOLTS Job Openings to decorate the economic calendar while trade/Brexit headlines will mostly drive risk-tone.

In addition to increasing hopes of an initial trade deal between the US and China, broad US Dollar (USD) strength also helps USD/CHF to take the bids near 0.9885 during the initial Asian session on Tuesday.

While comments from the United States (US) diplomats set the initial risk-on sentiment during Monday, China’s consideration to send the President Xi Jinping for the “Phase One” boosted the odds that the world’s largest economies are closer to the much-awaited trade deal. Recently, the Financial Times (FT) headlines indicate that the US administration is ready to turn down some of the previous tariffs, as spotted by the Politico as the key hurdle for the recent optimism. Also, comments from the US President Donald Trump signal that China wants the deal badly and both the parties are close to the trade agreement.

On the other hand, greenback buyers cheered Friday’s upbeat jobs report and an absence of any major negatives, except for weaker than anticipated Factory Orders. The pair’s recovery gained additional momentum after the San Francisco Fed’s Mary C Daly praised the US fundaments while also citing the need to slightly accommodative monetary policy.

Given the positive risk sentiment, the US 10-year treasury yields stay positive around Monday’s close, which gained 6 basis points by the day-end, whereas S&P 500 Futures also pleases buyers.

Moving, September JOLTS Jobs Openings will be closely followed to confirm recent optimism surrounding the US employment data while Purchasing Managers Index (PMI) numbers from ISM and Markit could keep traders entertained.

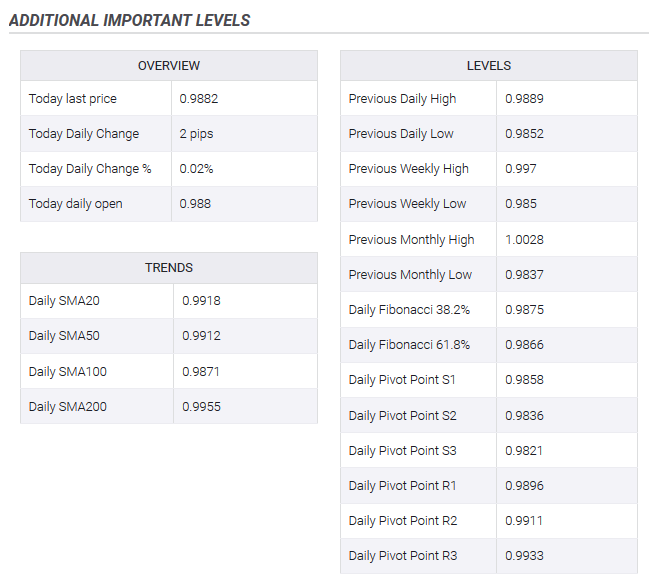

Technical Analysis21-day Simple Moving Average (SMA) near 0.9916 and a late-October high around 0.9970 can keep pair’s near-term upside capped while pair’s declines below September month low around 0.9837 could increase risk of breaking 0.9800 round-figure. |

Tags: Featured,newsletter,USD/CHF