Share this article It’s hard to imagine where we would be today in terms of economic progress, industrial production capacity and labour dynamics if Henry Ford never existed. The revolutionary system he pioneered in the early 20th century, largely known for implementing the concept of the “assembly line” (which, notably, was actually invented by Ransom Eli Olds, and merely popularized by Ford), forever changed the way companies thought about production processes. It massively increased...

Read More »“Does The West Have Any Hope? What Can We All Do?”

Share this article Interview with Godfrey Bloom I recently had the great pleasure of being interviewed by my good friend Godfrey Bloom, whose point of view and sharp assessment skills of economic and political events I have consistently found illuminating throughout the years. It’s always extremely refreshing talking to Godfrey, because his questions cut through the noise and concentrate on what is actually important. I find his views and arguments are also deeply thought...

Read More »Predictions vs. Convictions

Share this article Separating the signal from the noise Most regular readers and friends will undoubtedly already know what my position is in regards to projections and forecasts. For many years, I have consistently maintained that any and all attempts to “time the market” are as useless as they are unrealistic and I have always urged all responsible and rational investors to be extremely wary and suspicious of anyone that claims they can accurately predict market behavior. Innumerable...

Read More »Swissgrams: the natural progression of the Krugerrand in the digital age

Share this article Having worked in the precious metals industry for decades, I have had countless opportunities to have very honest and very enlightening conversations with numerous investors and partners alike. For many years, I’ve been discussing the challenges, the hurdles and the problems they’ve encountered. The details of each story I’ve heard might be as unique as the person who shared it with me, however, most of these accounts have a common denominator. Nearly all of them revolve...

Read More »Year in review: A tectonic shift has only just begun

Share this article As we’re approaching the final hours of 2024, it is a good time to take a step back and remember what this year taught us. History might not repeat itself, but it does rhyme, as the saying goes, and the past is always the best teacher to prepare us for the future. For many of our fellow humans, 2024 was yet another turbulent year, filled with terrible strife, war, death, pain and indescribable suffering. The two ongoing war fronts and the images that reach us all...

Read More »“THE BIG BULL MARKET IN GOLD AND SILVER HAS ONLY JUST BEGUN”

Share this article DR. THORSTEN POLLEIT (WWW.BOOMBUSTREPORT.COM) INTERVIEWS CLAUDIO GRASS Thorsten Polleit (TP): On November 5, 2024, Donald J. Trump was elected the new U.S. president with a landslide victory. His declared goal is to take on the “Deep State” and its bureaucracy. His advisor, Elon Musk, is urging the reduction of national debt, and even the inflationary Federal Reserve (Fed) has become a target, described as an evil that must be healed. Is all...

Read More »“THE BIG BULL MARKET IN GOLD AND SILVER HAS ONLY JUST BEGUN”

Share this article DR. THORSTEN POLLEIT (WWW.BOOMBUSTREPORT.COM) INTERVIEWS CLAUDIO GRASS Thorsten Polleit (TP): On November 5, 2024, Donald J. Trump was elected the new U.S. president with a landslide victory. His declared goal is to take on the “Deep State” and its bureaucracy. His advisor, Elon Musk, is urging the reduction of national debt, and even the inflationary Federal Reserve (Fed) has become a target, described as an evil that must be healed. Is all this just early enthusiasm,...

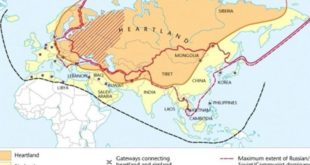

Read More »The Heartland theory: More relevant than ever?

Share this article Sir Halford Mackinder’s famous Heartland Theory was first formulated in the early 20th century, but it holds renewed relevance and importance today, especially when analyzed though a critical lens of the current geopolitical system, one that emphasizes individual freedom, limited government intervention, and skepticism of centralized power. Mackinder’s theory posits that control over the “Heartland” — roughly the region of Eastern Europe and Central Asia — grants...

Read More »The Heartland theory: More relevant than ever?

Share this article Sir Halford Mackinder’s famous Heartland Theory was first formulated in the early 20th century, but it holds renewed relevance and importance today, especially when analyzed though a critical lens of the current geopolitical system, one that emphasizes individual freedom, limited government intervention, and skepticism of centralized power. Mackinder’s theory posits that control over the “Heartland” — roughly the region of Eastern Europe and...

Read More »Gold climbing from record high to record high: why buy now?

Share this article Part II of II Business as usual” will simply not cut it anymore. The “print and spend” policies of the past, the QE lifelines, the liquidity injections, the zero and negative interest rates, the blatant debasement of the currency, the market manipulation and all the direct and indirect bailouts will not work as they did before. And it’s not only because the central bankers have overused these “weapons” and have by now exhausted all their...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org