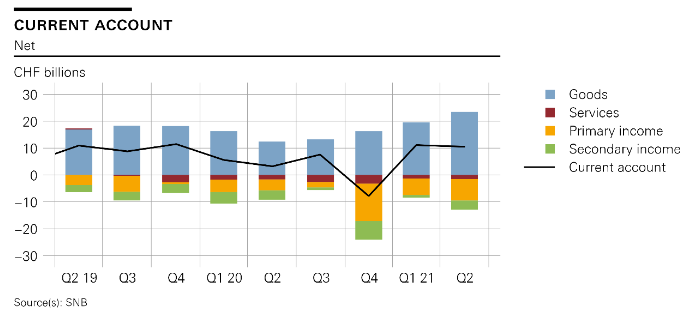

In the second quarter of 2021, the current account surplus amounted to almost CHF 11 billion, CHF 7 billion higher than in the same quarter of 2020. The rise was mainly attributable to a higher receipts surplus in goods trade. This was counteracted by primary income, where the expenses surplus increased compared to the same quarter in 2020 due to the fact that, in direct investment, expenses rose more strongly than receipts. In the financial account, reported transactions for the second quarter of 2021 showed a net acquisition of financial assets (CHF 19 billion) and a net incurrence of liabilities (CHF 7 billion). On the assets side, several factors contributed to the net acquisition: Resident investors purchased collective investment schemes and debt securities

Topics:

George Dorgan considers the following as important: 1.) SNB Press Releases, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| In the second quarter of 2021, the current account surplus amounted to almost CHF 11 billion, CHF 7 billion higher than in the same quarter of 2020. The rise was mainly attributable to a higher receipts surplus in goods trade. This was counteracted by primary income, where the expenses surplus increased compared to the same quarter in 2020 due to the fact that, in direct investment, expenses rose more strongly than receipts.

In the financial account, reported transactions for the second quarter of 2021 showed a net acquisition of financial assets (CHF 19 billion) and a net incurrence of liabilities (CHF 7 billion). On the assets side, several factors contributed to the net acquisition: Resident investors purchased collective investment schemes and debt securities of non-resident issuers (portfolio investment), commercial banks and companies increased their loans to non-residents (other investment), and the SNB conducted foreign currency purchases (reserve assets). On the liabilities side, portfolio investment and other investment were likewise responsible for the net incurrence. On both the assets and liabilities sides, the net acquisitions/net incurrences were counteracted by direct investment: Foreign-controlled finance and holding companies reduced their balance sheets by decreasing equity capital on the assets side and on the liabilities side. Including derivatives, the financial account balance totalled CHF 13 billion. |

Current Account Q2 2019-Q2 2021(see more posts on Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

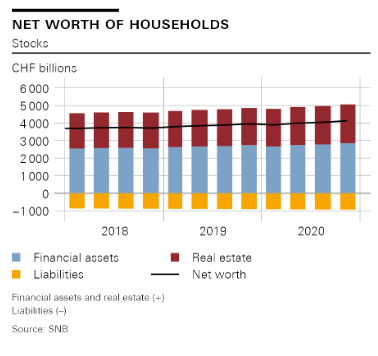

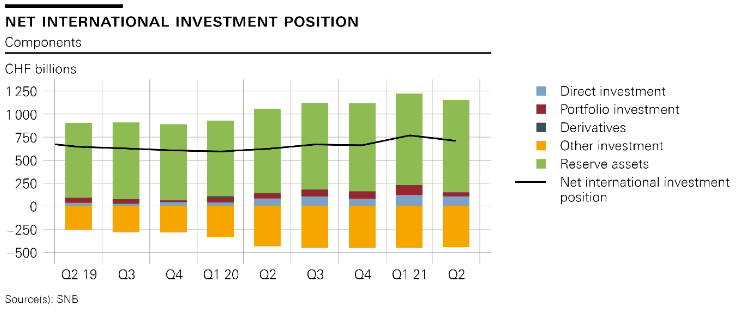

| In the second quarter of 2021, the net international investment position decreased by CHF 59 billion to CHF 709 billion compared to the previous quarter, as liabilities increased more strongly than assets: Assets rose by CHF 24 billion to CHF 5,646 billion and liabilities from CHF 83 billion to CHF 4,937 billion. On the assets side, price-related valuation gains were offset by exchange rate-related valuation losses. Although prices on stock exchanges abroad rose, the US dollar weakened against the Swiss franc at the same time; gains and losses therefore balanced each other out. The decisive factor for the increase in assets was therefore the transactions reported in the financial account. On the liabilities side, the increase was mainly due to a higher valuation resulting from the strong rise in prices on the Swiss stock exchange. |

Net international investment position, Q2 2019-Q2 2021 Source: snb.ch - Click to enlarge |

Data revisions

The data on the current account take into account revisions, some of which extend over the entire period. These revisions were particularly significant between 2012 and 2020. On average, the current account balance decreased by around CHF 2 billion per quarter during this period. These revisions were due to the closure of data gaps and newly available information from reporting institutions.

Further information

Comprehensive charts and tables covering Switzerland’s Balance of Payments and International Investment Position can be found on the SNB’s data portal.

Tags: Featured,newsletter