Overview: Most equity markets in the Asia Pacific region lost ground today. China’s Shenzhen, Hong Kong, and India were notable exceptions. The MSCI Asia Pacific Index is at its lowest level since June 2020. Europe’s Stoxx 600 is forging a base ahead of 4000 and is trading quietly with a small upside bias. The French stock market lagging after Macron lost his parliamentary majority, is raising questions about his reform agenda. US equity futures are firm, but the cash market is closed today. European bond yields are narrowly mixed, though French bonds are underperforming, and the 10-year yield is around three basis points higher. The US dollar is trading with a lower bias against all the major currencies. Sterling is the weakest and is practically flat. The

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of Japan, China, Colombia, Currency Movement, Featured, Federal Reserve, France, newsletter, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Overview: Most equity markets in the Asia Pacific region lost ground today. China’s Shenzhen, Hong Kong, and India were notable exceptions. The MSCI Asia Pacific Index is at its lowest level since June 2020. Europe’s Stoxx 600 is forging a base ahead of 4000 and is trading quietly with a small upside bias. The French stock market lagging after Macron lost his parliamentary majority, is raising questions about his reform agenda. US equity futures are firm, but the cash market is closed today. European bond yields are narrowly mixed, though French bonds are underperforming, and the 10-year yield is around three basis points higher. The US dollar is trading with a lower bias against all the major currencies. Sterling is the weakest and is practically flat. The Norwegian krone’s 1.2% gain leads the majors followed by the Australian and New Zealand dollars. Most emerging market currencies are also firmer, led by central Europe. Gold is consolidating quietly around $1840. August WTI is in a narrow range below $110. US natgas is extending last week's 21.5% collapse. It is off another 2.3% today. Europe’s natgas benchmark exploded almost 48% last week and is up another 3.5% today. Iron ore's precipitous drop is also extending. It fell 14% last week and is off another 7.6% today, its eighth consecutive losing session. July copper is off for a third session. It is down about 1% today after falling nearly 10.5% over the past two weeks.

Asia Pacific

As widely expected, China's loan prime rates were held steady at 3.70% and 4.45% for the one-year and five-year rates, respectively. Meanwhile, China's recovery from the Covid lockdowns is spotty, but sufficient to embolden investors and helping Chinese stocks outperform lately. However, the first reported Covid cases in Macau in several months weighed on casino shares. Separately, reports suggest that around a third of China's oil refining capacity is off-line due to Covid restrictions. That said, some reports suggest a rebound in car sales, higher oil refinery run rates, and a rising in trucking transport suggest the nascent recovery remains intact.

The Bank of Japan bought a massive amount of Japanese government bonds last week to defend its 0.25% cap on the 10-year. The BOJ added almost $81 bln of bonds to its balance sheet. It disrupted both the cash and futures market last week. Reports suggest that a personnel shift has also bolstered its efforts and market contacts. For dollar-based investors, the paltry 10-year JGB yield of 0.24% can earn closer to 2.65% if the yen is hedged back into dollars. Still, foreigners have been sellers and year-to-date (through June 10) have sold about JPY2 trillion (~$14.8 bln) of Japanese bonds. The economic highlight of the week is the May CPI figures due first thing Friday in Tokyo. The Bloomberg survey shows a median forecast of no change, leaving the year-over-year rate at 2.5% and the core measure, excluding fresh food at 2.1%. Excluding fresh food and energy, a 0.8% gain is expected. April saw the first reading above zero since July 2020 as last year's cut in cell phone charges dropped out of the 12-month comparison.

The dollar held below last week's high against the yen, seen around JPY135.60. It is in a tighter range than has been seen in recent sessions. It found support near JPY134.55. The consolidative tone may not persist as the divergence of monetary policy will likely intensify further next month. The Australian dollar is also consolidating. It is trading within the pre-weekend range (~$0.6900-$0.7050). It is firm but with the US holiday, the gains may be limited. The Chinese yuan reached seven-day's high today, extending its recovery that began last week. The dollar reached a high last week near CNY6.7610 and recorded a low today around CNY6.6735. The dollar's reference rate was set at CNY6.7120 compared with expectations (median from Bloomberg's survey) of CNY6.7126.

Europe

French President Macron appears to have been denied a parliamentary majority in yesterday's election. It did not do the euro any favors initially, but the immediate policy implication is not clear. The center did not hold as the alliance on the left of Macron, Nupes, and the far-right National Rally gained ground. The left-green coalition may be the main opposition party, but Le Pen (National Right) is the big winner with around a 10-fold increase in the number of seats than five years ago. There is much speculation that Macron may reach out to the center-right Republicans and their allies, who appear to have secured around 80 seats. Alternatively, Macron could seek to govern as a minority government, cobbling together coalitions on an issue-by-issue basis (e.g., raising the retirement age. Still, it seems reasonable to expect the election results to be recognized with a cabinet reshuffle that may include a new prime minister. France's strong presidential system may not weaken Macron at the European summit on June 23-24 or the G7 meeting June 26-28.

Rightmove reported that UK house prices rose to a new record this month for the fifth consecutive month. Its index is 9.3% above year ago levels. Some find a glimmer of hope in the fact that the index rose by only 0.3% this month, matching the slowest pace of the year. Supply has also increased. Separately, the UK rail workers will strike tomorrow, Thursday, and Saturday as negotiations over pay and jobs faltered over the weekend. Separately, the workers in the underground subway will strike tomorrow too in a separate dispute.

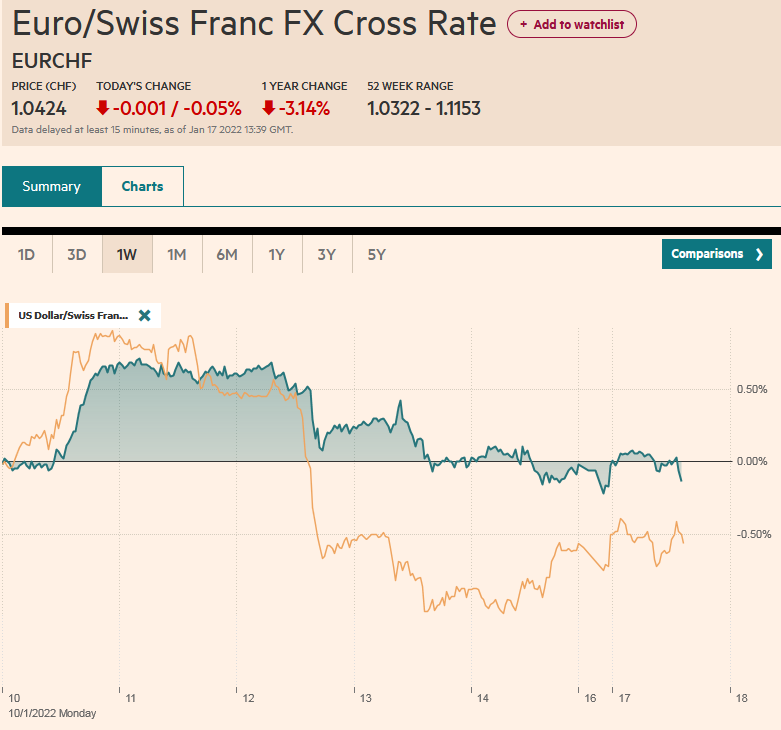

The euro recouped its early losses that pushed it a little through $1.0465 and it recorded session highs in the European morning around $1.0545. It is inside Friday's range (~$1.0445-$1.0560), which was inside Thursday's range (~$1.0380-$1.0600). Ultimately, a move above $1.0620 is needed to lift the technical tone. Sterling is also trading inside the pre-weekend range (~$1.2175-$1.2365), which was also inside last Thursday's range (~$1.2040-$1.2405). Today it found support near $1.2200. The session highs have been made late in the European morning slightly above $1.2260. On Wednesday, the UK reports May CPI figures. The headline rates are expected to be steady to slightly higher, while the core rate may ease to 6.0% from 6.2%.

America

What the Fed means when it says it will hike rates expeditiously is clearer. It means that the central bank will raise rates as quickly. That speed limit is a function of market expectations, which it seeks to shape through the communications channel and the economic data. Just as Volcker used money supply to justify what he wanted to do in the first place, the Powell Fed used the uptick in an inflation gauge it does not target and the increase in inflation expectations that spurred speculation of a 75 bp hike to raise rates faster than it had previously intended. Moreover, after cautioning that the large move was unusual, Powell explicitly allowed for a move of a similar magnitude next month. Governor Waller, a leading hawkish voice, indicated over the weekend that another 3/4-point move was his base case. He will support such a move if the economic data comes out as he anticipates.

Waller, like Powell, played down the fears of a recession, saying they were "a bit overblown." Powell said he saw "no sign" of a broad slowdown. Cleveland Fed's Mester took a slightly softer line. On "Face the Nation" she said that while she was not forecasting a recession, the risks were rising "partly because monetary policy could have pivoted a little bit earlier than it did." Both Powell and Waller have argued that the Fed's pivot came six months before the first rate hike in March. The two-year note yield climbed 100 bp between its pivot and the hike. Financial conditions were tightening before the Fed formally began its tightening cycle.

Mester acknowledged that growth was slowing to a little below trend. The Federal Reserve estimates trend growth, i.e., the non-inflationary pace, at 1.8%. The median forecast of Fed officials is for growth to be at 1.7% this year and next (down from 2.8% and 2.2% in March, respectively). That seems like a broad slowdown compared with what the Fed saw three months ago. For what it is worth, a couple of economic models are considerably more pessimistic. The NY Fed runs an economic model that was updated before the weekend. It puts the probability of a soft-landing, which it defines as four-quarter GDP straying positive over the next 2.5 years, around 10%. The odds of a hard land, which it defines as at least one-quarter of growth in the next 10, which four-quarter GDP growth falls more than -1% (similar to the 1990 recession) is seen at about an 80% chance. It clearly states that this is not its forecast but an input into the research staff’s “overall forecasting process." Bloomberg's model also sees a heightened risk of a recession by 2024. It puts the probability at 72%.

The US dollar rose to a marginal new high for the year against the Canadian dollar ahead of the weekend (~CAD1.3080). The main drag on the Canadian dollar seemed to come from the risk-off impulses but we also note the narrowing of Canada's interest rate premium over the US. The greenback has come back better offered today and is below CAD1.30. The pre-weekend low was near CAD1.2945 and this needs to be taken out to improve the Loonie's technical tone. Canada is expected to report a 0.8% increase in April retail sales tomorrow, followed by a jump in May consumer prices on Wednesday. The US dollar peaked last week near MXN20.70, the highest level in three months. A possible shelf is seen around MXN20.2150. A break of it could see MXN20.12. The highlight of the week is the bi-weekly CPI figures Thursday morning ahead of the Banxico meeting that is expected to result in a 75 bp rate increase (to 7.75%). Separately, Petro won the run-off election in Colombia to become the next president. He is advocating a major change in the thrust of policy, including taxing large landowners and stopping awarding oil exploration licenses. He will take office in early August. Over the past month, the Colombian peso has been the strongest currency in Latam, rising almost 1.8%. Year-to-date, the peso has appreciated by nearly 5.6%. Investors will not like the leftist-turn and the peso looks vulnerable.

Tags: #USD,Bank of Japan,China,Colombia,Currency Movement,Featured,federal-reserve,France,newsletter,U.K.