Summary:

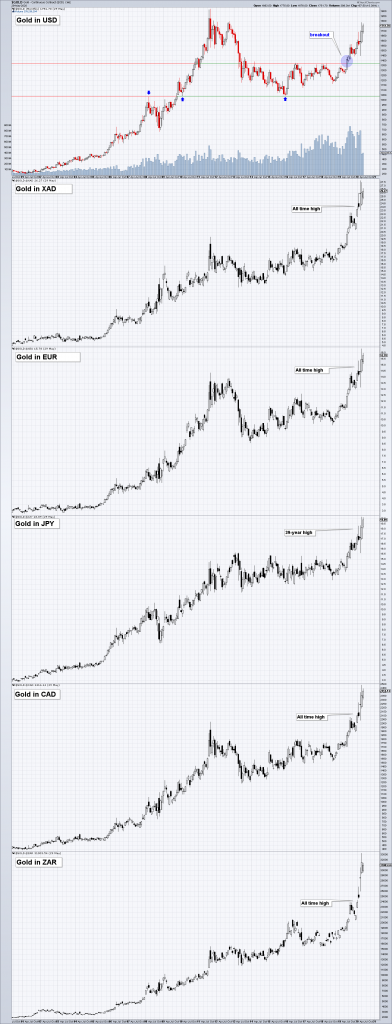

The New In Gold We Trust Report is Here! The In Gold We Trust 2020 report by our good friends Ronald Stoeferle and Mark Valek was released last week. It is the biggest and most comprehensive gold research report in the world. As always it contains a wealth of new material, as well as the traditional wide-ranging collection of charts and data that makes it such a valuable reference work for everything of interest to gold investors or indeed for anyone interested in precious metals (a download link to the report is provided below). Left: casting gold bars. Right: using gold as a shield against assorted slings and arrows. Here is a brief overview of the main subjects discussed in the report: – A review of the most important events in the gold market in recent

Topics:

Pater Tenebrarum considers the following as important: 6b.) Acting Man, 6b) Austrian Economics, 7) Markets, Featured, newsletter, Precious Metals

This could be interesting, too:

The New In Gold We Trust Report is Here! The In Gold We Trust 2020 report by our good friends Ronald Stoeferle and Mark Valek was released last week. It is the biggest and most comprehensive gold research report in the world. As always it contains a wealth of new material, as well as the traditional wide-ranging collection of charts and data that makes it such a valuable reference work for everything of interest to gold investors or indeed for anyone interested in precious metals (a download link to the report is provided below). Left: casting gold bars. Right: using gold as a shield against assorted slings and arrows. Here is a brief overview of the main subjects discussed in the report: – A review of the most important events in the gold market in recent

Topics:

Pater Tenebrarum considers the following as important: 6b.) Acting Man, 6b) Austrian Economics, 7) Markets, Featured, newsletter, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Download link to the IGWT 2020 Report:

In Gold We Trust 2020 – The Dawning of a Golden Decade (PDF)

Enjoy!

Chart by stockcharts

Tags: Featured,newsletter,Precious Metals