Stop me if you’ve heard this before: About US$275 billion (about SDR 193 billion) of the new allocation will go to emerging markets and developing countries, including low-income countries. This from the IMF’s July 30, 2021, statement gleefully announcing its governing body(ies) has(d) agreed to a general allocation of $650 billion in SDR’s, biggest in history, according to existing quotas. The purpose: “to boost existing liquidity.” This really does sounds very...

Read More »Real Dollar ‘Privilege’ On Display (again)

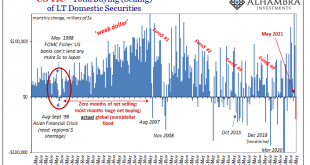

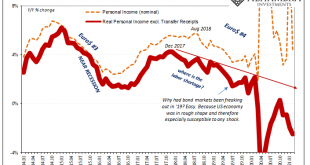

Twenty-fifteen was an important yet completely misunderstood year. The Fed was going to have to become hawkish, according to its models, yet oil prices crashed and the dollar continued to rise. Both of those things were described as “transitory” by Janet Yellen, and that they were helpful or positive (rising dollar means cleanest dirty shirt!), but domestically American policymakers’ clear lack of conviction and courage about that rate hike regime showed otherwise....

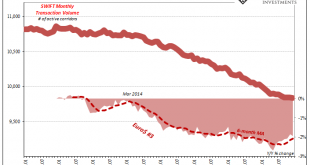

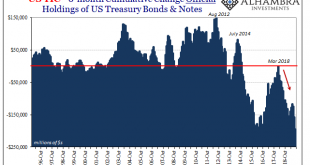

Read More »De-dollarization By Default Is Not What You Might Think

Last month, a group of central bank governors from across the South Pacific region gathered in Australia to move forward the idea of a KYC utility. If you haven’t heard of KYC, or know your customer, it is a growing legal requirement that is being, and has been, imposed on banks all over the world. Spurred by anti-money laundering efforts undertaken first by the European Union, more and more governments are forcing global banks to take part. KYC is a particularly...

Read More »Seriously, Good Luck Dethroning the (euro)Dollar

Scarcely a week will go by without some grand prediction of the dollar being dethroned. Set aside how if anything is to be deposed it would have to be the eurodollar, these stories typically follow the same formulaic approach: Country X is moving away from dollar reserves, “diversifying” its holdings because of the geopolitics of Y. Usually, it is the Chinese who are set to play the role of upstart. It makes sense. As the world’s second largest national economy...

Read More »Where The Global Squeeze Is Unmasked

Trade between Asia and Europe has dimmed considerably. We know that from the fact Germany and China are the two countries out of the majors struggling the most right now. As a consequence of the slowing, shipping companies have had to make adjustments to their fleet schedules over and above normal seasonal variances. It was reported last week that Maersk and MPC would “temporarily suspend” their sailings on one of the biggest routes between Europe and Asia. Weakening...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org