Overview: Equities remain under pressure as investors contemplate tighter financial conditions and the risks of recession. Most of the large equity markets in the Asia Pacific region sold-off, led by a 2.7% drop in Taiwan. Australia managed to buck the trend and managed a small gain. Europe’s Stoxx 600 is off by about 0.2% near midday after a 0.5% loss yesterday. US futures are lower and are threatening a gap lower opening for the S&P 500 and NASDAQ. Bonds are rallying. The US 10-year yield is off almost 8 bp and is slipping below 2.92% after a similar move yesterday. It closed at 3.08% last week after the employment report. European benchmark yields are off 9-13 bp with the peripheral premiums widening a little. The dollar rides higher, and the euro tested

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Currency Movement, Featured, Federal Reserve, India, Japan, newsletter, Switzerland, U.K., US, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Overview: Equities remain under pressure as investors contemplate tighter financial conditions and the risks of recession. Most of the large equity markets in the Asia Pacific region sold-off, led by a 2.7% drop in Taiwan. Australia managed to buck the trend and managed a small gain. Europe’s Stoxx 600 is off by about 0.2% near midday after a 0.5% loss yesterday. US futures are lower and are threatening a gap lower opening for the S&P 500 and NASDAQ. Bonds are rallying. The US 10-year yield is off almost 8 bp and is slipping below 2.92% after a similar move yesterday. It closed at 3.08% last week after the employment report. European benchmark yields are off 9-13 bp with the peripheral premiums widening a little. The dollar rides higher, and the euro tested parity for the first time in 22 years. The drop in yields is helping the yen resist the dollar’s pull and it is the only major currency rising against the greenback today. Outside of the Russian rouble, no emerging market currency is rising today. The Hungarian forint and Polish zloty are the weakest, off more than 1%, followed by the Mexican peso, falling by 0.9%. Gold buckled to about $1723.30 today as a new low has steadied in Europe and is a little higher on the day near $1735.50. August WTI is off about $2.50 but is holding above yesterday’s low (~$100.90). A break of $100 could spur a test on last week’s low closer to $95. US natgas is up 1.3% after yesterday’s 6.5% jump. Europe’s benchmark has surged 5.5% today after falling nearly 12% over the past two sessions. Covid concerns took another 4.5% from iron ore today after yesterday’s 2.5% decline. September copper is off more than 2%. It fell around 4% in the past two sessions. It has fallen by about a third since the March peak. September wheat reversed yesterday and fell by almost 4%. It is down another 1.4% now.

Asia Pacific

With a couple of exceptions (1993-1994 and 2009-2012), Japan's Liberal Democratic Party has dominated Japan's politics since 1955. While others in the region, including South Korea and Taiwan, have evolved genuine two-party systems, Japan has not. The LDP's typical economic policy is loose fiscal and monetary policy. Abe led the LDP back into government power in 2012 with the traditional LDP policy thrust, but on steroids. Former Chinese leader Deng Xiaoping once famously quipped that it does not matter if the cat is black or white as long as it catches mice. Japan tried both cats at the BOJ. Shirakawa (means white river) was reluctant to take bold initiatives to combat deflation. Abe brought in Kuroda (means black rice field). Kuroda's monetary policy has been aggressive. Abenomics failed to break the back of deflation in Japan and even now, if energy and fresh food were excluded, Japanese inflation is below 1%.

What to expect from Kishida's mandate? Japan's recovery in Q2 after the Q1 contraction looks weak. There is a pool of around JPY5.5 trillion (~$40 bln) of reserves from past budgets that can be used to pursue the fairer and greener growth Kishida advocates. An earlier effort boosted fuel subsidies that reduces prices by about 20%. Kishida's call for higher wages is not showing much success and new incentives/subsidies/tax breaks could be offered. New stimulus measures, and even a supplemental budget could be seen later this year. The LDP has long advocated a stronger defense, but officials are being slowly pushed in this direction. The changing geopolitics in the area and the assertion of China is helping facilitate this change in Japan. The Nikkei reports speculation of a cabinet reshuffle in August-September. Kishida will appoint a new BOJ governor and two deputies next year. The terms end in April 2023.

India is in the Quad (with US, Australia, and Japan) a security alliance. Yet, India continues to buy weapons from Russia, and last year purchased the same air defense system that Turkey (NATO) without much backlash from the US. It is continuing to trade with Russia and yesterday announced a new plan to settle trade in rupee. The rupee is trading at record lows against the dollar in recent days, and like the Chinese yuan, is not fully convertible. (~-6.5% year-to-date). The plan calls for Indian importers to make payments in rupee that will be credited to the special account of a correspondent bank of the foreign business. Exporters will be paid from the balances in the special account. India's move is likely not just driven by one consideration; it seems trade with Russia is a significant impetus. India's purchases of Russian oil in the three months to May reportedly have grown five-fold over the comparative year ago period.

After rising 20 bp last week, the 10-year US Treasury yield has pulled by 16 bp already this week. This has helped take some pressure off the Japanese yen, which fell to new 24-year lows yesterday. In September 1998, the dollar peaked near JPY147.65. The greenback is holding in a tight range below Monday's high (~JPY137.75) and has been confined about a half a yen range above JPY137.00. A joint statement by Japan's Minister of Finance Suzuki and US Treasury Secretary Yellen recognized that extreme volatility in the foreign exchange market is undesirable but stopped short of recognizing current volatility as excessive. The statement carefully avoided anything that could be seen as an endorsement of material intervention. The Australian dollar has been sold to a marginal new two-year low today near $0.6710. Only a move back above the $0.6760 area will help stabilize the technical tone. Today's high has been above $0.6745. The dollar gapped above yesterday's high (~CNY6.7195) and has not been below about CNY6.7245 today. Fears of new lockdowns amid a flare-up of Covid cases, though officials seem to have eased some rules of testing imports for the infection. The PBOC set the dollar's reference rate at CNY6.7287, a little above the CNY6.7269 median projection in the Bloomberg survey.

Europe

The Tory effort to replace Johnson as Prime Minister sees the first attempt to narrow the field of candidates. Today are the formal nominations. A candidate requires the support of at least 20 members of parliament. One of the key issues that is emerging is taxes. The rising tax burden imposed by former Chancellor Sunak strained the party and many of those who want to be Prime Minister are offering tax cuts. However, Sunak himself, still seen as a leading candidate, pushed back, and said he would cut taxes once inflation is brought back under control. The first round of voting by the Tory MPS will be held tomorrow. The candidate with the least votes and those receiving less than 30 votes will be eliminated from the contest. The final two will be subject to a straight ballot of the party's members.

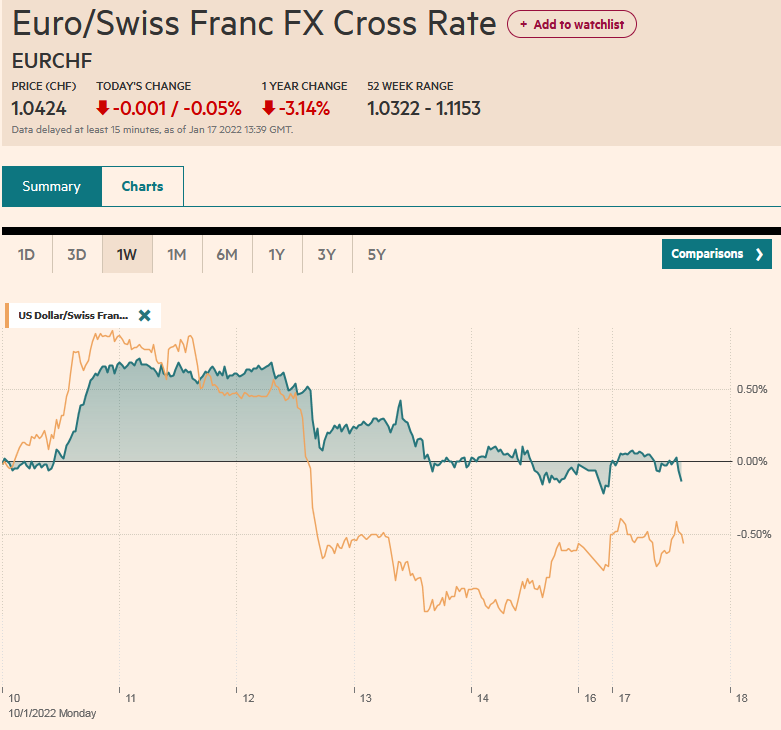

The Swiss National Bank unexpectedly hiked its deposit rate on June 16 by 50 bp to -0.25%. It suggested at that time that it no longer judged the currency to be very over-valued. Meanwhile, domestic sight deposits have been falling since mid-May. They have fallen by about 5% over the eight-week decline, while last week's drop of 1.6% is the largest in two years. The last drawdown of more than three weeks took place from mid-February to late-March 2021. Domestic sight deposits fell by about 2.3%. During that period, the euro rose by around 3.4% against the Swiss franc. Over the more recent six-week run, the euro initially appreciated from almost CHF1.03 to CHF1.04. However, since the SNB lifted rates, the euro has fallen four consecutive weeks (~-3.3%). The cross is trading at its lowest level since shortly after the SNB decision in early 2015 to lift the franc's cap against the euro. The momentum indicators are deeply oversold and flatlining as the euro struggles to sustain even modest upticks. The dollar peaked near CHF1.0065 in mid-May and after retreating to around CHF0.9550 in late May launched another run at the highs. It peaked in mid-June slightly below the mid-May high. It took out the May low in late June, but our idea of a potential double top proved wrong as the greenback has been climbing steadily this month. In fact, the dollar is rising for the ninth consecutive gain against the Swiss franc, and yesterday met the (61.8%) retracement objective near CHF0.9840.

News that German investors’ confidence is plunging (ZEW survey: expectations -53.8 vs. -28.0 and the current assessment -45.8 vs. -27.6) spurred euro sales that pushed the euro to parity for the first time since December 2002. It settled yesterday near $1.0040 and today reached only $1.0055. Parity is a more a psychological level rather than an important technical level. That said, the initial downside potential extends toward $0.9650-$0.9850. Still, the single currency is stretch. Yesterday was the fourth session in the past five that is has closed below its lower Bollinger Band (now seen ~$1.0035). Sterling's losses are also being extended. It approached $1.1805, a new low since March 2020 when it bottomed around four cents lower. The lower Bollinger Band is near $1.1845 now. The euro fell to two-month lows against sterling around GBP0.8435 today and but has found a bid in the European morning. Initial resistance is seen in the GBP0.8475-GBP0.8500 area.

America

In explaining why the Fed opted for a 75 bp hike last month instead of 50 bp, Fed Chair Powell pointed to the CPI and the University of Michigan's survey of consumer inflation expectations. We have suggested this has done the Fed a disservice on two counts. First, there is that since it formally adopted an inflation target it has chosen the PCE deflator. The year-over-year CPI accelerated to 8.6% from 8.3% and is expected to have risen further last month (median forecast in Bloomberg's survey is 8.8%). The PCE deflator was steady at 6.3%. Still, obviously elevated but three-quarters the pace. Powell also noted the jump in the University of Michigan's 5–10-year inflation outlook. However, that was a preliminary report, and, sure enough, the final reading was revised to show a 3.1% expectation not 3.3%. It was not a new high but matched the high earlier this year. At the end of the week, the preliminary July survey results will be announced. Economists (median forecast in Bloomberg's survey) looks for a decline back to 3.0%. The results of the NY Fed's monthly survey of three-year inflation expectations saw the median drop to 3.6% from 3.9%. It peaked last October at 4.2%. Still the one-year outlook worsened. Inflation expectations rose to 6.8% from 6.6%. The Fed funds futures market has nearly fully priced in a 75 bp hike later this month. The market currently sees only about a 20% chance of a 75 bp hike at the next FOMC meeting on September 21.

Yesterday's $43 bln sale of three-year notes saw strong non-direct bids (often asset managers and foreign investors). Today, Treasury offers $33 bln of 10-year notes. Wednesday, it sells $19 bln 30-year bonds. The bill auctions, which typically are fairly efficient tailed yesterday (higher yield than was prevailing in the when-issued market). Some attribute it to the uncertainty about Fed policy, but there are also supply considerations. Treasury is paying down bills, $15 bln this week after $21 bln last week. All told, it has paid down around $575 bln in bills since March, helped by an unexpected surge in tax receipts in April.

Today is a light calendar for North America. The main feature is Mexico's May industrial output figures. It is not typically a market-mover even in the best of times. Tomorrow is a big day with the US June CPI and the Bank of Canada meeting. The risk-off phase is weighing on the Canadian dollar. The greenback looks poised to test last week's high near CAD1.3085. Th upper Bollinger Band is around CAD1.3070. A convincing break of the CAD1.31 area could target the CAD1.3300-CAD1.3350 band. The greenback is surging against the Mexican peso. It is pushing above MXN20.90 for the first time since mid-March. The next technical target is seen in the MXN21.00-MXN21.07 area. It is well through the upper Bollinger Band (~MXN20.8350). The price action warns of continued pressure on other regional currencies today.

Tags: #USD,Currency Movement,Featured,federal-reserve,India,Japan,newsletter,Switzerland,U.K.,US