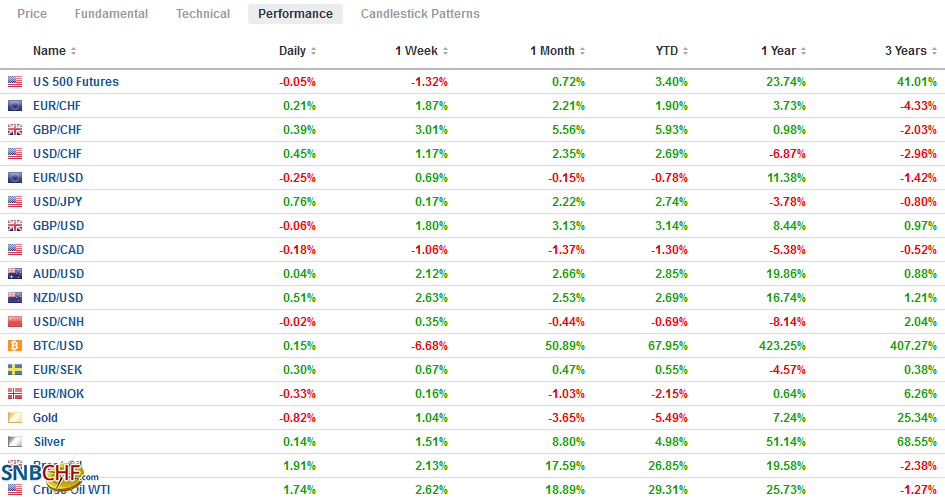

Swiss Franc The Euro has risen by 0.21% to 1.1018 EUR/CHF and USD/CHF, February 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The sharp recovery in US shares yesterday that saw the S&P 500 snap a five-day slide failed to carry into Asia Pacific trading earlier today. All the markets fell save India and Singapore. Losses were led by a 3% drop in Hong Kong as the first increase in the stamp duty (financial transaction tax) since 1993 was announced (0.13% from 0.10%). Most of the large markets in the region were off 1.5%-2.5%. Europe’s Dow Jones Stoxx 600 is posting minor gains in late morning turnover. Materials and energy are the strongest sectors. US shares are firmer, but little changed. Benchmark

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of Canada, Currency Movement, Featured, Federal Reserve, Hong Kong, New Zealand, newsletter, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.21% to 1.1018 |

EUR/CHF and USD/CHF, February 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The sharp recovery in US shares yesterday that saw the S&P 500 snap a five-day slide failed to carry into Asia Pacific trading earlier today. All the markets fell save India and Singapore. Losses were led by a 3% drop in Hong Kong as the first increase in the stamp duty (financial transaction tax) since 1993 was announced (0.13% from 0.10%). Most of the large markets in the region were off 1.5%-2.5%. Europe’s Dow Jones Stoxx 600 is posting minor gains in late morning turnover. Materials and energy are the strongest sectors. US shares are firmer, but little changed. Benchmark 10-year yields are higher, with the US Treasury at 1.37%. The steep sell-off in the Australian and New Zealand bond market continues. The five basis point increase today brings the five-day increase to 21 bp and 17 bp, respectively. Among the major bond markets, the 10-year UK Gilt yield has also risen 17 bp over the past week. The US 10-year yield is up nine basis points in the same time. Sterling spiked to almost $1.4240 in early Asian trade but has steadied in the $1.4150-$1.4200 area. It is not even the strongest currency today. That honor goes to the New Zealand dollar, which is up about 0.6% to reach almost $0.7400, a new three-year high. The Japanese yen and Swiss franc are the laggards with losses of around 0.50% and 0.25%, respectively. Emerging market currencies are mixed. Russia, Mexico, and China have stronger currencies, while Turkey, South Africa, and South Korea currencies are softer. The JP Morgan Emerging Market Currency Index is posting minor gains for the second session. Gold is quiet and consolidating above $1800. Resistance is seen in the $1815-$1820 area. Oil is also moving sideways, with April WTI gravitating around the middle of yesterday’s range (~$60.70-$63.00). |

FX Performance, February 24 |

Asia Pacific

Australia’s Q4 wage index was stronger than expected but does not appear to portend a cost-push threat to the inflation outlook. The 0.6% increase in the index was twice what the market expected. The year-over-year rate was steady at 1.4%, the lowest on record. It appears that the lower wage bill that was a product of the lockdowns was reversed. A pay freeze in the public sector continued. The slack in the labor market, where unemployment is reported at 6.4% vs. 5.1% before the pandemic, is expected to constrain wage pressures.

The Reserve Bank of New Zealand kept rates (0.25%) on hold as widely expected. Its asset purchase program was maintained at NZ$100 bln. The economic outlook was upgraded. It now sees last year’s contraction at 2.7% rather than 4%, and this year’s growth forecast was tweaked up to 3.7% from 3.4%. Unemployment is expected to peak at 5.2% vs. 6.4% previously. Nevertheless, the central bank remains cautious and remained committed to its stimulus measures. It also expected price pressures to ease next year.

The stamp-duty hike proposal in Hong Kong was part of a larger fiscal announcement by Financial Secretary Chan. He unveiled HK120 bln (~$15.5 bln) support efforts and forecast growth this year between 3.5% and 5.5% after a 6.1% contraction last year. Chan proposed boosting the consumption vouchers (HK$36 bln), but economists often see cash handouts being more effective and less expensive to manage than coupons. The registration tax for private cars may rise 15%, and vehicle license fees could be hiked by 30%. Chan seeks to boost revenue.

After dipping below JPY105 briefly yesterday, the greenback recovered smartly and rose a little above JPY105.80 in early European activity to test the week’s high. Although the momentum is strong, the intraday technical indicators are stretched. There is a $373 mln option struck at JPY105.95 that expires today. Initial support is seen around JPY105.50, and the 200-day moving average is just below there. The Australian dollar made a marginal new high but stalled in front of $0.7950, where a A$604 mln option is struck that also expires today. First support is seen near $0.7900 and then $0.7880. The PBOC set the dollar’s reference rate at CNY6.4615, which was a little stronger than the bank models anticipated. Some demand for the yuan was linked to what appears to be a record sell-off of Hong Kong shares by mainland accounts. The PBOC injected CNY10 bln via its open market operations, which stopped the three-day increase in the seven-day repo rate. Lastly, we note that Taiwan’s rating outlook was revised to positive from stable by Moody’s.

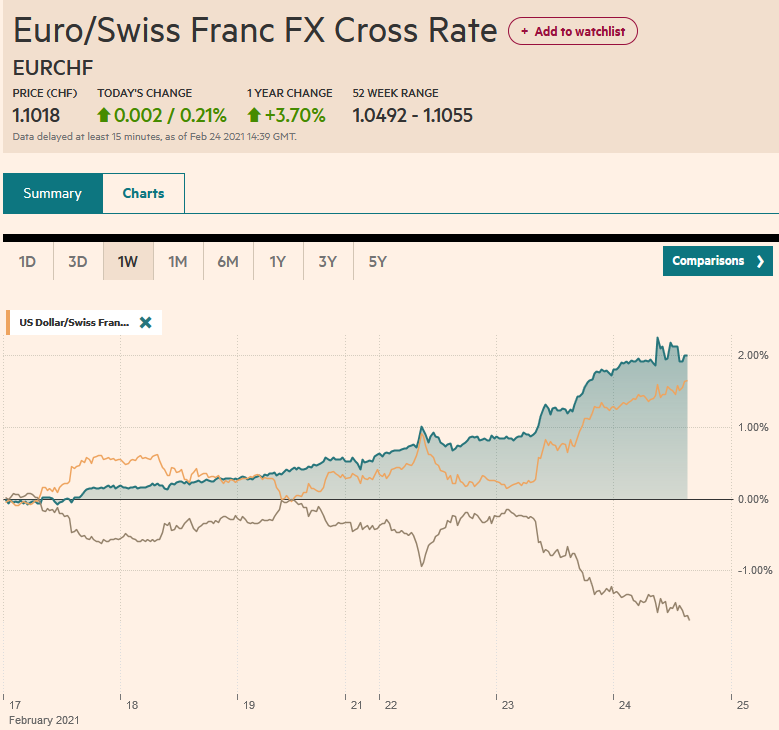

EuropeGermany revised up its estimate of Q4 20 growth to 0.3% from 0.1%, leaving the world’s fourth-largest economy 2.7% smaller than at the end of 2019 compared with its initial estimate of a 2.9% contraction. The reported did not appear to have much market impact. It is old news, and economists and investors anticipate a contraction of 1.0%-1.5% here in Q1 21. Still, the details, released for the first time, maybe interesting. Consumption fell 3.3%, twice what economists anticipated, and government spending fell by 0.5% (and Q3 was revised to 0.6% from 0.8%). Capital investment rose 1.0% (and Q3 was revised up to 3.9% from 3.6%). |

Germany Gross Domestic Product (GDP) YoY, Q4 2020(see more posts on Germany Gross Domestic Product, ) Source: investing.com - Click to enlarge |

The market has not only given up the idea that the Bank of England will adopt a negative rate, but sentiment has swung toward it being among the first to hike rates. The December 2022 short-sterling futures contract (a time deposit like the Eurodollar futures) now implies a 26 bp yield. In early January, it had implied a minus 3 bp yield. Also, while the increase in inflation expectations (as measured by the 10-year breakeven) accounts for the increase in nominal rates in the US. It does not in the UK. The 10-year Gilt yield has risen by 50 bp since the end of last year to about 0.75%. The UK 10-year breakeven has risen by about 30 bp (to a little more than 3.3%). This implies an increase in the real rate in the UK.

The euro is firm in a narrow range (~$1.2145-$1.2175) inside yesterday’s range. The $1.2200 area is a retracement objective of the decline since the January 6 high near $1.2350. The single currency has not traded above it $1.22 since January 13. In fact, with a brief exception, the euro has been confined to a $1.20-$1.22 trading range since early January. Stops are likely building up on both sides of the range. There are options for around 1.3 bln euro at $1.2175-$1.2180 expiring today. Sterling surged to almost $1.4240 in early Asia, and although it is trading nearly a cent below the high, it remains above yesterday’s high (~$1.4120). The upper Bollinger Band (two standard deviations about the 20-day moving average) is near $1.4145. Meanwhile, sterling is extending its streak against the euro. It is rising for the ninth consecutive session. On that spike in Asia, the euro fell to about GBP0.8540, its lowest level since last March. The euro began the streak near GBP0.8780 after finishing last year around GBP0.8940.

America

US equities recovered yesterday, and since Fed Chair Powell spoke before it, many observers and journalists are linking the two. Yet, Powell did not really say anything new. He reiterating and elaborated on his talking points, which are really well known. The recovery is uneven, and unemployment remains unacceptably high. While the Fed’s policies are lifting some asset prices, there are many factors at work, including economic optimism. Powell shows no sign of wavering about the $120 mln in bond ($80 bln Treasuries and $40 bln Agency MBS) a month. Of course, inflation is expected to rise. The Fed is encouraging it, but the issue is whether it is persistent. The Fed’s view seemed to be echoed by Bank of Canada Governor Macklem, who also reaffirmed the desire to let the economy strengthen until actual inflation is at its 2% target. Macklem observed that inflation was not a problem before the pandemic despite low levels of unemployment. Powell testifies before the House Banking Committee today. The questions may change, but the answer remains the same.

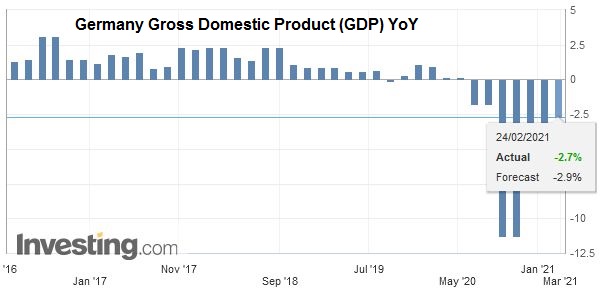

| The US report January new home sales today. The housing market remains a key strength of the US economy. The S&P CoreLogic house price index was reported yesterday, and in December, the index was a little more than 10% higher than at the end of 2019. A procedural ruling on whether the minimum wage increase can be included in the reconciliation fast-track may be announced today. If it is, the real threat to it comes from a couple Democrats, not Republicans. In fact, the stimulus bill looks to pass the House of Representatives at the end of the week without a single Republican vote, according to reports. Mexico report December retail sales. A 2.7% decline is forecast after a 3.3% rise in November. Brazil reports February IPCA inflation, and a rise will only firm expectations for a rate hike as early as next month. The Petrobras board seemed to push against President Bolsonaro’s efforts and endorsed market-based fuel prices. |

U.S. New Home Sales, January 2021(see more posts on U.S. New Home Sales, ) Source: investing.com - Click to enlarge |

| The overnight US repo rate traded at zero yesterday for the first time since last year’s chaos as the pandemic struck. This is just the latest illustration of the downward pressure on US money market rates. A key driving force is the Treasury’s drawdown of its cash balances at the Federal Reserve. The process is likely to take a few more months. It spills over and exerts pressure on the short-dated coupons, like the two-year. The softness of short-term US rates may make the dollar more attractive to use as a funding currency and may help explain its weakness, despite the rise in long-term rates. |

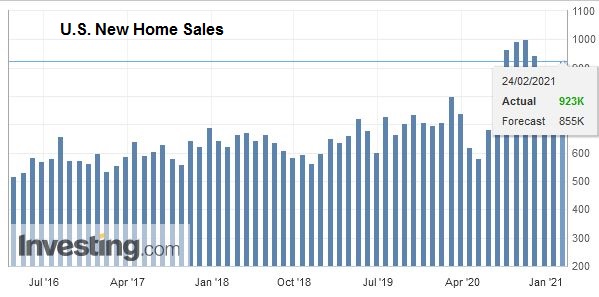

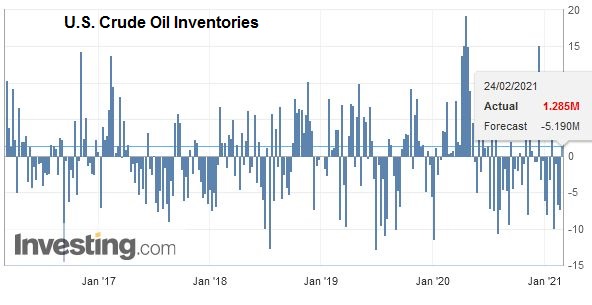

U.S. Crude Oil Inventories, February 24 2021(see more posts on U.S. Crude Oil Inventories, ) Source: investing.com - Click to enlarge |

The US dollar has remained below CAD1.26 support so far today after closing below it yesterday for the first time since April 2018. It spiked down to CAD1.2560 in Asia before steadying. The next important chart points are not until closer to CAD1.2500. While the CAD1.2600 area offers initial resistance, only a move above CAD1.2650 will take the downside pressure off the greenback. The Mexican peso is extending yesterday’s recovery. Recall that the dollar poked above MXN20.83 on Monday and reading inside Monday’s range yesterday but managed to close almost 1% lower and snap a six-day advance. Today the greenback is near MXN20.38 (the 50% retracement of the rally since February 15 low near MXN19.8925). The next retracement objective is near MXN20.25.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Bank of Canada,Currency Movement,Featured,Federal Reserve,Hong Kong,New Zealand,newsletter,U.K.