The dollar remains under pressure as market sentiment continue to improve; stimulus talks were extended Two major US airlines announced significant job furloughs starting today; US data for September will continue to roll out; weekly jobless claims will be reported The pound is underperforming as the flurry of optimism in the recent negotiations fades; final eurozone September manufacturing PMI was steady at 53.7 Bank of Japan quarterly Tankan report came in weaker than expected; Korea reported firm September trade data; Philippine central bank kept rates steady at 2.25%, as expected The dollar remains under pressure as market sentiment continue to improve. Global equity markets are mostly higher, with US futures pointing to a higher open here. DXY is down for

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The dollar remains under pressure as market sentiment continue to improve; stimulus talks were extended

- Two major US airlines announced significant job furloughs starting today; US data for September will continue to roll out; weekly jobless claims will be reported

- The pound is underperforming as the flurry of optimism in the recent negotiations fades; final eurozone September manufacturing PMI was steady at 53.7

- Bank of Japan quarterly Tankan report came in weaker than expected; Korea reported firm September trade data; Philippine central bank kept rates steady at 2.25%, as expected

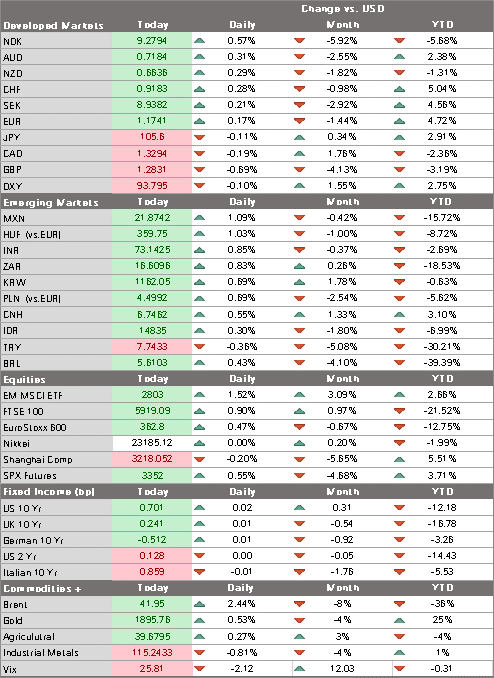

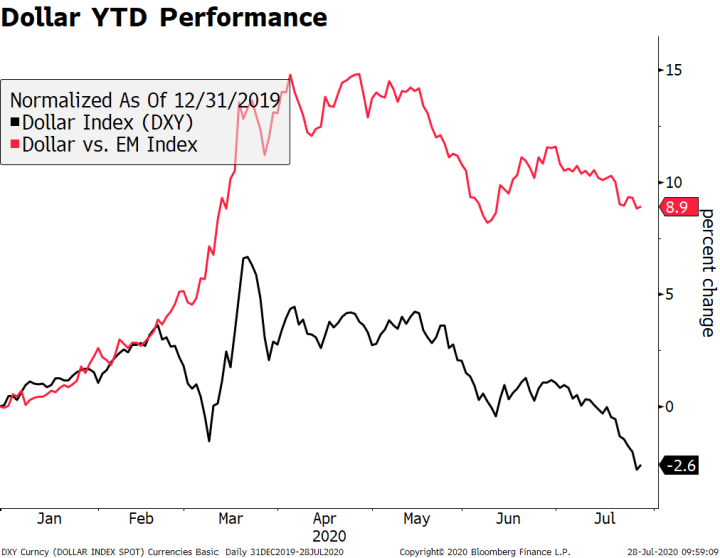

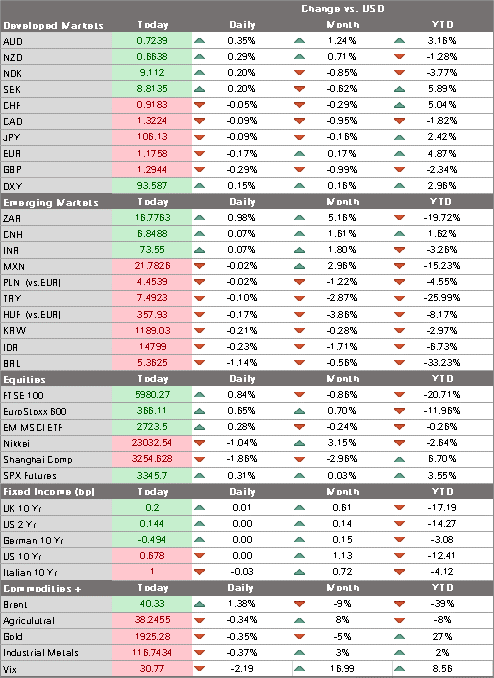

The dollar remains under pressure as market sentiment continue to improve. Global equity markets are mostly higher, with US futures pointing to a higher open here. DXY is down for the fourth straight day and traded at the lowest level since September 22.

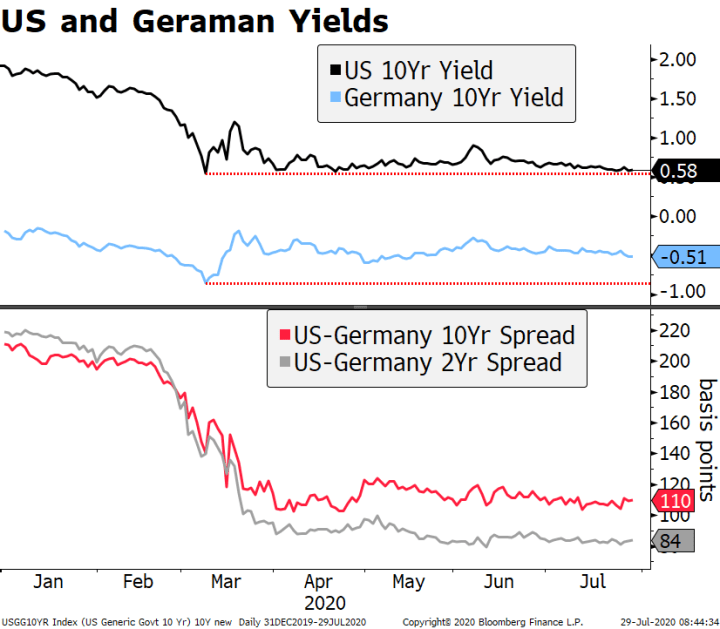

Key level is 93.51 as a break below would set up a test of the September 21 low near 92.749. Similar retracement objective for the euro comes in near $1.1775. Sterling remains heavy as recent Brexit optimism looks to have been overdone, while USD/JPY continues to trade in very narrow ranges near the 105.50 area. We continue to view the recent dollar bounce as a positioning adjustment rather than a trend change and see further losses ahead for the greenback.

AMERICAS

Stimulus talks were extended. House Democrats held off on a vote on their $2.2 trln bill in order to give House Speaker Pelosi and Treasury Secretary Mnuchin another day to negotiate a deal. Mnuchin said they “made a lot of progress,” enough to extend talks by a day. He also sees a compromise landing somewhere between $1.5 trln and $2.2 trln. If no deal is reached, House Democrats will go ahead with a vote on their latest bill. This Democratic bill contains a 6-month extension of the airline relief fund. Why is this important?

| Two major US airlines announced significant job furloughs starting today. This is because the $25 bln in support given to the industry under the CARES act was conditional on no layoffs or pay cuts before October 1. With no new stimulus deal yet in place, the airlines are being forced to begin furloughing. Passenger numbers plunged 90% in April and May, and are now only back to about a third of pre-pandemic levels now. American Airlines said it would being furloughing 19,000 employees, while United said it would do the same with 13,000. Note these actions will show up in the October jobs data.

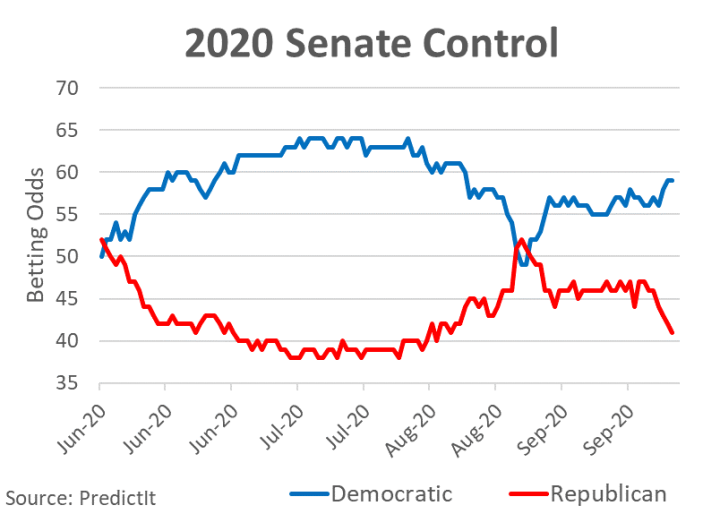

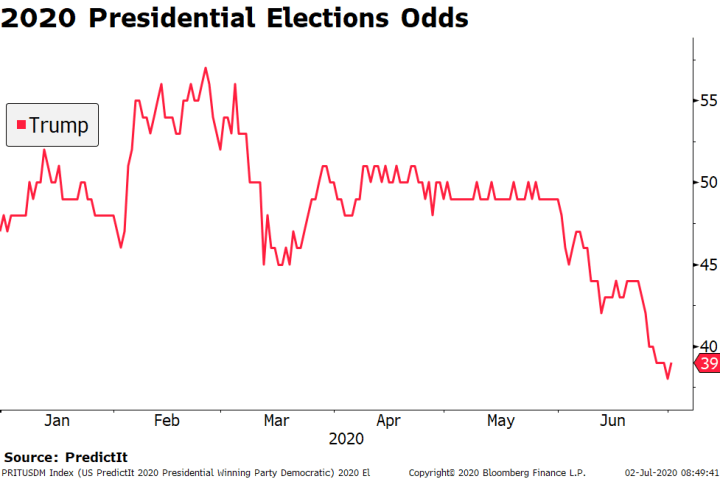

The odds of a democratic sweep have increased substantially over the last two days, mostly likely because of Iowa. It appears the race there between Republican Ernest and Democrat Greenfield is tipping in favor of the latter. As it stands, betting markets are giving Democrats a near 60% change of taking the Senate, thus establishing control of both houses. It’s worth noting that President Trump is well behind in the battleground states he won by surprise and is tied in several key states that he easily won, and that has spelled trouble for down-ticket Republican candidates. US data for September will continue to roll out. ISM manufacturing is expected to rise a few ticks to 56.4. The employment component will be the final clue for Friday’s jobs report. Yesterday, ADP reported private sector jobs rose 749k vs. 649 expected. This was a solid number but probably not enough to move the needle on expectations for Friday, where consensus sees 868k jobs added. Claims data for the BLS survey week containing the 12th of the month were mixed, with initial claims falling and continuing claims rising. Yesterday, Chicago PMI came in at a whopping 62.4 vs. 52.0 expected 51.2 in August, though the correlation with ISM is not very strong. That said, the regional Fed surveys have come in fairly firm too and so there are upside risks to today’s ISM data. A lot of other data will be reported today. September auto sales will also be reported and are expected to improve to a 15.70 mln annualized pace from 15.19 mln in August. If so, they would be the highest since February. September Challenger job cuts, August personal income and spending (-2.5% m/m and +0.8% m/m expected, respectively), core PCE (1.4% y/y expected), and construction spending (0.7% m/m expected) will also be reported. Fed speakers today include Williams and Bowman. Weekly jobless claims will be reported. Initial claims are expected at 850k vs. 870k the previous week, while continuing claims are expected at 12.20 mln vs. 12.58 mln the previous week. Adding regular and PUA initial claims shows about 1.5 mln are still filing for unemployment every week and that’s not so good. Elsewhere, regular continuing claims have stabilized around 13 mln but PUA continuing claims have started to fall and so the total of the two has dropped to around 24 mln from over 28 mln previously but still points to a soft labor market. |

2020 Senate Control |

|

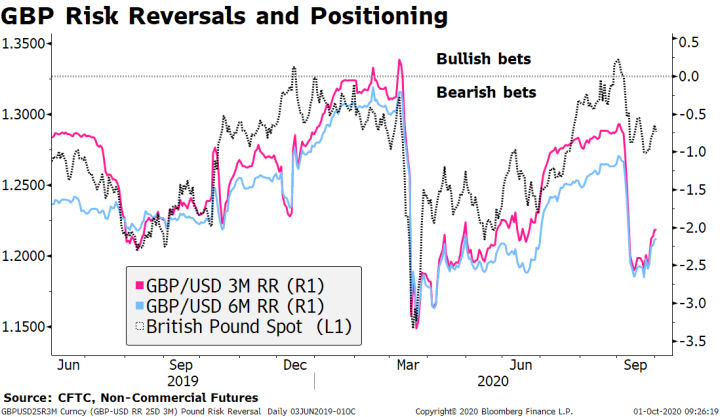

EUROPE/MIDDLE EAST/AFRICA The pound is underperforming as the flurry of optimism in the recent negotiations fades. Reports claim there was no breakthrough in the negotiations about state aid, not to mention fishing and the Internal market Bill. Indeed, the EU is getting ready to send the “letter of formal notice” to the UK for breaching the Withdrawal Agreement (i.e. gearing up for a potential lawsuit). A close below yesterday’s low near $1.2805 would give us an outside down day that signals further losses ahead. Risk reversals remain well off their recent lows, suggesting no new meaningful increase in demand for downside protections against the pound. Note the final September manufacturing PMI was revised down a couple of ticks from the preliminary to 54.1. Final eurozone September manufacturing PMI was steady at 53.7. Germany fell a couple of ticks from the preliminary to 56.4, while France rose three ticks to 51.2. Spain and Italy improved from August to 50.8 and 53.2, respectively. While the manufacturing readings remain solid, the services readings came in much worse and dragged the preliminary composite reading down to 50.1. Final services and composite PMIs will be reported Monday.

|

GBP Risk Reversals and Positioning, 2019-2020 |

| ASIA

Bank of Japan quarterly Tankan report came in weaker than expected. Large manufacturing index came in at -27 vs. -24 expected and -34 in Q2, ending a six quarter streak of declines but remaining below zero for a third straight quarter. The large non-manufacturing index came in at -12 vs. -9 expected and -17 in Q2, here ending a four quarter streak of declines but remaining below zero for a second straight quarter. The large manufacturing and non-manufacturing outlooks came in at -17 and -11, respectively. Large companies across all industries expect to boost capex by 1.4% this fiscal year vs. 3.2% in Q2. Lastly, it’s worth noting that the readings for the small businesses were much worse than the large one, with headline numbers coming in at -44 for manufacturing and -22 for non-manufacturing. Korea reported firm September trade data. Exports rose 7.7% y/y vs. 3.5% expected and -10.1% in August, while imports rose 1.1% y/y vs. -5.1% expected and -15.8% in August. While the data were boosted by an extra two and a half working days this September, the y/y gains are nonetheless welcome. Korea is shaping up to be one of the stronger economies in the region, helped by the recovery in China was well as the weak won relative to the yen. Next policy meeting is October 14 and no change is expected then. Philippine central bank kept rates steady at 2.25%, as expected. Governor Diokno said “A continued pause will allow prior measures by the Bangko Sentral ng Pilipinas to further work their way through the economy.” However, the bank approved a PHP540 bln ($11.2 bln) cash advance to the government to help fund virus relief efforts, the second such loan this year. CPI rose 2.4% y/y in August, the lowest since May and in the bottom half of the 2-4% target range. The bank cut its inflation forecasts slightly to 2.3% this year, 2.8% next year, and 3.0% in 2022. We believe the easing cycle could resume in the coming months if the peso remains relatively firm. |

Table October 1, 2020 |

Tags: Articles,Daily News,Featured,newsletter