Gold Gives You Personal Sovereignty

Gold Gives You Personal Sovereignty

2022-03-09

Dave Lukas of Misfit Entrepreneur invites Stephen Flood, CEO of GoldCore, to the show. Dave and Stephen talk about what people should know before investing in gold and silver, the present state of inflation, central banking, and the monetary system.

Further, he explains why gold is still your safe-haven asset and how it provides you with personal sovereignty. They also talk about cryptocurrencies and their future.

Stephen also discusses some of the lessons he’s learned along the route to being a successful entrepreneur.

Click Below to Listen to the Podcast

Download Your Essential Checklist

The Truth About The National DebtWatch David M Walker Only on GoldCore TV

GOLD PRICES (USD, GBP & EUR – AM/ PM LBMA Fix)

07-03-2022 1999.25 1980.95 1520.63 1505.52

SWIFT Ban: A Game Changer for Russia?

SWIFT Ban: A Game Changer for Russia?

2022-03-04

As part of the sanctions against Russia, seven Russian banks have been cut off from SWIFT.

We start by discussing what SWIFT is, and then the implications of completely cutting Russia out of SWIFT.

What is SWIFT and Why Russia is Being Excluded

SWIFT – The Society for Worldwide Interbank Financial Telecommunication is a messaging system that links more than 11,000 banks in 200 countries.

The system doesn’t move actual money between the banks but transmits messages between banks with instructions to settle transactions.

Additionally, this system is crucial to the international trade system – without it, countries wouldn’t be able to settle trade transactions between countries.

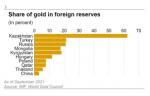

The bar charts in the graphic from the Wall Street Journal below illustrate the growth

Central Banks’ record gold stockpiling

Central Banks’ record gold stockpiling

2022-01-22

According to recently released data by the World Gold Council (WGC), as of September 2021, the total amount of gold held in reserves by central banks globally exceeded 36,000 tons for the first time since 1990. This 31-year record was the result of the world’s central banks adding more that 4,500 tons of the precious metal to their holdings over the last decade and it provides ample support for the investment case for gold, in both directly performance-related terms, but also from a big picture perspective.

Lessons from 2021: The rational way out

Lessons from 2021: The rational way out

2021-12-27

As we are all preparing to bid farewell to 2021, there is a general feeling that this year, much like its predecessor, will not be missed. To my mind, however, it is clear that even though the past 12 months didn’t really teach us anything new, they did help cement the lessons of 2020 and spread important ideas to people who might otherwise have never come to question anything about the status quo.

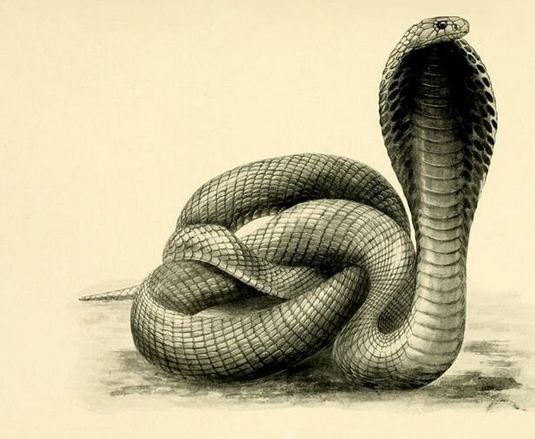

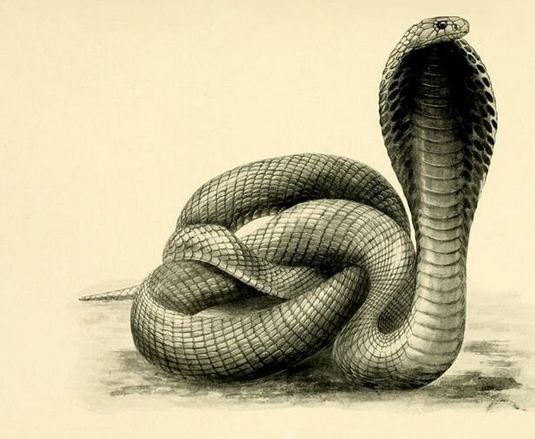

Government interventions and the Cobra effect – Part II

Government interventions and the Cobra effect – Part II

2021-12-03

Of course, one of the most important and consequential parts of the incredibly complex organism that is the economy is money itself. It is its lifeblood and as the song goes, “it makes the world go round”. Therefore, manipulating the currency itself is one the most dangerous and hubristic things a central planner can do, which probably explains why it’s their favorite pastime.

Government interventions and the Cobra effect – Part I

Government interventions and the Cobra effect – Part I

2021-12-02

Almost two decades ago, German economist Horst Siebert coined the term the “Cobra effect” to describe the real-world consequences of “well-intentioned” government interventions that go awry and produce the exact opposite results from what they aim for.

Corruption of the currency and decivilization – Part II

Corruption of the currency and decivilization – Part II

2021-11-03

Many rational economists and students of history have written countless analyses on the gold standard and the terrible impact that its end has had on the world economy. However, as the Fall of Rome clearly demonstrates, the implications of the introduction of the fiat money system and of the limitless manipulation of the currency by the State reach much further.

50 years since the closure of the “gold window”

50 years since the closure of the “gold window”

2021-10-09

President Nixon’s unilateral decision to sever the last link between the dollar and gold had wide ranging and long lasting consequences for the global economy and for the entire monetary system. The end of sound money facilitated and accelerated the concentration of power at the top and the ability to manipulate the currency allowed politicians and central planners to further expand the state’s reach and push ahead with populist, reckless and wasteful policies.